Shares of Bitcoin (BTC-USD) mining company Iris Energy (NASDAQ:IREN) are up over 197% year-to-date. Despite the notable rally, analysts are bullish about this penny stock (learn more about penny stocks here). Moreover, the Street’s average price target suggests enormous upside potential in Iris Energy stock from current levels.

Is Iris Energy Stock a Good Buy?

Analysts’ consensus rating suggests Iris Energy is an excellent stock to buy near the current levels. The company achieved record Bitcoin mining revenue of $75.5 million in Fiscal 2023 (ended June 30, 2023), up from $59 million in the previous fiscal year. The improvement reflects the increase in the number of Bitcoin mined.

The company’s growing self-mining operating capacity and focus on exploring next-gen generative AI computing augur well for growth. Moreover, it partnered with WEKA, a data platform software provider, to offer storage and data management solutions tailored for generative AI, which is expected to deliver incremental revenue. Additionally, the company unveiled plans for a new 1,400 megawatt development site in West Texas, a move that H.C. Wainwright analyst Mike Colonnese sees as offering substantial potential for future growth.

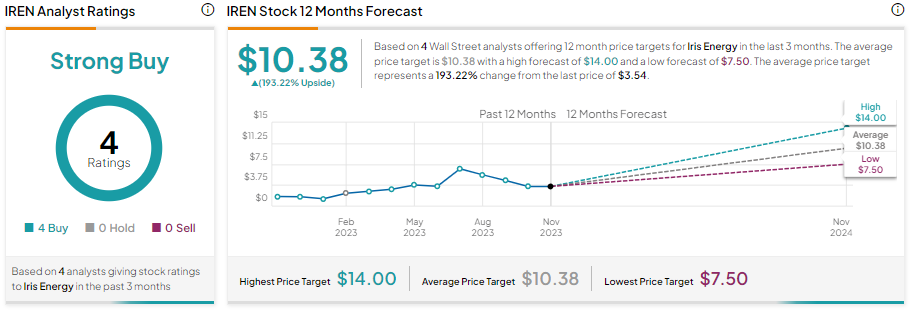

The analyst reiterated a Buy rating on IREN stock on November 22. However, Colonnese trimmed the price target to $10 from $11. Including Colonnese, four Wall Street analysts cover Iris Energy stock with a unanimous Buy recommendation. Further, the average price target of $10.38 suggests 193.2% upside potential from current levels.

Bottom Line

Iris Energy’s capacity expansion, focus on driving operating efficiency, and generative AI ambitions bode well for future growth as reflected via analysts’ Strong Buy consensus rating. Wall Street’s average price target for IREN stock indicates significant upside potential. Meanwhile, investors can leverage TipRanks’ penny stock screener to discover more compelling penny stocks.