Investing in exchange-traded funds (ETFs) comes with several benefits, such as diversification, higher liquidity, and a lower expense ratio compared to individual stocks or mutual funds. Today, we have leveraged the TipRanks ETF Screener to scan for two energy-sector ETFs with more than 20% upside potential: Vanguard Energy ETF (VDE) and Fidelity MSCI Energy Index ETF (FENY).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a closer look at what Wall Street thinks about these two ETFs.

Should You Invest in VDE?

The Vanguard Energy ETF is passively managed and seeks to track the performance of the MSCI U.S. Investable Market Energy 25/50 (MSCI 25/50) Index, which measures the investment return of stocks in the energy sector. VDE has $8.06 billion in assets under management (AUM), with its top 10 holdings contributing 65.31% of the portfolio. Notably, the VDE ETF has a current dividend yield of 3.28%. Its expense ratio stands at 0.10%.

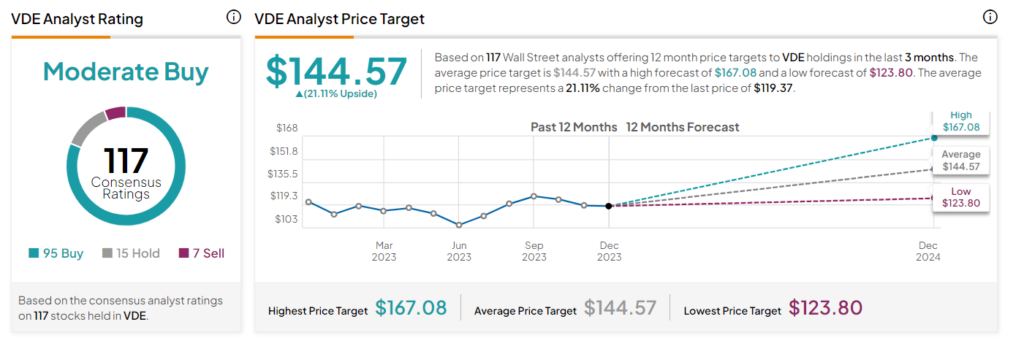

On TipRanks, VDE has a Moderate Buy consensus rating. Of the 117 stocks held, 95 have Buys, 15 have a Hold rating, and seven stocks have a Sell rating. The average Vanguard Energy ETF price target of $144.57 implies a 21.1% upside potential from the current levels.

Is FENY a Good Investment?

The Fidelity MSCI Energy Index ETF tracks the performance of the MSCI 25/50 Index by investing at least 80% of its assets in securities included in the index. FENY has $1.49 billion in AUM, with the top 10 holdings contributing 65.09% of the portfolio. Further, the ETF boasts a current dividend yield of 3.27%. Meanwhile, the expense ratio of 0.08% is one of the lowest in the industry.

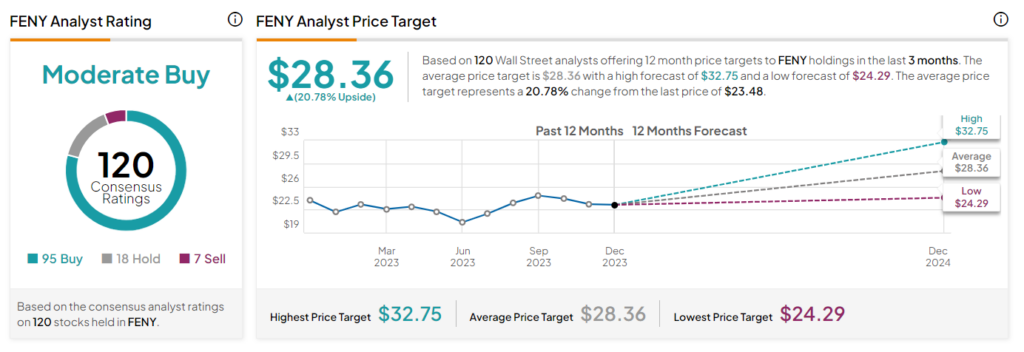

On TipRanks, FENY has a Moderate Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 120 stocks held, 95 have Buys, 18 have a Hold, and seven stocks have a Sell rating. The average Fidelity MSCI Energy Index ETF price forecast of $28.36 implies a 20.8% upside potential from the current levels.

Ending Thoughts

Sector-focused ETFs offer a strategic way to diversify and capture potential growth within the chosen sectors. Given the solid upside potential expected by analysts, VDE and FENY ETFs might seem attractive to investors.