After lagging the market earlier this year, energy stocks look like they are ready for a breakout. Crude oil prices are up over the past month, and energy stocks are beginning to follow suit. The Vanguard Energy ETF (NYSEARCA:VDE) can help investors capitalize on this momentum. It’s up 3.3% over the past month and up 11.5% over the past quarter, while the broader market, as represented by the Vanguard S&P 500 ETF (NYSEARCA:VOO), is down 3.5% and up 4.6%, respectively, over the same time frames.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Similarly, VDE is even outperforming the previously high-flying Nasdaq (NDX), as the Invesco QQQ Trust (NASDAQ:QQQ) (which tracks the Nasdaq 100 Index) is down 3.4% over the past month and up 7.6% over the past quarter.

In July, OPEC+ oil production hit a near two-year low, and Saudi Arabia, the world’s second-largest producer of oil, looks committed to continuing to limit production in the near term, which should give oil prices continued support.

Some investors may also be taking gains from year-to-date winners and rotating into undervalued sectors that had previously lagged the market, like energy. Given this geopolitical backdrop and the renewed momentum in energy stocks, the sector looks attractive, meaning it’s time to take a closer look at the Vanguard Energy ETF.

What is VDE ETF’s Strategy?

VDE is a passively-managed ETF from ETF and mutual fund giant Vanguard that “seeks to track the performance of a benchmark index that measures the investment return of stocks in the energy sector,” according to Vanguard. This long-standing ETF launched all the way back in 2004 and now has $8.3 billion in assets under management (AUM).

VDE’s Holdings

VDE offers investors decent diversification, with one caveat. While it holds 114 stocks, its top 10 holdings account for 64.8% of the fund, and its top two holdings, ExxonMobil (NYSE:XOM) and Chevron (NYSE:CVX), account for roughly one-third of assets.

That being said, VDE is more diversified than another popular ETF, the larger Energy Select Sector SPDR Fund (NYSEARCA:XLE), which invests in the energy sector of the S&P 500 (SPX) and only holds 23 stocks. VDE is also slightly less concentrated than XLE — XLE’s top 10 holdings make up nearly three-quarters of the fund’s assets (versus the aforementioned 64.8% for VDE). Further, ExxonMobil and Chevron make up about 40% of XLE’s assets.

Below, you can check out an overview of VDE’s top 10 holdings using TipRanks’ holdings tool.

A large stake in ExxonMobil is not necessarily a bad thing, as the oil giant enjoys a ‘Perfect 10’ Smart Score. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. The score is data-driven and does not involve any human intervention.

While ExxonMobil has a perfect Smart Score, Chevron has a less enviable neutral Smart Score of 5. Still, an impressive seven out of VDE’s top 10 holdings feature Outperform-equivalent Smart Scores of 8 or better. Perhaps even more impressively, 50% of VDE’s top 10 holdings feature perfect Smart Scores — ExxonMobil, ConocoPhillips (NYSE:COP), Occidental Petroleum (NYSE:OXY), Phillips 66 (NYSE:PSX), and Pioneer Natural Resources (NYSE:PXD).

VDE itself boasts an outperform-equivalent ETF Smart Score of 8 out of 10.

Is VDE Stock a Buy, According to Analysts?

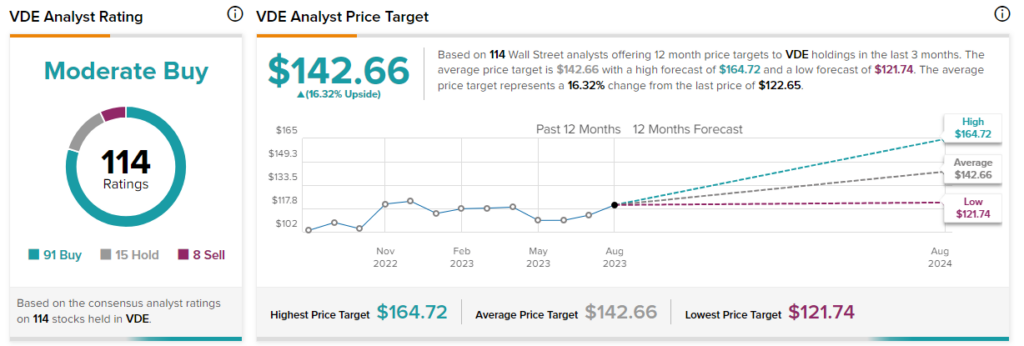

Turning to Wall Street, VDE earns a Moderate Buy consensus rating based on 91 Buys, 15 Holds, and eight Sell ratings assigned in the past three months. The average VDE stock price target of $142.66 implies 16.3% upside potential.

Longstanding Dividend

VDE also offers investors a solid dividend yield of 3.74%. While a dividend yield in this range perhaps doesn’t sound quite as enticing as it did a couple of years ago before interest rates began rising, it still adds a nice boost to the total returns of an investment over time.

Furthermore, VDE has a longstanding track record as a dividend payer, having paid a dividend to its holders for 16 years in a row. Also, the payout has been growing recently — VDE’s annual dividend payout has grown by a CAGR of 18.7% over the past three years.

This yield is comparable to XLE’s dividend yield of 3.66%.

Reasonable Fees

Vanguard is well-known for offering cost-effective ETFs and mutual funds, and VDE is yet another example in a long line of these, with a reasonable expense ratio of just 0.10%. This means that an investor putting $10,000 into VDE will pay just $10 in fees during their first year of holding it.

Over the course of a decade, this investor would pay just $128 in fees. Choosing low-cost ETFs with modest expense ratios is a good way for investors to preserve the principal of their portfolios over time.

Note that VDE’s expense ratio is identical to competitor XLE’s expense ratio of 0.10%.

Looking at Its Long-Term Performance

VDE has put up a monster three-year annualized total return of 42.2%, outperforming the broader market by a considerable margin. For instance, Vanguard’s S&P 500 ETF, VOO, had an annualized total return of 13.7% over the same time frame.

However, its five-year annualized total return of 7.0% and its 10-year annualized total return of 3.8% aren’t quite as compelling, indicating that this is likely an ETF to buy opportunistically and to take gains on over time as opposed to one that you can simply “set and forget.”

Investor Takeaway

VDE boasts an Outperform-equivalent Smart Score, and its portfolio features a strong group of energy stocks with high Smart Scores, including many with Perfect 10 Smart Scores. The analyst community is also bullish on VDE, assigning it a Moderate Buy rating. The macro backdrop for energy companies looks solid, and the sector appears to be gaining momentum as the early stages of a rotation may be underway.

With these favorable indicators, an investor-friendly expense ratio, and a solid and reliable dividend, VDE looks like an attractive investment to own in the current environment.

For investors choosing between XLE and VDE, both are great energy ETFs that are attractive for similar reasons, with the primary difference being that VDE offers a bit more diversification.