The just-released CPI report for August came in lower than July but higher than expected – and markets have tanked in response. The headline number was the 8.3% annualized rate of inflation for the month, against the 8.1% expected. To tame inflation, the Federal Reserve is likely to raise interest rates by 75 basis points at its next meeting on September 21.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For investors, this means that it might be time to shift priorities in the portfolio. Higher inflation and interest rates usually send investors into a “flight for safety” mode, which gives rise to value stocks due to their more fundamentally secure standing.

Against this backdrop, we’ve opened up the TipRanks database to find two value tickers that have earned Strong Buy ratings from Wall Street. In fact, Deutsch Bank analysts sees their upside potentials starting at 50% and heading up from there. Let’s take a closer look.

Blue Owl Capital (OWL)

We’ll start with a financial firm, Blue Owl Capital. This company is a provider of private market capital solutions, working through three subsidiaries in the direct lending business: Owl Rock, Oak Tree, and Dyal Capital. At the end of 1H22, Blue Owl had over $199 billion in total assets under management, and keeps its focus on providing attractive risk-adjusted returns for investors.

Blue Owl shares entered the public markets in May of last year, as the result of a SPAC merger between Owl Rock and Dyal Capital with the Altimar Acquisition Corporation. Since going public, Blue Owl’s revenues and earnings have both increased steadily. The company’s 2Q22 top line came in at $327 million, up 82% y/y. On earnings, the company reported distributable earnings of 13 cents per adjusted share. This compared favorably to the 9 cents reported in the year-ago quarter – and it fully covered the company’s current dividend payment.

The dividend was most recently declared in August, at 11 cents per common share for an August 29 payout. The 44 cent annualized dividend gives a yield of 4%, well above the market average.

Blue Owl has caught the eye of Deutsche Bank analyst Brian Bedell, who believes the stock offers a winning combination of growth and value.

“We view OWL as possessing a solid mix of favorable attributes within the alternative asset mgmt. industry, those being: 1) a business profile geared toward strong secular growth trends in the need for capital solutions for the private capital industry, 2) an earnings mix that maximizes the contribution from fee-related earnings, 3) a solid contribution from retail distribution, & 4) a very strong FRE growth profile mostly via strong fundraising prospects over at least the next two years,” Bedell wrote.

The analyst summed up, “We view the stock as offering compelling value in addition to having the strongest FRE CAGR for 2021-24E of 29-30%…”

In addition to his bullish comments, Bedell gives OWL shares a Buy rating and a $19 price target that implies a robust one-year upside of 72%. (To watch Bedell’s track record, click here)

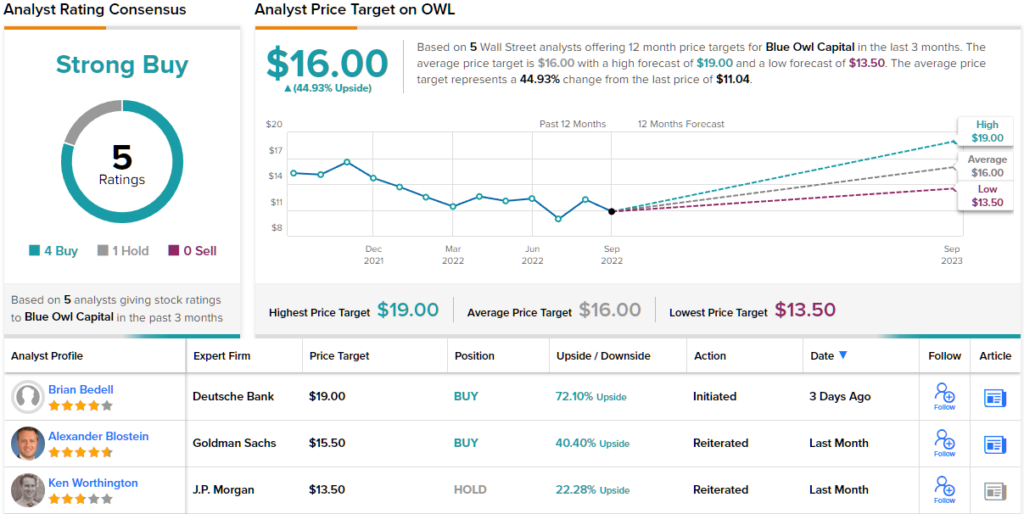

Overall, the Strong Buy rating on this stock is based on the consensus view of Wall Street’s analysts, whose 5 most recent reviews here include 4 to Buy and 1 to Hold. The shares are priced at $11.04 and their $16 average target suggests they have ~45% gain in store for the year ahead. (See OWL stock forecast on TipRanks)

ABM Industries (ABM)

The next value stock we’re looking at is ABM Industries. The company is a contract facilities manager offering a range of services to its clients, including cleaning and janitorial services, parking management and maintenance, facilities engineering, and HVAC and mechanical services. These are the background logistical matters that give headaches to companies around the world in every niche, from schools to offices to hospitals to factories, and ABM solves it. The company has clients in aviation, business, education, healthcare, industry, and manufacturing.

ABM has reported sound financial results consistently for several years now, and used the corona crisis to introduce its ‘Enhanced Clean’ service to customers. In the company’s fiscal year 2022, it saw revenues increase from approximately $1.5 billion per quarter to $1.9 billion. The most recent quarter, 2Q of fiscal 2022, showed $1.96 billion at the top line, for a 27% year-over-year gain. Adjusted EPS grew 4% y/y, to 94 cents.

So ABM runs a profitable business – and it passes the profits on to investors. The company’s dividend is currently 19.5 cents per common share, or 78 cents annualized. At that rate, the dividend yields a 1.85%, but the real attraction here is the reliability; ABM paid out the common share dividend in 225 consecutive quarters.

ABM also has a clear strategy for growth by acquisition, and on September 1 it closed its deal to acquire RavenVolt, a designer and installer of microgrid power solutions. The acquisition enhances ABM’s technical solutions services, and positions the company to deliver solutions for EV infrastructure, power generation, and bundled energy.

Covering ABM for Deutsche Bank, analyst Faiza Alwy describes the stock as his “Best ‘Value’ Idea.”

“We remain Buy-rated on ABM believing that the stock should re-rate higher from current levels (of <8x FY23 EBITDA, 12.4x P/E) as the company improves cash flow and continues to execute on its Elevate strategy including share gains via accretive acquisitions in core and adjacent spaces alongside digitalization initiatives allowing for a more productive workforce,” Alwy noted.

Alwy’s bullish comments fully support her Buy rating on the shares, and her price target of $65 implies a 12-month upside of ~55% for ABM. (To watch Alwy’s track record, click here)

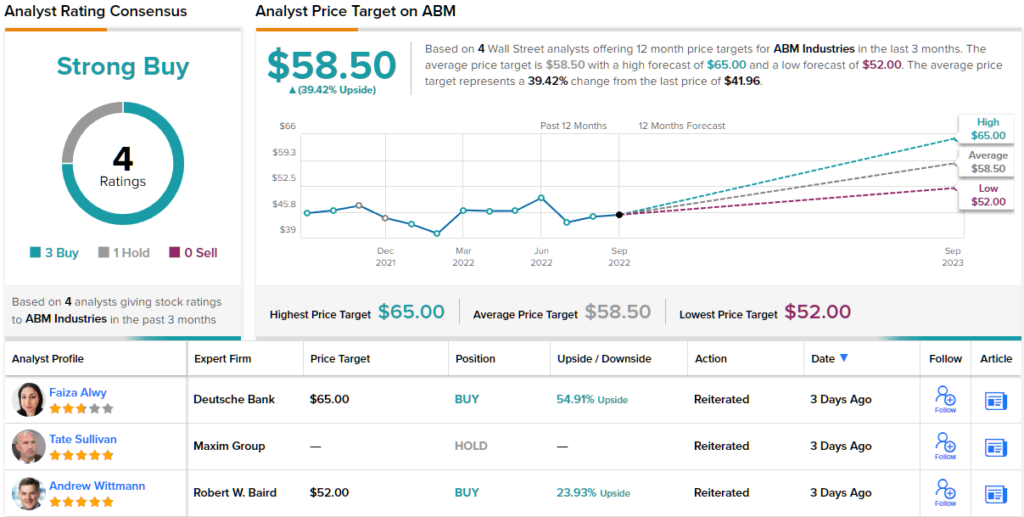

Overall, there are 4 recent analyst reviews of this stock, and they include 3 Buys over 1 Hold to support the Strong Buy consensus rating. The average price target here is $58.50, indicating potential for a 41% upside from the current trading price of $41.96. (See ABM stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.