Growth stocks never fail to capture investors’ attention, and for good reason. When a stock doubles in just a few months, it’s clear that something in the story is working, and many investors naturally want to participate in that momentum.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

That said, the familiar warning that “past performance is no guarantee of future returns” still applies. Yet, history can often provide useful context when evaluating a company’s current position and trajectory. While past gains don’t predict what comes next, they can help highlight which businesses are executing well and capturing market confidence.

Keeping all of that in mind, we’ve opened up the TipRanks database to find two ‘monster growth’ stocks, shares that have posted triple-digit gains over recent months. The question now is whether there’s still upside ahead, so we checked with the analysts to find out. Let’s dive in.

JFrog (FROG)

First on our list of growth stocks today is JFrog, a software company that specializes in what it calls ‘liquid software.’ This is both a concept and a practice; the company works to enable a fast and seamless flow for software products from the developers all the way to the end users. The company has put together a software supply chain platform, designed to accommodate everything from accelerated releases, to security, to scaling, to cloud migration, to AI and machine learning, to IoT. In short, JFrog is working to make it easy to bring software systems to where they’re needed.

JFrog’s own products aim at an enterprise and developer user base, where software starts, and allow these creators to achieve a continuous, secure, and non-invasive software update chain. The platform was built from the ground up as a universal, hybrid, multi-cloud approach, fit for use by major global enterprises such as American Express, Nvidia, RedHat, and Airbus, and it assists developers in creating the next generation of secure, automatic software deliveries.

AI has been the driving force in tech recently, and JFrog, through its Artifactory, has joined that bandwagon. The Artifactory gives developers a unified solution for bringing together and managing a wide range of software artifacts, including AI and ML models, binaries, files, packages, components, releases – all of the various work products that are generated through the process of developing, releasing, updating, and using software. The JFrog Artifactory is a central hub where DevOps and developers can integrate with tools and processes for improved automation and ensure release integrity.

JFrog’s stock is up 104% for the year to date, a gain that includes a strong jump after last week’s release of the Q3 report.

JFrog reported $136.9 million in revenue, representing a 26% year-over-year gain, while beating the forecast by $8.6 million. The company reported a non-GAAP EPS of 22 cents, up 7 cents from the year-ago period and 6 cents per share better than had been anticipated.

In an important metric that should interest investors, JFrog reported strong gains in its high-end annual recurring revenue (ARR) customers. In the $100,000-plus category, the numbers grew from 966 in the year-ago period to 1,121, and in the larger million-dollar-plus category, these ARR customers increased from 46 to 71 year-over-year.

This software company has attracted the attention of Oppenheimer’s 5-star analyst Ittai Kidron, who is clear about his confidence in the company and its potential for long-term success.

“We took too long to fully appreciate JFrog’s Artifactory differentiation and ability to expand this sticky customer base into emerging opportunities securing/registering/governing AI/ML models,” Kidron explained. “While late to recognize JFrog’s potential role in AI-related workloads, we believe it’s still very early with respect to what we see as a long tail of AI expansion. In upgrading, we’re taking a long-term approach anticipating continued progress with JFrog’s enterprise sales motion, leverage from new bundling/cross-sell opportunities, and expectations for continued strong product execution/expansion. Our confidence also reflects management’s improved execution, which we believe can be sustained.”

As noted, Kidron’s confidence leads him to upgrade the stock from Perform (i.e., Neutral) to Outperform (i.e., Buy), while the analyst’s $75 price target points toward a one-year gain of 25%. (To watch Kidron’s track record, click here)

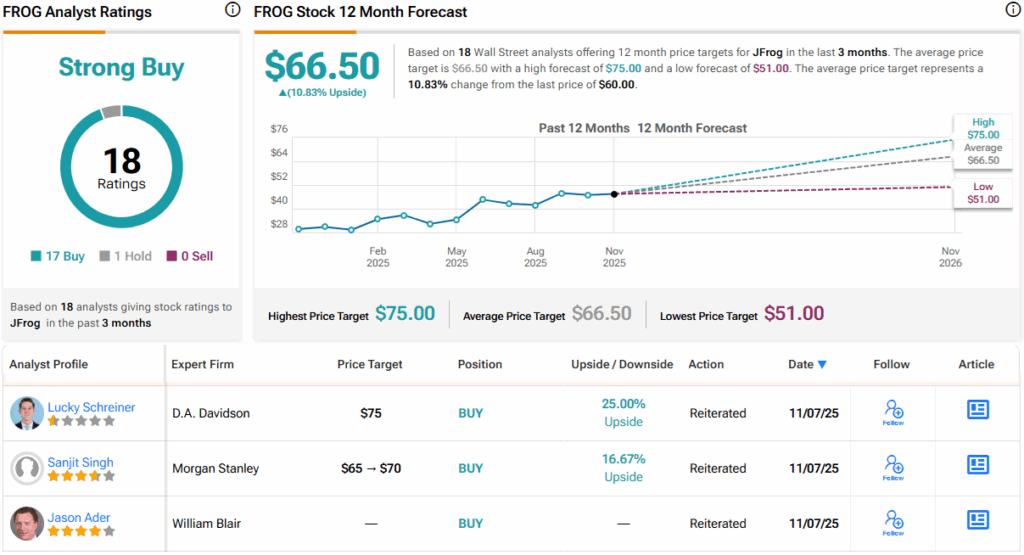

There are 18 recent analyst reviews on file for FROG, and their lopsided 17-to-1 split favors Buy over Hold for a Strong Buy consensus rating. The shares are currently trading for $60, and the $66.50 average target price implies an upside potential of 11% for the year ahead. (See FROG stock forecast)

Babcock & Wilcox Enterprises (BW)

Ohio-based Babcock & Wilcox is a venerable industrial name, founded back in 1867. The company has a history in designing, building, and installing utility boilers, and has a history of innovation in the field of industrial power; the company even supplied power components for the USS Nautilus, the world’s first nuclear-powered submarine.

Today, Babcock & Wilcox is known for its BrightLoop technology, a chemical looping technology that is designed to provide the flexibility necessary in a changing global energy landscape. The tech can accommodate and meet the challenges posed by new infrastructure, supply chains, and shifting governmental policies. It produces steam, hydrogen, and syngas, all of which can meet a wide range of needs in vital economic sectors: energy, industry, and agriculture.

The company’s BrightLoop operates on a technological breakthrough, a process that allows it to convert a diverse range of fuel feedstocks into usable energy. The tech provides that energy with high levels of efficiency and reliability, and low levels of carbon pollution.

Babcock & Wilcox has seen its stock gain an impressive 242% this year – and a humungous 2000%+ since April’s lows – with the company’s value proposition buoyed by some positive developments, including regaining compliance with the NYSE’s listing standard.

Additionally, the company announced on November 4 that it had entered into an LNTP agreement – limited notice to proceed – with Applied Digital, to supply 1 gigawatt of power for an AI factory. The full contract is anticipated to be released during 1Q26, and the project is valued at $1.5 billion. Under the proposal, Babcock & Wilcox will build four 300-megawatt natural gas-fired power plants for the AI project.

Furthermore, during Q3, Babcock & Wilcox also entered into a strategic partnership with Denham Capital, the private equity fund. The partnership includes the conversion of coal-fired power plants to natural gas, to provide cleaner power for AI data centers in North America and Europe. The company states that its pipeline for the AI data center segment now totals over $3 billion.

At the same time, the mood hasn’t been dampened by mixed results in its 3Q25 financial release. Revenue, at $149 million, was down 2.4% from the prior year and missed the forecast by $6.57 million. The bottom line, at 30 cents per share, was 39 cents per share better than had been anticipated. The company had $201.1 million in cash and liquid assets on hand at the end of the quarter.

This stock is covered by Aaron Spychalla, of Craig-Hallum, a 5-star analyst rated by TipRanks in the top 3% of Wall Street’s experts. Spychalla likes the potential inherent in the company’s pivot to the AI data center segment, and wrote following the Q3 results: “More noteworthy was the signing of a limited notice to proceed on a $1.5B+ contract with Applied Digital for 1 gigawatt (GW) of natural gas power utilizing BW’s boilers and associated steam turbines for an Applied Digital AI Factory. Though still subject to a final notice to proceed (expected 1Q26), this is obviously a substantial development for a ~$600M business, and we think shows the potential for BW to help bring baseload power generation online quicker, alleviating a key bottleneck in the market currently. This also builds on the recently announced partnership with Denham Capital to convert existing coal plants to power data centers in the U.S. and Europe, with BW noting an AI/Data Center pipeline of $3B+. In the midst of all of this, the balance sheet continues to improve as asset sales are resulting in debt paydown.”

Looking ahead, the top-tier analyst adds, “While still looking for FCF to improve (- $38M in 3Q), we are upgrading shares to a BUY given the magnitude of the potential growth from the power generation opportunity in the coming years.”

That Buy rating is accompanied by a $7 price target that indicates room for a potential upside of 25% in the next 12 months. (To watch Spychalla’s track record, click here)

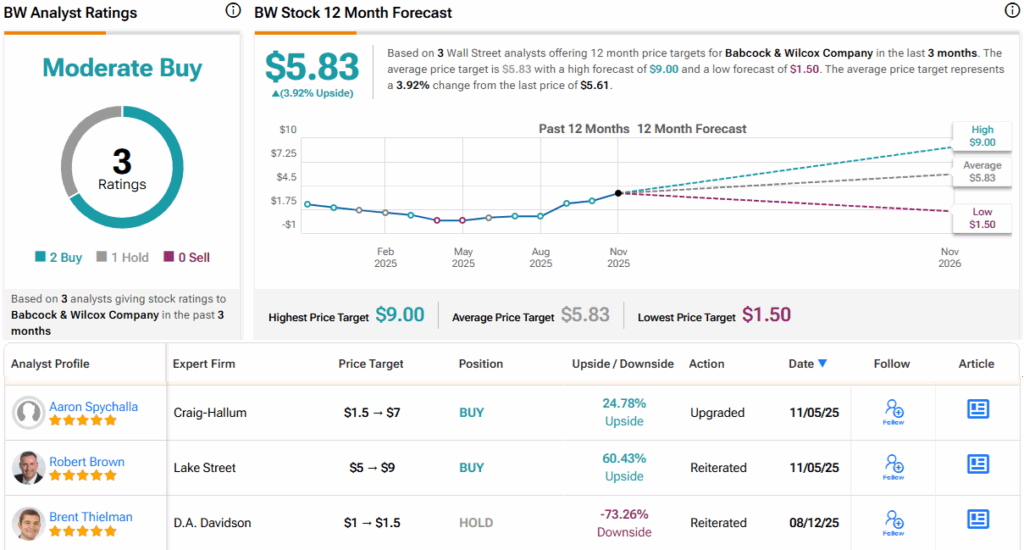

Babcock & Wilcox holds a Moderate Buy consensus rating on Wall Street, based on 3 reviews that include 2 Buys to 1 Hold. The shares have a selling price of $5.61, and their $5.83 average target price suggests a modest 4% gain over the next year. (See BW stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.