Shares of Verizon Communications (NYSE:VZ) are now offering a near-record dividend yield of 7% following the harsh beating they have been taking over the past couple of years. Note that Verizon has never cut its dividend throughout its long history. Further, during the two previous times (in 2008 and 2010) that the stock offered such a high dividend yield, investors quickly took the opportunity to capitalize on such an opportunity, resulting in shares rebounding shortly after.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In that sense, Verizon stock could be offering a compelling opportunity for income-oriented investors seeking a hefty yield, especially given it comes from a reputable telecom large cap.

On the flip side of this argument, Verizon is currently confronting substantial risks due to the recent surge in interest rates. The company finds itself heavily burdened with debt, a prevalent situation within the industry, resulting in a significant anticipated increase in interest expenses upon eventual note refinancing.

As interest expenses already consume a significant portion of operating cash flows, coupled with the company’s obligation to maintain high CapEx (capital expenditures — investments in the business) for future infrastructure expansion, there is a potential for Verizon’s financial position to deteriorate progressively. Hence, I am neutral on the stock.

Growing CapEx Prompts High Indebtedness

To understand Verizon’s problem related to its indebtedness, you need to understand why the company has to undertake significant amounts of debt. It is basically because Verizon needs to consistently invest growing amounts of money in CapEx due to the nature of the telecom industry. Essentially, Verizon operates a vast network infrastructure that includes cellular towers, fiber optic cables, data centers, and other critical components.

Importantly, Verizon must continuously expand and upgrade its network infrastructure to meet the growing demand for data services and support new technologies like 5G. This involves deploying additional cell towers, laying more fiber optic cables, and enhancing the capacity and coverage of existing infrastructure.

These investments are crucial to meet the surging demand for data services, support cutting-edge technologies, optimize network performance, secure spectrum licenses, accommodate customer growth, ensure network resilience, and capitalize on emerging trends such as edge computing and IoT. However, they necessitate substantial and consistent funding. Therefore, Verizon turns to the debt markets, where it can access the necessary funds to finance these investments.

But why are creditors willing to keep lending to Verizon? For two compelling reasons. Firstly, as a telecommunications giant serving millions of customers with an essential and recession-proof service, Verizon enjoys highly predictable and recurring cash flows.

Secondly, these investments are backed by tangible physical assets such as telecom towers and fiber optic cables, providing solid collateral. These two factors contribute to the lenders’ confidence in allowing Verizon’s debt load to grow significantly without causing concern.

To put the aforementioned details into perspective, Verizon’s capital expenditures have been steadily increasing annually. For instance, in 2013, the company allocated $16.6 billion for CapEx. Last year, this figure had already risen to $23.1 billion.

Considering that the company generated $37.1 billion in cash flows from operations during the same period, with $13.6 billion and $10.8 billion allocated to debt repayment and dividends, respectively, it is logical that Verizon needed to issue additional debt to cover all CapEx and enhance its liquidity further.

This consistent trend has led to Verizon’s total debt skyrocketing from approximately $50 billion a decade ago to an astounding $186.2 billion in its most recent quarterly report. Historically, Verizon’s massive debt load was not a significant topic of discussion, given the prevailing below-average interest rates.

However, with interest rates currently on the rise, Verizon’s cost of debt is expected to increase substantially as the company has to gradually refinance its debt, potentially putting a strain on its free cash flow. According to consensus estimates, Verizon’s interest expenses are projected to surpass $5.0 billion in Fiscal Year 2024, representing a substantial increase compared to last year’s interest expenses of $3.61 billion in Fiscal Year 2022.

Is Verizon’s 7%-Yielding Dividend Safe?

Considering Verizon’s substantial debt burden, which poses a threat to its future profitability, as I previously discussed, it is understandable that the market maintains a skeptical outlook on the company’s dividend. This skepticism has led to a sell-off of shares and a high dividend yield. In my opinion, the company is unlikely to reduce its dividend despite the anticipated impact on Verizon’s net income due to increased interest expenses.

It is a core pillar of its investment case, and doing so would completely put off existing and prospective investors, sending shares down the drain. Just take a look at AT&T’s (NYSE:T) stock price following last year’s dividend cut.

Consequently, I believe Verizon will strive to manage the forthcoming rise in interest expenses by controlling its operating costs and potentially assuming additional debt while hoping for a return to normal interest rates in the medium term, which would provide some relief. Still, there is definitely risk regarding a potential dividend cut, so I wouldn’t take this possibility off the table.

Is VZ Stock a Buy, According to Analysts?

Turning to Wall Street, Verizon Communications has a Moderate Buy consensus rating based on five Buys and seven Holds assigned in the past three months. At $44.38, the average Verizon Communications stock price target implies 19.3% upside potential.

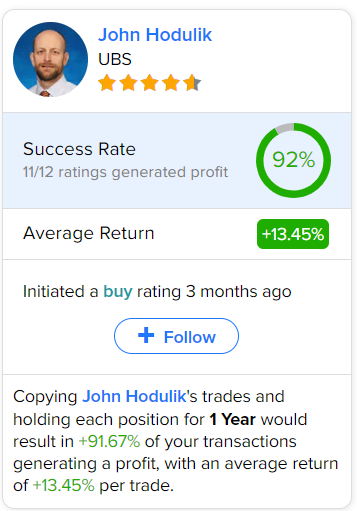

If you’re wondering which analyst you should follow if you want to buy and sell VZ stock, the most accurate analyst covering the stock (on a one-year timeframe) is John Hodulik from UBS, with an average return of 13.45% per rating and a 92% success rate.

Conclusion

In conclusion, Verizon presents a mixed picture for investors. On the one hand, the stock offers a compelling opportunity for income-oriented investors seeking a hefty yield, considering its near-record dividend yield of 7% and the company’s history of never cutting its dividend.

On the other hand, Verizon faces substantial risks due to its heavy indebtedness and the anticipated increase in interest expenses. The company’s financial position could deteriorate progressively, posing a threat to its future profitability.

I choose to lean on the view that the company is likely to strive to maintain its dividend to retain investor confidence. However, the risk of a potential dividend cut cannot be disregarded entirely.