Chipotle Mexican Grill Stock (NYSE:CMG) is up 43% year-to-date, leaving many investors wondering whether it can continue to sustain its impressive rally. The Mexico-inspired quick-service restaurant (QSR) giant continues to grow rapidly while gaining operating leverage and quickly advancing its profitability. I believe this trend is set to persist. Thus, further upside is likely despite the stock’s strong rally and rich valuation. Accordingly, I am bullish on the stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Q2-2023 Results – Growth is Not Slowing Down

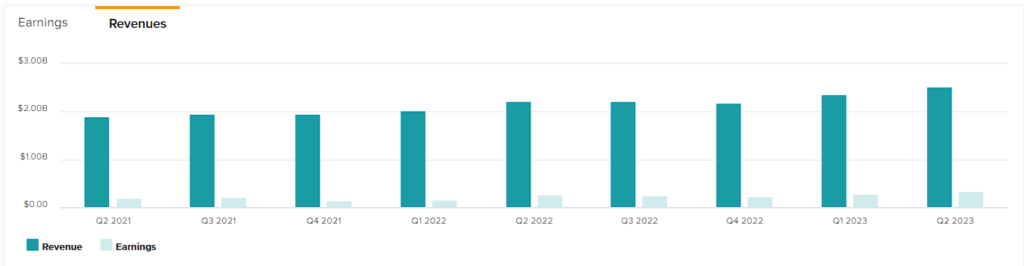

Chipotle’s Q2-2023 results made one thing clear: the company’s growth is not slowing down anytime soon. Revenues in the second quarter rose 14% year-over-year to reach $2.5 billion, driven by higher revenues from Chipotle’s existing restaurants and the opening of new restaurants. Specifically, comparable sales growth from existing restaurants came in at 7.4%. In the meantime, Chipotle ended the quarter with 3,268 locations, up from 3,052 in the comparable period last year.

Regarding its profitability, Chipotle was once again able to record a significant boost in its profits in Q2, thanks to its unique operating model. As a reminder, Chipotle is the only company with the QSR space that owns 100% of its locations. The majority of QSR brands featuring thousands of locations usually franchise their restaurants. They usually do this in order to scale faster in a capital-light way, as well as to enjoy frictionless, lower-risk, royalty-sourced cash flows.

While Chipotle’s avenue of operating each and every location on a corporate level is more tedious, it comes with many advantages. These include complete control over the quality of the food and scaling economics, allowing for a gradual expansion in margins. For context, Chipotle’s average restaurant sales in Q2 were $2.94 million, up from $2.75 million last year. In particular, economies of scale and efficiencies raised unit economics, leading to Chipotle’s restaurant-level operating margin rising by 230 bps to 27.5%.

The growth in Chipotle’s restaurant-level operating margin inherently led to the company’s overall operating margin climbing to 17.2%, up from 15.3% in Q2 2022. Further, the company doesn’t really carry debt on its balance sheet except for its lease liabilities. Thus, net income wasn’t compressed by notably higher interest expenses, as is the case with most companies these days. The gain in operating margins, therefore, translated to a significant bottom-line increase. EPS, in particular, surged by 33.2% to $12.32.

Investors Pay a Premium for Quality

Shares of Chipotle are currently trading at a forward P/E of nearly 45x based on its Fiscal 2023 consensus EPS estimate of $43.46. No matter which way you look at this multiple, it’s undoubtedly a rich one. It’s largely higher than both the P/Es of the company’s industry peers and that of the S&P 500 (SPX). Given Chipotle’s ever-lasting double-digit revenue growth and even more impressive earnings growth, it’s easy to see why investors have been willing to pay a premium price for its shares.

Chipotle’s Project Square One

The company has multiple qualities, including full control over its restaurants and a continuous focus on enhancing in-store efficiency. For instance, Chipotle’s Project Square One is wrapping up, with its results already visible in higher same-store sales.

This project included teaching team members on the line how to deliver a great experience on the go while listening out of both ears and handing items down politely to the next team member. Such actions add up during a peak volume window, making each restaurant noticeably more efficient.

While this project is officially wrapping up, management has committed to integrating the program into its ongoing training efforts permanently. Quarterly retraining for Chiptle’s crew members will maintain a sharp focus on excellence in the basics. This should ensure the ongoing development of exceptional individuals and the delivery of exceptional food. No other player in the QSR space matches its relentless commitment to consistently enhancing operational efficiency. Investors’ enthusiasm is, therefore, justified.

Is CMG Stock a Buy, According to Analysts?

Regarding Wall Street’s view on the stock, Chipotle Mexican Grill now features a Moderate Buy consensus rating based on 16 Buy and six Hold ratings assigned in the past three months. At $2191.10, the average CMG stock forecast implies 11.4% upside potential.

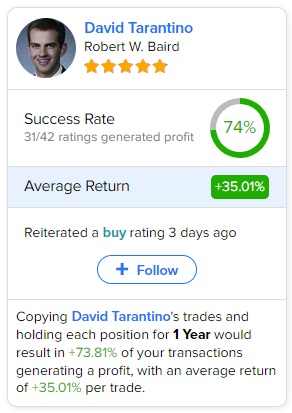

If you’re wondering which analyst you should follow if you want to buy and sell CMG stock, the most profitable analyst covering the stock (on a one-year timeframe) is David Tarantino from Robert W. Baird, with an average return of 35.01% per rating and a 74% success rate. Click on the image below to learn more.

The Takeaway

Overall, Chipotle Mexican Grill continues to stand out in the quick-service restaurant industry, exhibiting impressive growth, profitability, and a commitment to excellence. Despite its premium valuation, the company’s unique approach to owning all its locations, coupled with its relentless focus on operational efficiency, justifies investors’ high morale. Thus, I remain bullish on Chipotle and believe that this is a stock to be held for the long term — not to be traded.