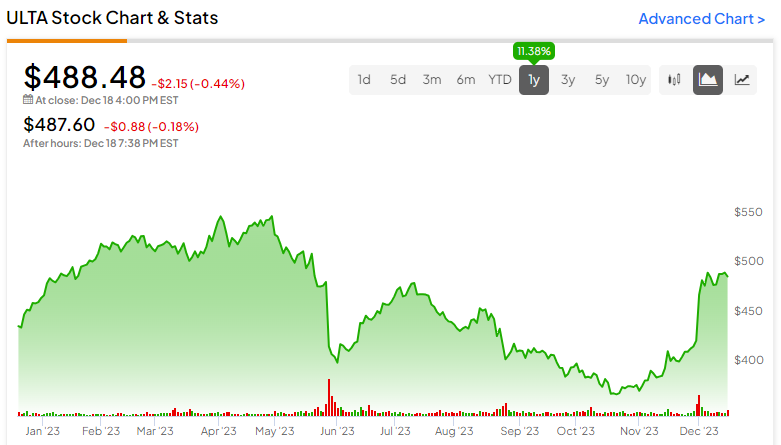

Just based purely on its year-to-date performance, cosmetics and personal care specialist Ulta Beauty (NASDAQ:ULTA) doesn’t seem particularly convincing. After a choppy 52-week period, the company has underperformed the S&P 500 Index (SPX). However, relevance to ever-evolving beauty trends and a possibly stabilized economy should help regain momentum convincingly. I am bullish on ULTA stock as it looks to bounce back on more favorable conditions.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Broader Stabilization Should Help ULTA Stock

Recently, Wall Street has focused intently on the Federal Reserve, with the central bank hinting at three possible rate cuts next year. Naturally, the discussion centered on high-level topics, such as the implications for the labor market and residential real estate. Nevertheless, the Fed’s decision should also impact the consumer discretionary space and, thus, ULTA stock.

Fundamentally, the biggest implication of the possible upcoming pivot in monetary policy is encouraging disinflation data. For roughly the past two years, the Fed grappled with skyrocketing inflation, which inherently crimped consumer sentiment due to rising prices. By logical deduction, lower rates induce increased money velocity (all other things being equal), which is inflationary. So, the Fed must have justification to even consider lowering borrowing costs.

Again, that justification may stem from favorable disinflation data, which may have been reflected in Ulta’s most recent earnings report. As TipRanks contributor Aditya Raghunath stated, Ulta increased its revenue by 6.4% on a year-over-year basis to $2.5 billion. Further, same-store sales popped up 4.5% from one year prior.

In fairness, the company suffered from a challenging macroeconomic environment, along with stubbornly elevated inflation levels (compared to historical norms). As a result, both gross and operating margins took a hit relative to the year-ago quarter.

Nevertheless, the encouraging aspect is that Ulta continues to beat analysts’ expectations. As well, the damage inflicted on the business due to macro headwinds has been mitigated. In other words, assuming the economy stabilizes – which is what the Fed appears to be targeting with its interest rate modulation discussion – ULTA stock would be playing ball on at least more favorable grounds.

Aligning with Dynamic Beauty Trends Could Boost the Business

For those unaccustomed to fashion and beauty trends, it’s a daunting arena to decipher. Mainly, the challenge centers on the dynamism of shifting trends. For example, last year, many looks catered to the glam or shiny look-at-me approach. Looking forward to next year, industry experts suggest that minimalism may be the “in” look.

That’s a lot to take in because companies in the field must constantly account for the underlying dynamism. However, that’s where ULTA stock could shine. For one thing, the underlying enterprise offers a wide range of products, catering to various budgets and preferences. Therefore, Ulta can tap into multiple trends on a dime.

Just as well, the company offers a robust omnichannel experience. That’s important because online transactions are making a comeback. Following the dramatic spike in broader e-commerce stats during the initial wave of COVID-19, online sales as a component of total retail transactions faded. However, since Q2 2022, online retail sales as a percentage of total sales have been increasing. Thus, a strong omnichannel presence is a must, which is a key advantage for ULTA stock.

Perhaps most importantly, Ulta’s brick-and-mortar locations feature beauty advisors and hair salons. By incorporating evolving beauty trends and fine-tuning them to perfectly fit each individual customer, Ulta enjoys a comprehensive advantage.

Indeed, ample marketing research shows that Generation Z consumers prefer a personalized retail approach. Ulta can give the emerging consumer demographic exactly what it wants, thus benefiting ULTA stock.

Don’t Overlook the Long-Term Financial Resilience

Now, one thing that should not be ignored is the framing of Ulta’s margins. Yes, as pointed out earlier, the company incurred a year-over-year decline in gross and operating margins. That’s never a positive development, of course, but context matters. As a discretionary retail play against historic economic challenges, you have to expect some profitability erosion.

Further, Ulta’s current gross margin of 39.86% isn’t terrible compared to historical norms. On a trailing-12-month (TTM) basis, this metric comes in at 39.09%. That’s pretty much in line with Fiscal Year 2022 and 2023’s results of 39.03% and 39.62%, respectively. Put another way, consumers are not dramatically shying away from the company’s products.

Subsequently, that’s a huge positive for ULTA stock, assuming that the economy stabilizes next year.

Is ULTA Stock a Buy, According to Analysts?

Turning to Wall Street, ULTA stock has a Moderate Buy consensus rating based on 15 Buys, four Holds, and one Sell rating. The average ULTA stock price target is $537.20, implying 10% upside potential.

The Takeaway: ULTA Stock is Surprisingly Well Positioned

Ulta Beauty’s choppy year may have masked its potential. A stabilized economy and alignment with 2024’s beauty trends (minimalism, diverse options) could boost ULTA stock. Additionally, the Fed’s potential rate cuts, Ulta’s strong omnichannel presence, and personalized customer service position it well for next year’s consumer discretionary landscape. Personally, I wouldn’t overlook Ulta’s resilient margins for a discretionary retailer facing historic challenges.