ETFs focused on high-quality stocks have grown in popularity in recent years. Fund giant Vanguard, whose Vanguard S&P 500 ETF (NYSEARCA:VOO) is the third-largest ETF in the world by market cap, launched its own Vanguard U.S. Quality Factor ETF (NYSEARCA:VFQY) in 2018. However, is its quality-focused offering better than its flagship, $317.8 billion ETF that simply invests in the S&P 500 (SPX)? Let’s compare and find out.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Strategies of Each ETF

VOO’s strategy is straightforward. It simply invests in the stocks in the S&P 500, with no extra bells or whistles attached.

VFQY’s strategy adds a bit more complexity, incorporating a quality factor into its investments. Essentially, this means that VFQY’s managers are looking for stocks with strong fundamentals, namely strong profitability and balance sheets.

Diversified Portfolios

VFQY is incredibly diversified. It holds 458 positions, and its top 10 holdings make up a mere 14.5% of the fund, so investors don’t need to worry about having too much exposure to one stock or a handful of stocks. Below is an overview of VFQY’s top 10 holdings, created using TipRank’s holdings tool.

Because it invests in the entire S&P 500, VOO is also extremely diversified. It sports 505 holdings, and its top 10 make up 30.4% of assets. VOO’s top 10 holdings are listed below.

Qualitatively, one difference you’ll notice between VFQY and VOO’s holdings is that because VOO just invests in the S&P 500 without any additional screens or factors, VOO skews more towards the big tech stocks that occupy the top of the S&P 500 more heavily.

Because VOO is market-weighted, these holdings make up larger positions within the fund than they do in VFQY. For example, top Apple (NASDAQ:AAPL) is the top holding for both funds, but it has a 7.5% weighting in VOO and just a 1.7% weighting in VFQY.

Based on these weightings, one could say that VFQY is more diversified than VOO, even though overall, both of these funds offer ample diversification.

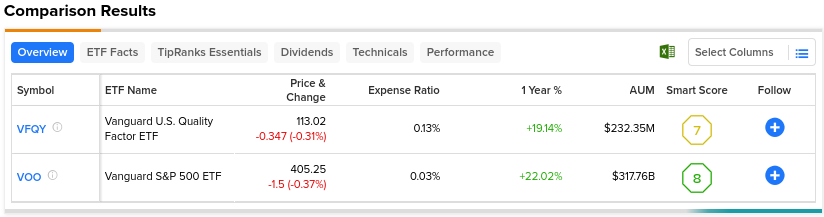

VFQY has an ETF Smart Score of 7 out of 10 versus an ETF Smart Score of 8 out of 10 for VOO. The Smart Score is TipRanks’ proprietary quantitative stock scoring system. It gives stocks a score from 1 to 10 based on eight market key factors. The score is data-driven and does not involve any human intervention. A Smart Score of 8 or above is equivalent to an Outperform rating.

Five of VFQY’s top 10 holdings feature Smart Scores of 8 or better, while seven of VOO’s score 8 or better.

Are VFQY and VOO Buys, According to Analysts?

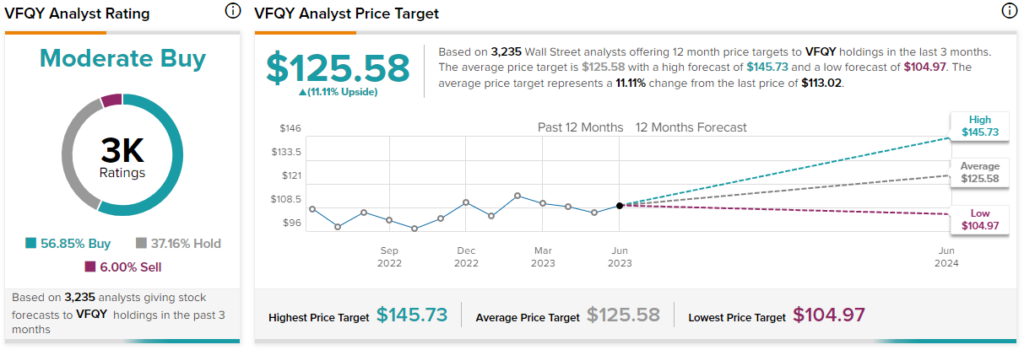

Turning to Wall Street, VFQY has a Moderate Buy consensus rating, as 56.85% of analyst ratings are Buys, 37.16% are Holds, and 6% are Sells. At $125.58, the average VFQY stock price target implies 11.1% upside potential.

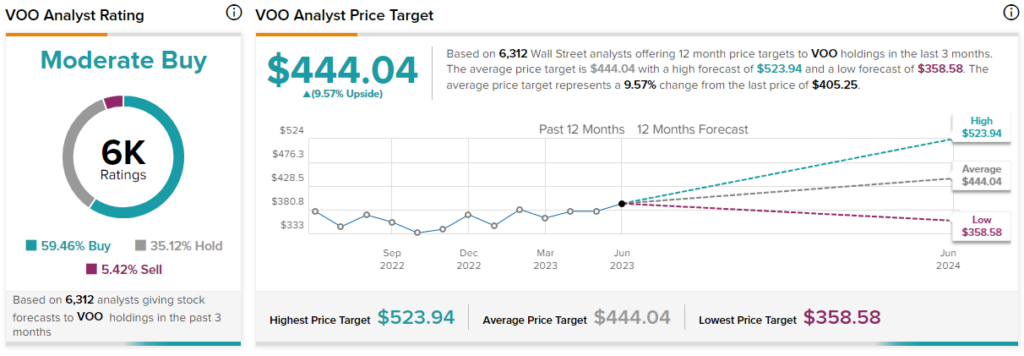

Meanwhile, VOO also has a Moderate Buy consensus rating based on 59.46% of ratings being Buys, 35.12% being Holds, and just 5.42% of ratings coming in as Sells in the last three months. At $444.04, the average VOO stock price target implies 9.6% upside potential.

Long-Term Track Records — VOO Takes the Win

VFQY has delivered admirable returns for its investors since its launch. As of the end of May, the quality-focused ETF had a three-year total annualized return of 12.5%, which is nothing to sneeze at. It also had a five-year total annualized return of 7%.

However, these results were bested by its fund-mate, VOO. Over a three-year time frame, VOO edged out VFQY with a total return of 12.8%. However, when we look out over a longer time frame, that’s when the rubber really starts to meet the road. VOO’s five-year annualized return of 11% is four full percentage points better than VFQY’s per year, giving VOO an inarguable edge in this comparison.

Comparison of Fees — VOO Wins Again

Vanguard is often praised for its low-fee investment products, and these two funds fit that bill. VFQY features a reasonable enough expense ratio of 0.13%, but VOO has a clear edge here as well, with a rock-bottom 0.03% expense ratio.

Assuming that the expense ratio remains the same and that the ETF returns 5% annually, an investor putting $10,000 into VFQY would pay $13 in expenses in year one, $42 over three years, $73 over five years, and $166 over 10 years.

Meanwhile, under the same parameters, an investor allocating the same amount towards VOO would pay just $3 in year one, $10 over three years, $17 over five years, and $39 over the course of the decade, offering substantial savings against its counterpart.

Below, you can check out a comparison of VFQY and VOO using TipRanks’ ETF Comparison Tool, which is customizable and allows users to compare up to 20 ETFs at once across a variety of factors.

Investor Takeaway

VFQY is a good ETF with a strong portfolio of holdings, a solid performance track record, and reasonable fees. However, it is outshined by its own Vanguard counterpart, VOO, which has a less complex strategy but a similarly strong portfolio, an even better track record, and even lower fees.

It may sound surprising that a fund that just invests in the S&P 500 outperforms one specifically focused on high-quality stocks, but keep in mind that the S&P 500 index itself is actually already a pretty good barometer for quality.

The S&P 500 accounts for most of the total value of all stocks listed on U.S. exchanges. These stocks must be profitable, have their primary listing in the United States, trade on the NYSE or NASDAQ, have a market cap of over $12.7 billion or more, and meet certain float and liquidity requirements.

It takes years of strong performance to attain this type of market cap and to be included in this index, so being in the S&P 500 already makes it more likely that a stock is of “high quality.” For the reasons discussed above, while VFQY is a solid investment choice, it’s hard to see a compelling reason to choose it over the even better VOO.