Ulta Beauty stock (NASDAQ:ULTA) appears to be tailor-made for today’s market, as its investment case combines three key attractive characteristics: strong growth, a very healthy balance sheet, and a cheap valuation. The largest specialty beauty retailer in the U.S., offering more than 25,000 beauty products in more than 1,350 stores, has showcased robust momentum lately. Yet, the stock’s valuation is trading at some of the most attractive levels in recent history. Consequently, I am bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Robust Growth Story is Driven by Synergistic Factors

The first factor supporting my favorable outlook in ULTA’s investment case is the company’s robust growth story, driven by three synergistic factors — Ulta’s store expansion, e-commerce focus, and loyalty program. Let’s dive in.

Store Expansion

As a premier beauty products retailer, ULTA strategically expands its physical footprint, carefully selecting locations across diverse regions to reach an ever-widening customer base. The pace of this expansion is remarkable, soaring from 449 stores in 2011 to 1,074 in 2017 and reaching 1,362 by the end of this past July.

Focus on E-Commerce

The second crucial element revolves around ULTA’s adept focus on bolstering sales through e-commerce. Recognizing the escalating significance of online retail, the company has made substantial investments in its e-commerce platform.

This move has propelled overall growth and empowered ULTA with targeted marketing campaigns, promotions, and exclusive online offerings. In turn, e-commerce sales have risen notably over the years. Notably, these are higher-margin sales versus retail sales, benefiting ULTA’s profitability.

ULTA’s Loyalty Program

The third and final pillar of ULTA’s growth narrative is its esteemed loyalty program, Ultamate Rewards. Currently boasting 40 million members, Ultamate Rewards provides the company with invaluable data and consumer insights, serving as a potent competitive advantage. To illustrate the program’s extensive success, a staggering 95% of ULTA’s total sales are attributed to Ultamate Rewards members.

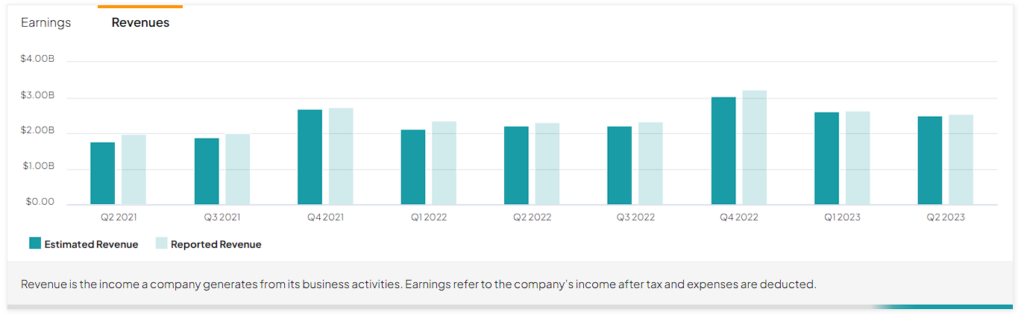

Recent Results Embody ULTA’s Growth Story

ULTA’s growth trajectory, propelled by the harmonious synergy of these three key factors, continued to be once again evident in its most recent Fiscal Q2 results. Notably, net sales for the quarter rose by 10.1%, fueled by an 8% uptick in comparable sales, which includes both existing stores and e-commerce sales, coupled with a stellar showing from recently opened stores.

More specifically, transaction volumes saw a notable 9% uptick during the quarter, demonstrating robust consumer engagement, even in the face of a marginal 1% dip in average ticket size. Clearly, the subtle decrease in average units per transaction was more than offset by the positive impact of elevated average selling prices, underscoring the inherent inelasticity of the cosmetics industry—an aspect worth keeping in mind when we discuss the stock’s valuation.

Very Healthy Balance Sheet

The second compelling aspect of ULTA’s investment appeal in the current market climate lies in its healthy balance sheet. Unlike many businesses grappling with diminished profits due to rising interest expenses as a result of rising rates, ULTA stands insulated. Remarkably, the company boasts a debt-free balance sheet (when excluding lease obligations), contrasting sharply with its cash position of $388.6 million.

In fact, the company’s net interest income increased to $4.4 million compared to $0.1 million in Q2-2022 due to higher average interest rates on cash balances. This, in my view, serves as yet another compelling facet for investors to factor into their evaluation of ULTA’s investment potential.

An Attractive Valuation Seals the Deal

Impressive growth and a strong balance sheet create a powerful combo. Yet, what truly seals the deal for me is the stock’s appealing valuation. It’s this winning trifecta that positions ULTA’s investment appeal as tailor-made for the current market conditions.

Specifically, due to ULTA’s strong growth year-to-date and its ongoing momentum, consensus EPS estimates from Wall Street point toward another all-time high EPS of $25.41 for Fiscal 2023. This implies a forward P/E of 16.3. On a next-12-month basis, ULTA’s forward P/E stands at an even lower 15.9x. This is one of the lowest multiples the stock has traded at in recent years.

With its dominant market position, strong double-digit revenue growth, robust balance sheet, and a clear path towards achieving yet another year of record-breaking performance, I find ULTA’s recent dip and discounted valuation to present a compelling investment opportunity for prospective investors.

Is ULTA Stock a Buy, According to Analysts?

Regarding Wall Street’s view on the stock, Ulta Beauty has sustained a Moderate Buy consensus rating based on 12 Buys, three Holds, and one Sell assigned in the past three months. At $518.00, the average ULTA stock forecast suggests 24.9% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell ULTA stock, the most profitable analyst covering the stock (on a one-year timeframe) is Rupesh Parikh from Oppenheimer, with an average return of 36.7% per rating and a 73% success rate. Click on the image below to learn more.

The Takeaway

ULTA stock emerges as a compelling investment opportunity, combining robust growth, a sound balance sheet, and an enticing valuation.

The company’s strategic expansion, focus on e-commerce, and successful loyalty program underscore a compelling growth story. Furthermore, its debt-free balance sheet and substantial cash reserves come in handy in the current macroeconomic landscape. Wrapped up by its discounted valuation, ULTA offers an attractive proposition for investors seeking a blend of growth and stability in today’s dynamic market.