Shopify stock (NYSE:SHOP) has rallied by about 99% year-to-date, underscoring the company’s positive trajectory. Noteworthy achievements include reaccelerating revenue growth and a decline in stock-based compensation. As the force behind a leading platform for merchants, Shopify consistently adds exciting features, translating into increased recurring revenues and processing fees. However, with the stock potentially on the pricy side, especially after its recent rally, my outlook on Shopify remains neutral.

Revenue Growth Reaccelerating Despite Macro Headwinds

Shopify is experiencing a remarkable surge in revenue growth, defying expectations in the face of rather tough macroeconomic headwinds. Despite the prevailing high interest rates, which might suggest a slowdown in merchant activity on the platform due to a softer business environment, Shopify’s performance tells a different story.

Normally, heightened interest rates often restrict the purchasing capability of consumers, as exemplified by increased mortgage payments and higher credit card interest. Consequently, it would be reasonable for someone to anticipate that Shopify’s merchants might experience adverse effects, potentially negatively impacting Shopify itself.

Surprisingly, in its most recent Q3 results, not only did Shopify maintain the robust momentum from the previous year, but it actually saw an acceleration in growth.

In Q3, Shopify achieved $1.7 billion in revenue, marking a 25% year-over-year increase. Excluding the sales of its logistics businesses from the previous year, the year-over-year growth rate soared to an impressive 30%, showcasing a significant uptick from the 22% growth in Q3 2022. The driving force behind this stellar performance can be attributed to the exceptional performance of gross merchandise volume (GMV), which reached $56.2 billion, a remarkable 22% increase from the previous year.

Noteworthy is the fact that this 22% year-over-year growth in GMV represents the highest quarterly growth rate since the pandemic-fueled surge in 2021. The resilience of Shopify’s GMV is fueled by a strategic blend of factors, including an expanded footprint in payments, sustained growth in various solutions such as capital, markets, and installments, the positive impact of subscription pricing changes on standard plans, and an increase in the number of active merchants across Standard, Plus, and point-of-sale platforms.

Shopify’s robust gross merchandise volume (GMV) performance can be attributed to a dynamic interplay of factors. Notably, the surge in Shopify Payment usage, coupled with sustained expansion across various solutions such as capital, markets, and installments, played a pivotal role.

Additionally, a significant boost came from a complete quarter of advantages stemming from the subscription pricing modifications on the company’s Standard plans. Concurrently, there was a noticeable uptick in the number of active merchants across Standard, Plus, and point-of-sale, reflecting widespread growth.

Zooming in on the escalating payments adoption, a substantial portion of the $56.2 billion GMV, precisely $32.8 billion or 58%, was processed through Shopify Payments—an increase from the previous year’s 54%. Important to note is Shopify’s revenue stream, with transaction fees ranging from 2.4% to 2.9%, establishing a solid foundation for continuous frictionless, high-margin cash flows.

This sets the stage for Shopify to effortlessly capitalize on expanding consumer spending and inflationary forces, positioning it for sustained revenue growth.

Improving Margins, Controlled Stock-Based Compensation Improve Investment Case

In addition to the remarkable resurgence in revenue growth, Shopify’s investment appeal has recently become even more enticing, thanks to the successful management of its once soaring stock-based compensation. With a noticeable control over expenses, coupled with escalating revenues, the company has achieved an expansion in margins, significantly enhancing its prospects for earnings growth.

Notably, Shopify experienced a significant reduction in stock-based compensation during Q3, with the figure dropping to $102 million from last year’s $150 million. This decline is expected to continue, as reflected in the firm’s Q4 guidance, which anticipates stock-based compensation of $100 million. This trend should bode well for Shopify investors, alleviating concerns about continuous dilution.

In the meantime, as I mentioned, Shopify has capitalized on growing economies of scale, boosting its margins and overall profitability. In Q3, SHOP’s Subscription Solutions gross margin increased to 81.9% (from 78.1% in Q3 2022), and the Merchant Solutions gross margin rose to 41.0% (from 37.2% in Q3 2022), resulting in an overall Q3 gross margin of 52.6%, up from 48.5% the previous year.

Combining that with lower operating expenses, Shopify’s free cash flow margin climbed to 16%, up from a negative 11% in the prior-year period.

Shopify Could be Too Expensive Despite a Positive Outlook

With Shopify demonstrating impressive growth and improving profit margins, the stock currently presents a highly optimistic outlook. Wall Street anticipates the company achieving an adjusted EPS of $0.69 this year, reflecting a remarkable surge of 1,588% compared to the previous year’s modest profitability. Wall Street projects a further 50% growth in adjusted EPS to about $1.00 in Fiscal 2024. However, note that this implies the stock is trading at 105 and 70 times EPS for this year and the next, respectively.

While investors apparently expect the company to grow into its valuation over time via strong earnings growth, such high multiples pose a significant risk. Any misstep from Shopify could swiftly lead to a compression of its valuation multiple, potentially resulting in significant downside for shareholders.

Is SHOP Stock a Buy, According to Analysts?

Following SHOP’s significant rally, Wall Street has employed a more cautious view of Shopify. The stock has gathered a Moderate Buy consensus rating based on 11 Buys and 18 Holds assigned in the past three months. At $68.10, the average Shopify stock price target implies 4.03% downside potential, nonetheless.

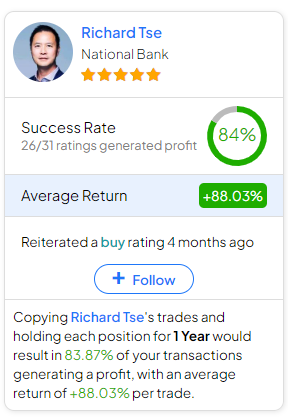

If you’re wondering which analyst you should follow if you want to buy and sell SHOP stock, the most profitable analyst covering the stock (on a one-year timeframe) is Richard Tse from National Bank, with an average return of 88.03% per rating and an 84% success rate. Click on the image below to learn more.

The Takeaway

Shopify’s robust year-to-date rally and resilient revenue growth showcase the company’s strong position in the market. Despite macroeconomic challenges, the Q3 results reveal a remarkable acceleration in revenue and impressive gross merchandise volume performance.

Additionally, the effective management of stock-based compensation and improving profit margins enhance SHOP’s investment appeal. However, caution is warranted, with the stock potentially trading at overpriced multiples.

Consequently, while the positive outlook persists, investors should carefully monitor potential risks associated with the current valuation.