The mighty eight-week rally in the U.S. dollar has left investors wondering if the currency’s strength is positive for the economy, how it is expected to affect stock markets, and whether it would be prudent to amend their portfolio holdings in these circumstances. Let’s delve into these questions.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

“The Least Dirty Shirt”

The U.S. dollar’s robust gains, initially fueled by the Federal Reserve’s aggressive tightening and now bolstered by America’s economic resilience and the USD’s status as a global safe haven, signify the currency’s dominance in the face of worldwide economic challenges.

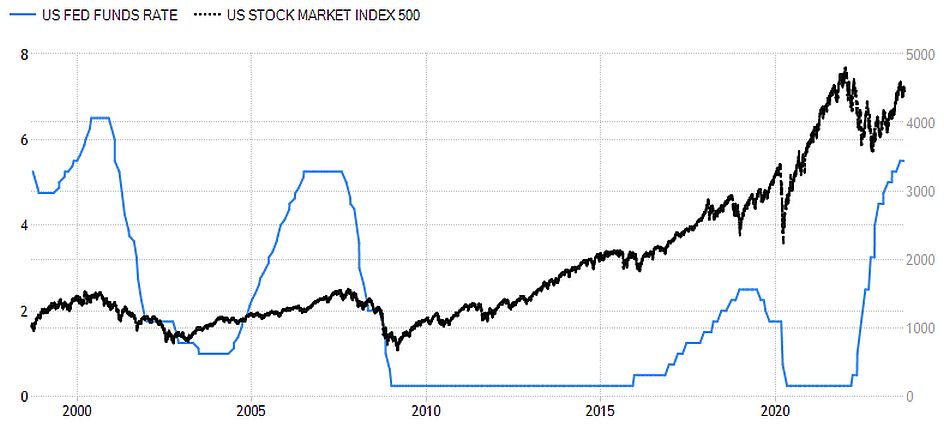

After bottoming in mid-July, the U.S. Dollar Index (DXY) has risen for eight straight weeks, the longest stretch of uninterrupted gains since 2005, rising to a six-month high. Apart from its previous surge to its most recent peak in September 2022, the DXY is now at its highest level since 2002.

Source: Trading Economics

The U.S. dollar’s surge in the second half of last year was driven by the Federal Reserve’s “fast and furious” tightening campaign, propelling the overall rates in the economy and attracting flows of capital into dollar-denominated assets such as bonds. But now it’s the comparison of the economic performances of different countries that pulls the money into U.S. assets.

The apparent resilience of the American economy, at a time when the global economy is sputtering, makes it look like “the least dirty shirt” in the pile. The U.S. economic strength means that even if the Fed foregoes further interest-rate hikes, it may leave its key rates higher for longer to make sure the inflationary cycle is broken.

As the U.S. economic data continues to come in solid, analysts are seeing lower chances of a recession – in stark contrast with gloomy prospects elsewhere. Almost all leading economies outside of the U.S. are now in a downturn, a development expected to pressure their central banks to ease (or, at least, not tighten) their monetary policies. The current, and most of all, expected interest rate differential will continue lifting the dollar in the coming months.

There are also important long-term causes for the USD’s supreme reign. Many investors around the globe view the dollar as a safe haven in times of economic or market turbulence, partly because of its status as a reserve currency, as well as the currency of international trade and financial transactions. When the global economy is on the upswing, a narrative of the USD losing its special status may shine, but when the times are tough, everyone rushes to the safety of King Dollar.

The King Shall Overcome

The currency’s strength lends a helping hand to policymakers, too. The dollar’s surge against other currencies supports lower import prices, which lowers overall inflation. Although in the U.S. inflation is mostly caused by domestic factors such as services, still, every basis point of a downward move in prices counts as a bonus. That is especially true at a time when the gas prices at the pumps are on the rise, threatening to lift the headline inflation.

Oil prices have been steadily increasing since June, reaching their 2023 highs on the OPEC+ extension of the production cuts. But now they are also propped up by the signs of strength in the world’s largest economy, meaning that the U.S. demand for energy won’t decline. Meanwhile, the current administration’s policies prevent meaningful domestic production increases. Besides, there’s also the seasonality factor at play now, with energy demand rising in the year’s colder months.

Source: Trading Economics

However, there are always at least two sides to every story. Since the commodities are traded and priced in U.S. dollars globally, historically, the relationship between the two has been inverse, i.e., when the USD is strong, the price of oil is lower in dollar terms. True, this negative correlation has been weakening in recent years, as the U.S. has increased its oil exports thanks to shale production, switching sides from net oil importer to net oil exporter. But many times, expectations influence short-term market movements more strongly than the fundamentals. Since market players believe that the USD surge should put a cap on the leap in oil prices, it does just that. Of course, King Dollar is not alone in its battle against oil-price inflation: it is being assisted by the weakening energy demand in the flagging global economy. So, while the world is hit by a double whammy, the U.S. economy enjoys the show.

While more self-sufficient than other developed markets, the U.S. economy is not an island. Surely, if the global economy is in crisis, the U.S. will be impacted, too. But at least for now, the global slowdown looks more like a normal downward part of the economic cycle than a crisis, which allows for optimism about the U.S.’s economic prospects.

The Stock Market is not the Economy

The complexities and contradictions inherent in the relationship between the USD and the U.S. stock market confound any attempt to predict the stocks’ performance based on the currency’s movements. While a stronger dollar initially appears detrimental to U.S. stocks, its reputation as a refuge and the outperformance of U.S. businesses can buoy equity markets, though this relationship is nuanced by factors like interest rate changes and broader market dynamics.

At first sight, the U.S. stocks look much more vulnerable than the economy to the USD’s upward moves. A stronger dollar makes U.S. exports more expensive abroad, suppressing demand and shrinking revenues accrued from foreign trade. The companies in the S&P 500 (SPX) earn about 40% of their revenue overseas, so, in addition to falling sales, they see their income from foreign operations shrink in dollar terms. On the other hand, companies that depend on imported inputs for their operations benefit as the input costs shrink in dollar terms.

Theoretically, a continued increase in the currency’s value could depress foreign investment in U.S. stocks as they become much more expensive in other currencies. Large overseas investors, such as mutual funds, hold a significant chunk of the U.S. equity market, ranging from 30% to 40%, so their moves in either direction could be more than tangible.

However, it must be remembered that the USD is rising because other economies are doing much worse, and because it is universally believed to be a store of value when times are harsh. So, King Dollar lends some of its shine to all U.S. assets – but it works both ways. American stocks have long traded at a premium to their global counterparts. When U.S. businesses’ earnings are believed to strongly outperform foreign companies thanks to a better economy, overseas investors are willing to pay even higher premiums. A significant increase in foreign holdings would both prop the stock prices directly and lift them indirectly: higher demand for dollars needed to buy U.S. stocks increases the USD’s value and, eventually, the prices of the U.S. stocks.

Source: Trading Economics

Importantly, stock markets, and especially tech companies that have been in the lead of the U.S. market’s both gains and losses in recent years, are significantly impacted by the direction and speed of the interest rate changes. So, if the strengthening dollar lessens the imperative for further hikes, it supports the stock markets. Of course, if the USD surges as fast and high as it did in the second half of 2022, it could do more harm than good, but that’s not certain: stock performance depends on many more factors than their price in other currencies or the price of the currency versus its peers.

Stick to Fundamentals and Carry On

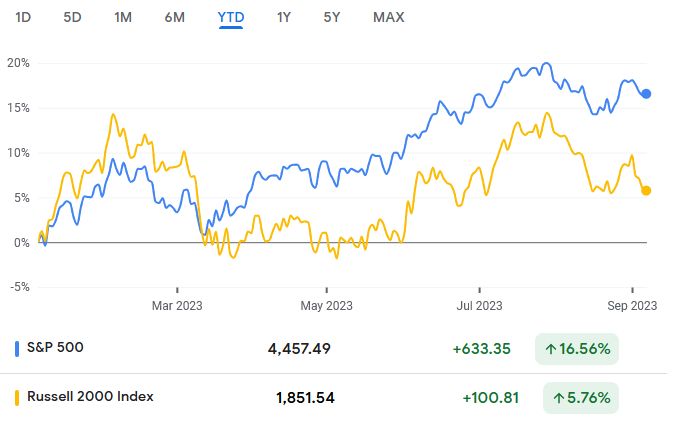

So, facing the formidable rally in the U.S. currency, should prudent investors alter their holdings and strategy? The short answer is “no.” First of all, individual investors are strongly advised against basing their decisions on short-term factors such as the notoriously volatile currency market moves. Currency strength and outlook can play a role in investment decisions, but it is much more important to screen for the economic and market drivers of these moves. For example, theoretically, while the USD’s strength harms the revenues of large, international companies, domestically oriented smaller firms (many of which depend on imported inputs) should thrive. But although the U.S. economy is in better shape than its overseas peers, there’s still too much uncertainty in the economic outlook. This uncertainty, coupled with tight financial conditions, impacts the performance of the Russell 2000 Index (a small-cap index comprised of the smallest 2,000 stocks in the U.S. stock market), which still doesn’t seem to be planning to catch up with the large-cap S&P 500.

Source: Google Finance

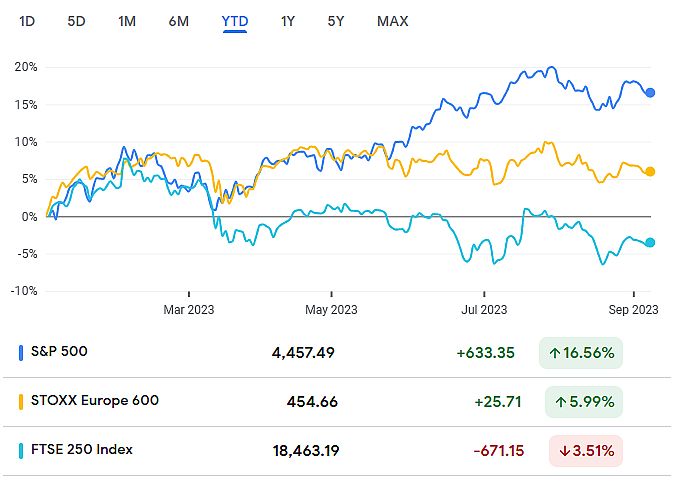

In another example, international stocks might now look attractive to U.S. investors, as in addition to historically lower valuations, they are now much cheaper in dollar terms. But, while individual European, U.K., or Australian companies may have stellar fundamentals and great prospects, making them a worthwhile investment, their markets, in general, are a different story. It wouldn’t be a prudent decision to buy into an international ETF, for instance, based on the cheapness of the underlying index – given that one of the reasons for this cheapness is the weakness of that index’s domestic economy, which, of course, drives down the stock market sentiment.

Source: Google Finance

To conclude: currency movements are one of the important indicators of the markets’ perception of the strength and prospects of the underlying economies. They shouldn’t be viewed in isolation from the economic factors directly affecting stocks. Rather, it’s important to analyze the market’s and the specific stock’s fundamentals and base investment decisions on trustworthy data and analysis.