U.S. telecommunication service providers, including Verizon (NYSE:VZ) and AT&T (NYSE:T), will announce their second-quarter financial results this week. Verizon will report on July 25 before market open, and AT&T is set to release its results on July 26 before the opening bell. Their quarterly results are likely to have benefited from an accelerated pace of 5G deployments and fiber roll-outs.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Year-to-date, both T stock and VZ stock have declined 17.5% and 11.2%, respectively. The fall can be attributed to challenges such as aging telephone lines inherited from predecessor companies and high debt balances.

Key Trends to Watch in Q2

In a note to investors on July 11, Goldman Sachs analyst Brett Feldman said cable operators are likely to have witnessed slightly negative to slightly positive net additions during the quarter. At the same time, he expects fixed wireless services to have registered subscriber growth of over 100% across major providers.

In addition, Feldman anticipates major telecom providers to report “modest declines in their wireline broadband subscriber bases” on account of ongoing declines in copper/digital subscriber line usage.

Moving on, a slowdown in industry-wide growth and increased cable competition are expected to have affected postpaid phone net additions in the quarter, according to the analyst.

What is the Price Target for T Stock?

During a recent investor conference, management provided insights into AT&T’s second-quarter 2023 performance. The company stated that postpaid phone net additions are expected to be slightly above 300,000 and that fiber broadband net additions are projected to be in the mid-200,000 range for the quarter. These expectations reflect a considerable decline on a year-over-year basis and may have implications for the companies’ overall financial results.

Wall Street analysts expect AT&T to report revenues of $29.96 billion in Q2, which reflects a slight improvement from the previous quarter’s revenue of $29.6 billion. At the same time, analysts expect T stock to post earnings of $0.60 per share in Q2, down from $0.65 in the prior-year quarter.

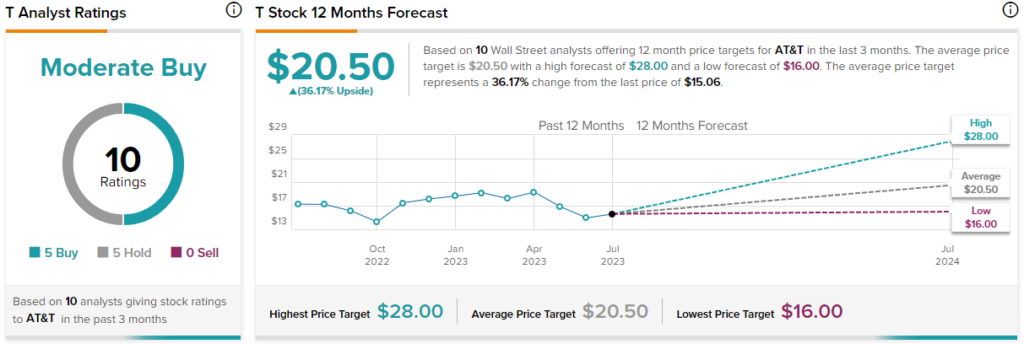

T stock has five Buy and five Hold recommendations, reflecting a Moderate Buy consensus rating on TipRanks. The average T stock price target of $20.50 implies 36.2% upside potential from here.

What is the Earnings Forecast for VZ Stock?

Verizon’s performance in the second quarter is expected to be affected by factors such as a deceleration in the expansion of its fiber network and intense competition. On the other hand, Verizon introduced myPlan, a personalized phone plan starting at $25/line for unlimited data, which is likely to have helped VZ stabilize its postpaid customer base.

Analysts expect Verizon to post revenues of $33.33 billion in Q2, lower than $33.79 billion in the prior-year quarter. Wall Street also expects VZ to post earnings of $1.17 in Q2, reflecting a decline from $1.31 per share in the same quarter last year.

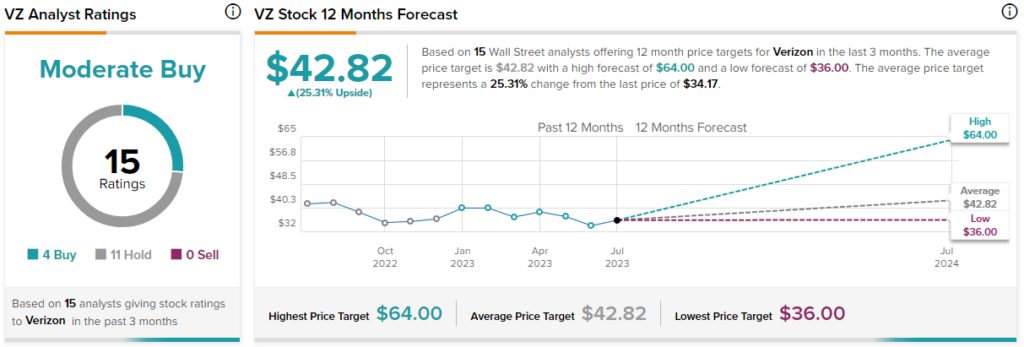

Overall, VZ stock sports a Moderate Buy consensus rating on TipRanks based on four Buy and 11 Hold recommendations. Analysts’ average 12-month price target of $42.82 implies 25.3% upside potential.