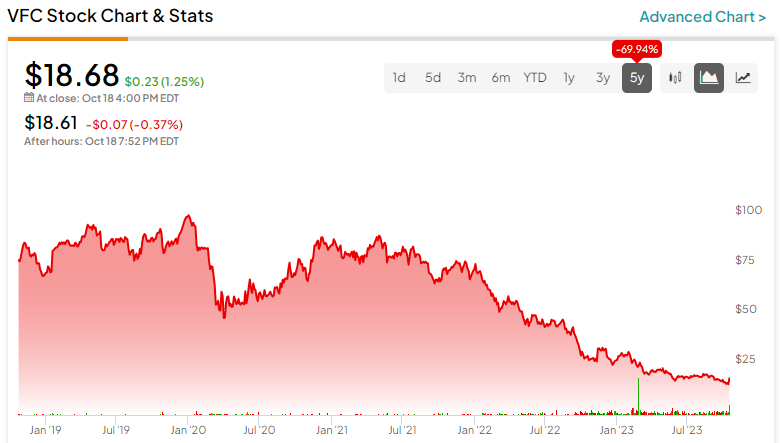

Shares of VF Corp (NYSE:VFC), the parent company of a stable of well-known fashion brands, including Vans, The North Face, Dickies, and Timberland, are down nearly 45% from their 52-week high. However, there’s reason for optimism. A prominent activist investor, Engaged Capital, has taken a stake in the company and believes shares could more than double from current levels. Plus, the stock trades at a cheap valuation, and it sports an attractive forward dividend yield of about 6.4%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Therefore, I’m bullish on the stock based on its valuation, dividend yield, and the potential of the activist to create meaningful change at the company.

Clearance Rack Valuation

Shares of VF Corp are cheap, trading at a forward price-to-earnings multiple of just 9.1. This represents a sizable discount to the valuation of the broader market. The S&P 500 (SPX) currently enjoys a forward price-to-earnings multiple of nearly 20. VFC’s depressed valuation leaves plenty of room for multiple expansion if VF Corp can turn things around and surpass the low bar the market has set for it in terms of expectations.

Dividend Yield Still Attractive After Cut

Unfortunately for long-term holders, VF Corp reduced the amount of its quarterly dividend payout earlier this year. This came after 49 straight years of dividend growth, with the company only a year away from becoming a Dividend King.

However, the good news for new investors taking a look at the stock now is that with a payout of $0.30 per quarter, the current dividend yield of 6.4% still looks fairly attractive. Even with this reduced payout, VF Corp is still an attractive income stock with a yield that far surpasses the average dividend yield of the S&P 500 (currently just 1.6%) and also beats the yield of the 10-year Treasury note (currently 4.95%).

Furthermore, while nobody likes a dividend cut, the fact that this cut is already in the rearview mirror means that the company can move forward and is less likely to need to make a drastic reduction to its payout again in the near future.

Get Active

There are plenty of stocks out there that are cheap or have high dividend yields, but they are often cheap for a reason. They are in a state of decline and lack a catalyst to drive the price higher. Here’s where Engaged Capital, a prominent activist investor, comes in.

Not only has Engaged reportedly invested in the company, but it outlined a plan to turn the business around and believes the stock could be worth much more than it is today if VF Corp works with the firm and implements its recommendations.

How much more? The stock is currently priced at $18.68 per share (and keep in mind this price already includes a large 14% gain from Tuesday, which was the direct result of the news of Engaged buying in), but Engaged Capital believes shares could reach $46 within three years. That would represent a return of roughly 146% — not too shabby for three years.

What kind of changes does Engaged Capital want VF Corp to make? As you might guess, the activist investor wants the company to reduce its expenses. It believes the company can cut $300 million in costs through “the elimination of duplicative costs and corporate excess.”

Additionally, Engaged Capital wants VF Corp to hold off from making acquisitions and to explore the idea of selling non-core assets — basically, any brand that’s not Vans or The North Face. Streamlining the business in this way to focus on its most popular and productive brands doesn’t seem like a bad idea. Engaged Capital also wants the company to consider refreshing its board with retail-industry veterans that the activist has recruited.

And while relations between activists and management teams can sometimes be hostile, that doesn’t seem to be the case here. Engaged Capital says that the previous CEO, Steve Rendle, who abruptly stepped down last year, made mistakes, but they believe that the new CEO, Bracken Darrell, is the right person to make changes and lead the company forward. The Wall Street Journal reports that Engaged Capital founder Glenn Welling has had “constructive” talks with Darrell.

Is VFC Stock a Buy, According to Analysts?

Turning to Wall Street, VFC earns a Hold consensus rating based on three Buys, 10 Holds, and two Sell ratings assigned in the past three months. The average VFC stock price target of $21.71 implies 16.2% upside potential.

Investor Takeaway

While analysts clearly don’t share Engaged Capital’s bullish outlook on VF Corp, that’s what makes a market. With an undemanding valuation, sizable dividend yield, and the likelihood of Engaged Capital shaking things up, VF Corp looks like an attractive investment opportunity with real potential upside, moving forward.