Shares of telecom behemoth Verizon (VZ) took a sharp turn lower last week following the release of some rough second-quarter earnings results. Investors are growing increasingly concerned over Verizon’s stagnating wireless growth. Despite the Q2 disappointment and downbeat outlook over the ugly economic storm clouds ahead, Verizon stock still looks incredibly attractive at just nine times trailing earnings with its bountiful 5.7% dividend yield.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sure, intense headwinds could take a big bite out of subscriber growth. Warren Buffett had also cut its Verizon stake earlier this year, possibly in response to looming headwinds and increased competition from telecom rivals like AT&T (T).

That said, there’s already so much negativity baked into Verizon stock. I remain bullish.

Verizon Faces a Tougher Environment and Fiercer Competition

For years, Verizon has been a standout performer in the U.S. telecom market. With such a dominant share of the American wireless market, Verizon has been able to rake in the cash flows and fund generous dividend increases over time. Verizon’s dominance in wireless used to be a major positive, as the firm made the most of its strong market positioning. However, with competition heating up in the face of a recession, Verizon’s customer base could be at risk.

The company posted underwhelming results for the second quarter, but they were by no means abysmal. Verizon’s EPS of $1.31 missed by just a penny, while revenues were a bit on the light side at $33.8 billion, essentially flat on a quarter-over-quarter basis.

The biggest concern with Verizon was the slowdown in postpaid wireless customer additions. However, the 14,000 wireless customer adds marked an improvement from the 36,000 losses sustained in the first quarter (typically a period of seasonal weakness). Nevertheless, the second-quarter bounce-back was far softer than expected, perhaps signaling the start of a sustained economic slowdown.

Indeed, Verizon’s softer wireless numbers may be viewed as just the beginning of a more drastic plunge in wireless subscribers. With a recession on the way, the telecom sector will certainly feel pressure as average revenues per user begin to shrink.

As telecom goes for a slide, Verizon rival AT&T is picking up traction, with positive wireless subscriber momentum of late. Undoubtedly, AT&T’s media spin-off has allowed the firm to take a step back and focus on its bread-and-butter telecom business. The leaner AT&T certainly looks meaner through the eyes of rivals like Verizon. As AT&T continues investing heavily to play catch up, it may take share away from the likes of Verizon.

Verizon has some levers it can pull to stave off increasing competitive pressure in a commoditized market. Increased promotional activity and other margin-eroding moves can help Verizon give wireless growth a jolt again. Still, such efforts will likely be matched by its rivals in a hurry.

Higher interest rates are also not doing Verizon any favors. Capital spending requirements will likely remain quite elevated as the firm continues investing in improving network performance and expanding coverage. Despite hefty expenditures, Verizon’s balance sheet looks quite solid, with net debt sitting below three times EBITDA.

Verizon’s dividend is also stable with a 47.5% payout ratio. However, it could become stretched, and its growth could be muted if wireless weakness intensifies, going into recession. Management aims to use 50-60% of free cash flows to fund its dividend — a very hefty commitment.

Wall Street’s Take on VZ

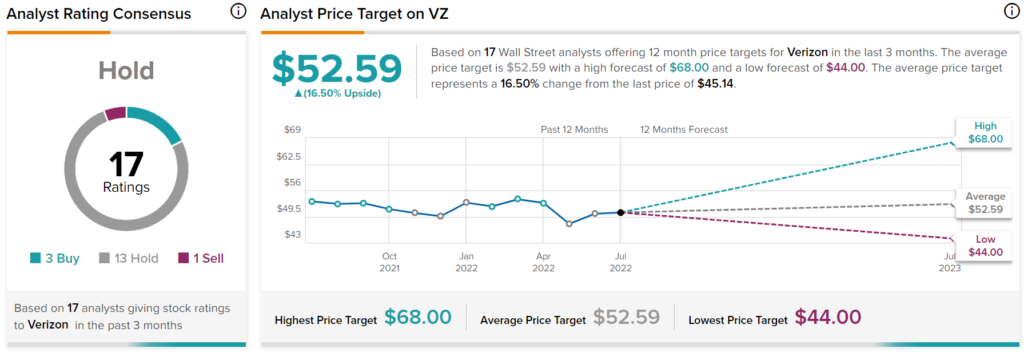

Turning to Wall Street, Verizon has a Hold consensus rating based on three Buys, 13 Holds, and one Sell assigned in the past three months. The average VZ price target of $52.59 implies 16.5% upside potential. Analyst price targets range from a low of $44.00 per share to a high of $68.00 per share.

Bottom Line: Negativity is Likely Already Reflected in the Valuation

Verizon is in a tough spot as it seeks to do everything in its power to retain its leadership position in the U.S. postpaid phone market. AT&T is a telecom underdog that could make it increasingly difficult for Verizon to extend its lead. With a recession on the horizon and hefty capital expenditures ahead, Verizon faces some of the choppiest waters in recent memory. That said, the valuation already seems to bake in so much negativity.

If the coming economic downturn ends up more benign than the average recession, Verizon stock could have compelling upside, and it’s contrarians who buy amid the pessimism that will be able to “lock in” the swollen yield.