Consumers took two hits in the pocketbook this past week. First came the August inflation numbers, with the headline annualized rate rising from 3.2% to 3.7%. And on the heels of that came news that US crude oil, the WTI benchmark price, jumped above $90 per barrel for the first time since last November and is currently trading at $91.05.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That increase marks the latest in a series of oil price increases this year. WTI is up 40% from the low point it hit in March of this year and shows a total year-to-date gain of 13.5%. The rising prices are commonly attributed to the general spike in the global crude price, stemming from decisions by Russia and Saudi Arabia to extend production cuts through the end of this year.

The rising price of oil will make a politically radioactive mix with rising inflation, putting pressure on the Federal Reserve to maintain – or even boost – high-interest rates despite the risk of recession.

But increased oil prices will also bring opportunities, particularly for energy sector investors, as oil stocks are positioned to gain from rising prices of their chief product.

5-star analyst John Freeman, from Raymond James, has been following that line, and his recent two ‘Strong Buy’ picks are worth a closer look. These are both oil stocks with heavy exposure to the US oil patch, and each has solid upside potential for the coming year. Let’s take a closer look.

Marathon Oil Corporation (MRO)

First up is Marathon Oil, a long-standing stalwart in North America’s oil industry. As a direct business descendant of Standard Oil, Marathon, in its current incarnation, boasts a $16.5 billion market cap and realized more than $7.5 billion in revenues last year. The company’s primary activities revolve around hydrocarbon exploration and production. Marathon Oil’s operations focus on high-production basins, including the Delaware and Eagle Ford formations in Texas and the Bakken fields in North Dakota. The company is also developing promising assets in Equatorial Guinea.

Marathon Oil’s asset base is well-balanced between oil and natural gas, and the company has a history of generating profits for investors. The independent E&P firm is also committed to providing capital returns through both share repurchases and dividends.

Marathon Oil repurchased $372 million worth of stock in the quarter and paid out $62 million in dividends. The common stock dividend, at 10 cents per share, provides a modest yield of 1.46%. The company has been steadily increasing the payment for several years.

Turning to John Freeman’s view, we find the analyst bullish on Marathon Oil, pointing out that the company has been beating production estimates and that the stock appears undervalued.

“As a recap regarding their 2Q results, MRO easily exceeded estimates due to stronger liquids production and indicated 3Q production should be above midpoint of guidance. MRO maintains the most aggressive buyback program within our coverage and as a result sees very strong per-share growth despite targeting a flat production profile. Equatorial Guinea still provides huge upside for next year, which we are modeling quite conservatively given the volatility in natural gas prices, even so we are modeling an impact to net income of ~$480M thanks to the change in 2024. MRO’s 2024 FCF estimate of 18% vs. 8% average in our coverage universe and multiple of 3.4x vs 5.5x coverage average puts them among the most undervalued names in our coverage,” Freeman opined.

Looking ahead, the Raymond James analyst gives this stock a Strong Buy rating, and his price target, raised from $40 to $45, implies a one-year upside for the shares of 68%. (To watch Freeman’s track record, click here)

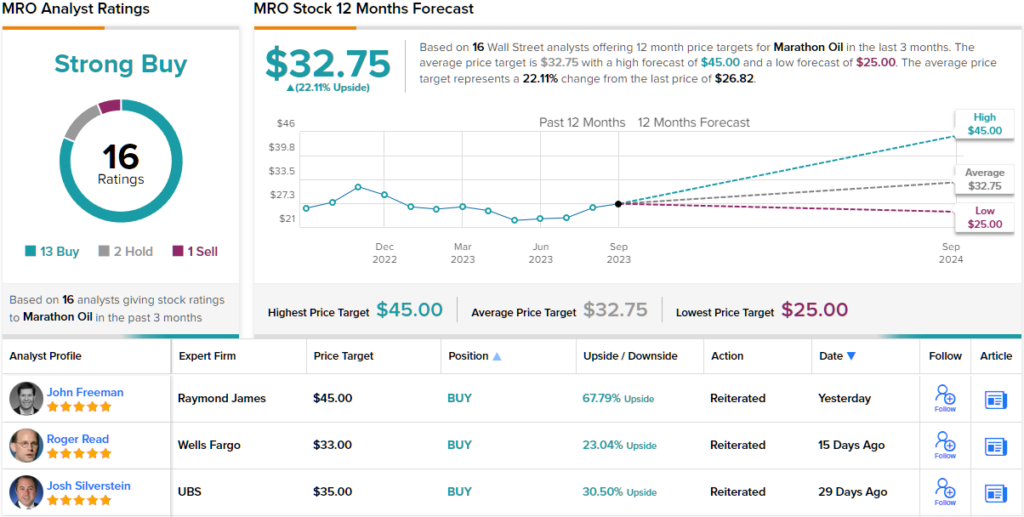

The Street, generally, is also bullish here. MRO gets a Strong Buy consensus rating, based on 16 analyst reviews with a breakdown of 13 Buys, 2 Holds, and 1 Sell. MRO shares are priced at $26.84 and their $32.75 average price target suggests they will increase by 22% in the year ahead. (See MRO stock forecast)

Diamondback Energy (FANG)

Next up is Diamondback Energy, another independent oil and gas E&P firm operating in the Texas oil patch. Diamondback specializes in unconventional onshore plays, producing both crude oil and natural gas. The company is involved in acquiring, exploring, developing, and exploiting these resources, employing horizontal drilling techniques to maximize well efficiency.

Diamondback primarily operates in the Permian Basin, located in its home state of Texas, which is one of North America’s largest oil basins. The company has consistently delivered strong production figures, with recent months showing significant growth. In the second quarter of this year, Diamondback achieved a daily average production of 449,912 barrels of oil equivalent, marking a 5.8% increase compared to the previous quarter and a robust 18% year-over-year rise.

Notably, Diamondback remains steadfast in its commitment to delivering value to its shareholders. In the second quarter, the company repurchased $321 million worth of common shares as part of a $473 million total capital return program. This program represented approximately 86% of the free cash flow and included base dividend payments. The Q2 dividend, paid on August 17, amounted to 84 cents per common share, annualizing to $3.36 and yielding 2.1%. Importantly, Diamondback has consistently met its quarterly dividend obligations since 2018

Freeman’s comments on Diamondback are all about the company’s forward prospects. He notes that production guidance is going up, and writes, “FANG’s outlook has steadily improved since the beginning of the year, both increasing production guidance while decreasing capital expenditures. Perhaps most notable is the quarter over quarter decrease in capex expected from 3Q to 4Q ($~675M to $~595M) with Diamondback stating that this 4Q figure stands to be their baseline run-rate for 2024. As a result, we adjusted our 2024 capex lower by 4% from $2.7M to $2.6M. All-in-all we are expecting an increase to 2024 free cash flow yield from ~10% to 13% due to the commodity strip and production adjustments. FANG maintains a strong balance sheet and excellent shareholder return framework (75% FCF returned to shareholders), as such we reiterate our Strong Buy rating.”

That Strong Buy rating comes along with a $191 price target, showing the analyst’s confidence in a 23% upside on the one-year horizon. (To watch Freeman’s track record, click here)

Overall, Wall Street takes a bullish stance on Diamondback shares. 13 Buys and 1 Sell issued over the previous three months make the stock a Strong Buy. Meanwhile, the $175.64 average price target suggests ~13% upside from current levels. (See Diamondback stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.