Vinco Ventures Inc. (BBIG) is involved in the development of digital media and content technologies and has its headquarters in Bethlehem, Pennsylvania. Its subsidiaries, ZVV Media Partners and Zash Global Media and Entertainment Corporation, have an 80% stake in the online video-sharing network company Lomotif Private Limited.

I am neutral on Vinco Ventures as it is very difficult to value and is highly volatile. Therefore, forming a bearish or bullish opinion on the stock here is difficult, and the investment is highly speculative. (See Analysts’ Top Stocks on TipRanks)

Strengths

Vinco Ventures operates on its BIG model that stands for Buy, Innovate, Grow. The company has made intelligent investments to grow its portfolio, used internal traffic platforms to innovate and drive more conversion, and expedited growth by reaching target numbers quicker.

Aside from an 80% share in Lomotif Private Ltd, Vinco Ventures’ subsidiaries have completed the making of its first TV series, Preach, and feature film, Camp Hideout. The content is expected to start getting revenue in the first half of 2022.

Cryptyde, Inc., another one of the company’s subsidiaries, is also on the verge of releasing its E-NFT album, featuring Nick Cannon and the Ncredible Gang on its E-NFT.com platform. The subsidiary also recently launched Tory Lanez’s “When It’s Dark” album on its E-NFT platform, the first album to sell one million units on the blockchain.

Recent Results

In its third-quarter 2021 report, Vinco Ventures reported revenues of $2.23 million, a decrease of 11.5% from the $2.52 million in the third quarter of 2020. The company’s gross profit margin went down from 40.3% to 31.4% year over year. This was chiefly attributed to the reduction in sales of PPE in the Edison Nation Medical division.

Vinco Ventures’ selling, general, and administrative expenses amounted to $25.9 million, out of which $6.2 million was equity compensation, $5.6 million was costs related to legal and professional fees, $5.1 million was operating costs of ZVV, and $6.2 million was operating costs of Lomotif.

The company also posted a $542.5 million net loss in the third quarter of 2021 or a loss of $7.59 per basic and diluted share compared to a net loss of $2.8 million or a loss of $0.30 per basic and diluted share year-over-year. The large increase in net loss is attributed to the issuance of warrants during the third quarter of 2021 and costs related to Lomotif’s transactions and operations.

At the quarter ended September 30, 2021, Vinco Ventures had cash equivalents and restricted cash of $149.9 million.

Valuation Metrics

BBIG stock is tough to value right now, given that it is still running up significant losses. That said, it is currently trading at about a 31.7 times price-to-sales ratio, which seems incredibly high.

Furthermore, the stock price is highly volatile right now, as it jumped from a low of $2.23 on August 20, 2021, to a high of $12.49 on September 8, 2021, and has since continued to gyrate considerably, with it currently sitting at around $3.15.

A big contributor to this volatility is that it has been one of the popular WallStreetBets stocks in recent months and has also been highly discussed on Stocktwits and Twitter, leading to significant retail investor interest.

Furthermore, the short interest in the company is quite large at 20.6% as of this writing, indicating significant fundamental risk for the company.

TipRanks’ Smart Score Rating

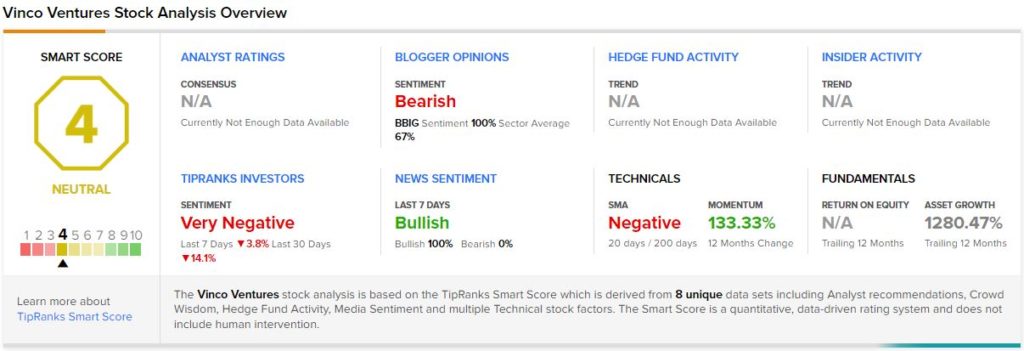

Vinco Ventures scores a 4 out of 10 from the TipRanks Smart Score rating system, indicating that it is on the lower end of the neutral range. This is based on very negative sentiment from TipRanks investors, negative technicals, bearish blogger opinions, and bullish news sentiment.

Summary and Conclusion

Vinco Ventures is a highly speculative investment that is not followed by the professional Wall Street analyst community. It is trading at a large price-to-sales premium, lacks much fundamental strength, is heavily shorted, and the stock price experiences massive volatility. As a result, only the most aggressive and speculative investors may want to consider adding shares.

Disclosure: At the time of publication, Samuel Smith did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >