Semiconductor giant Broadcom (NASDAQ:AVGO) has been among the top-performing tech stocks since the company went public in August 2009. In less than 15 years, AVGO stock has gained 7,411%. If we account for dividend reinvestments, total returns reach 10,231%. Comparatively, the S&P 500 Index (SPX) has returned “just” 560.7% after dividend reinvestments since Broadcom’s IPO. Today, Broadcom’s market cap is $576 billion, making it one of the largest companies in the world, but it may not be too late to buy the stock right now.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While it might be impossible for AVGO stock to replicate its historical gains, I am bullish on the company due to its recent acquisition of VMware, the AI megatrend, and a widening dividend payout.

An Overview of Broadcom

Broadcom is a diversified technology company that designs, manufactures, and sells a wide range of semiconductor, enterprise software, and security solutions. Initially, Broadcom primarily operated in the semiconductor segment. But over the years, it entered other verticals, such as enterprise software and network security. It did this on the back of big-ticket acquisitions, including Avago, CA Technologies, and VMware.

Today, the company’s widening product portfolio serves markets such as cloud, data center, wireless, storage, networking, broadband, and industrial, among other sectors.

VMWare Drives Growth in Q1

In late 2023, Broadcom closed its $69 billion acquisition of VMware, allowing it to gain traction in the cloud segment. The combined entity will now allow enterprise clients to create and modernize public and hybrid cloud environments. The VMware Cloud Foundation (VCF) is a software stack that serves as the foundation of private and hybrid clouds.

The acquisition allowed Broadcom to increase net sales by 34% year-over-year to $12 billion in Fiscal Q1 of 2024 (ended in January). If we adjust for VMware, Broadcom increased its sales by 11% year-over-year. The company stated that Semiconductor Solutions revenue grew by 4% to $7.4 billion, while Infrastructure Software sales rose by 153% to $4.6 billion.

Broadcom expects strong bookings at VMware to accelerate revenue growth through Fiscal 2024. Analysts expect Broadcom to end Fiscal 2024 with sales of $50.23 billion, up from $35.82 billion in Fiscal 2023.

AI Is Key for AVGO

Broadcom emphasized that AI (artificial intelligence) sales in Q1 quadrupled to $2.3 billion, offsetting a cyclical slowdown in verticals such as enterprise and telecommunications. The company explained that enterprises are looking to run their growing AI workloads on premise, driving strong demand for VCF. As a result, it now expects software sales to touch $20 billion in Fiscal 2024.

In August 2023, VMware and Nvidia (NASDAQ:NVDA) entered into a partnership that enables VCF to run GPUs or graphics processing units, allowing companies to deploy AI models on-premise.

Further, Broadcom’s Networking sales were up 46% to $3.3 billion, accounting for 45% of Semiconductor sales. This growth was attributed to demand for its custom AI accelerators at two of its hyperscale customers. Due to these factors, Broadcom expects Networking sales to grow 35% in Fiscal 2024, up from its previous forecast, which projected annual growth of 30%.

In December, Broadcom disclosed that it expects AI to account for 25% of its Semiconductor revenue in 2024. It now projects AI sales to account for 35% of Semiconductor revenue at more than $10 billion, offsetting weakness in Broadband and Service Storage.

Strong Profit Margins and a Growing Dividend

Broadcom ended Q1 with gross margins of 75.4% and an operating margin of 57%. If we exclude transition costs of $226 million, it reported an operating profit of $7.1 billion, up 30% from the year-ago period, indicating a margin of 59%. The tech heavyweight also reported an adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $7.2 billion or 60%.

Broadcom has successfully converted its solid profit margins into free cash flow, which allows it to reinvest in acquisitions, raise dividends, and lower balance sheet debt. In Q1, it reported free cash flow of $4.7 billion after spending $122 million in capital expenditures and paid shareholders a quarterly dividend of $2.43 billion, indicating a free cash flow payout ratio of just over 50%.

Broadcom pays shareholders an annualized dividend of $21 per share, indicating a yield of almost 2%, which might not seem much. But in the last 13 years, these payouts have risen by 37% annually, which is exceptional, as it significantly increases the yield on cost. Further, despite an uncertain macro environment, Broadcom raised its quarterly dividend per share to $5.25 from $4.60 per share in the last 12 months.

Broadcom ended Q1 with gross debt of $75.9 billion, which might make investors nervous. However, its high cash flow margin and almost $12 billion in cash provide it with enough room to lower its debt profile.

What Is the Target Price for AVGO Stock?

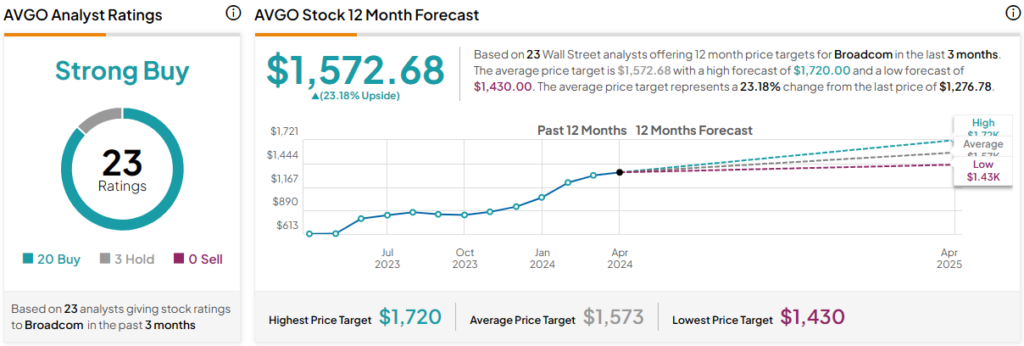

Out of the 23 analyst ratings given to AVGO stock, 20 are Buys, three are Holds, and none are Sells, indicating a Strong Buy consensus rating. The average AVGO stock price target is $1,572.68, indicating upside potential of 23.2% from current levels.

Broadcom is forecast to expand its adjusted earnings by 12% to $47.30 per share in 2024 and by 22% to $57.7 per share in 2025. So, priced at 26x forward earnings, AVGO stock is not too expensive, given that the sector median multiple is 23.2x

The Takeaway

Broadcom is a blue-chip tech stock that has created massive wealth for shareholders. I believe that it remains a top stock to hold at its current valuation due to soaring AI sales, a strong balance sheet, and a growing base of dividend payouts.