Risk and reward should be on every investor’s mind right now, and for good reason. The risks of market investing are piling up; according to Nadia Lovell, senior US equity strategist with UBS, we’re almost certain to see a recession hit this year. The chance of a hard downturn, in her view, is somewhat mitigated by a hot labor market and an excess in consumer savings – but even so, Lovell believes that the S&P 500 will drop to 3,700 this year before rebounding to 4,000 by year’s end.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lovell sees two drivers pushing the market into recession, pointing her finger at both a corporate earnings contraction and the rapid shift of the Federal Reserve to a policy of restrictive monetary tightening. “We think that there’s more pain to come on the earnings side,” she says, and goes on to add, “It’s going to be difficult for the economy to grow with such a massive change in the Fed Funds rate in 10 months. And so we find it difficult to see that we get earnings growth this year. And earnings are likely to contract at least 4%.” Adding additional grimness to that picture, Lovell is also predicting a higher unemployment rate, which she states is inevitable in a recessionary environment.

Getting down to brass tacks, Lovell makes some specific sector recommendations for investors, to find the most attractive balance of risk and reward. She points to energy and healthcare stocks as solid choices, defensive plays that find wide endorsement among investment professionals. Energy stocks should do well as long as demand stays strong and supply limited, while healthcare stocks combine affordable valuations and sound growth potential.

The stock analysts at UBS are taking Lovell’s evaluation as a starting point, and picking out individual stocks from these two sectors. We can dip into the TipRanks database for the latest details on some of these picks; here are two of them, with comments from the UBS analysts.

OPAL Fuels Inc. (OPAL)

We’ll start in the energy sector, where OPAL Fuels is a leader in the renewable natural gas (RNG) segment. The company operates on both the production and distribution ends, capturing potentially harmful methane emissions and converting it into low-carbon-intensity RNG. The renewable fuel can be used to replace diesel and other fossil fuels.

This company lists several ‘green economy’ advantages attributable to its RNG product, starting with savings in cost. Replacing diesel fuel with RNG can save transport fleet operators up to 50% in fuel costs every year. In addition, RNG production can be used to reduce methane emissions from landfills or dairy farms, and can be used to increase hydrogen production as another alternate fuel.

OPAL is a newcomer to the public trading markets, having gone public in July of 2022 through a SPAC transaction, a business combination with ArcLight Clean Transition Corporation II. The transaction was approved on July 15, and the OPAL ticker started trading on July 22.

In its most recent quarterly report, for 3Q22, OPAL showed a top line of $66.6 million, for a 41% year-over-year gain. This was derived from quarterly production of 0.6 million MMBtu of RNG, a y/y production increase of 50%; from sales of 7.4 million GGEs (gasoline gallon equivalents) of RNG, up 17% y/y; and deliveries of 30.7 million GGEs, which was up 33% from the prior year quarter. The company is guiding toward full-year 2022 RNG production of 2.2 million to 2.3 million MMBtu.

OPAL is working to meet that goal by expanding its production capacity, and earlier this month the company announced the commencement of full operations at the first landfill gas to RNG facility in the state of Florida. The new facility is expected to produce up to 5 million GGEs per year going forward.

In his coverage of OPAL for UBS, William Grippin highlights why investors should lean into this name right now. He writes, “We expect OPAL to grow adj. EBITDA by ~55% CAGR through 2026E, underpinned by a 4-yr construction backlog of renewable natural gas (RNG) projects. In our view, OPAL offers a favorable risk/reward skew with the current ~11x 2024 UBSe EV/EBITDA multiple not fully reflecting the growth potential of OPAL’s project backlog. Key milestones over the next 12 months include: 1) On-time commissioning of 4 out of 7 currently in-construction projects, 2) conversion of 4-5 pipeline projects to in-construction status, 3) Establishment of final 2023 renewable fuel volume obligations by the EPA.”

Looking forward from this stance, Grippin gives OPAL shares a Buy rating with a price target of $13 to indicate his confidence in ~86% upside on the one-year time frame. (To watch Grippin’s track record, click here)

Overall, this small-cap RNG firm has picked up 5 recent reviews from the Street’s analysts and these are all positive, backing up a unanimous Strong Buy consensus rating. The stock is currently selling for $7 and its average price target, standing at $13.75, implies a robust 96% upside potential over the coming year. (See OPAL stock forecast)

Sarepta Therapeutics, Inc. (SRPT)

For the second UBS pick we’ll switch to the healthcare sector. Sarepta is a biopharma company that has scored a ‘hat trick,’ having a comprehensive product and research lineup that features drug candidates in the discovery and clinical stages of development, as well as approved products in the commercialization stages. The company takes a gene editing approach to biopharmaceuticals, and is working on treatments for genetically-based disease conditions with a particular focus on muscular dystrophy.

On the commercial side, Sarepta has three approved gene therapy products on the market for the treatment of Duchenne muscular dystrophy. These three drugs, Exondys 51, Vyondys 53, and Amondys 45, brought in a total of $207.8 million in product revenues for 3Q22 – this was up 24% year-over-year, and made up the bulk of the company’s $230.3 million total top line. The additional revenues came from collaboration payments on pipeline drug candidates.

The company also just released preliminary Q4 and full-year product revenue results; net product revenues for the quarter are expected to reach ~$235.5 million, amounting to a 32% y/y increase while revenues for the full-year are expected to reach $843.3 million, above guidance of $825 to $840 million.

Turning to the pipeline, the most important program to note is SRP-9001 being developed together with Roche. This drug candidate is a potential treatment for ambulant patients with Duchenne; based on positive clinical trial results, the company this past September submitted the Biologics License Application to the FDA, and is seeking accelerated approval. A PDUFA date has been set for May 29. At the same time, Sarepta is also running the EMBARK clinical trial – a global, randomized, double-blind, placebo-controlled study of SRP-9001, that is fully enrolled and dosed – and has proposed this trial as a confirmatory study to support accelerated approval.

Covering Sarepta for UBS is analyst Colin Bristow, who sees potential regulatory and clinical trial catalysts in the company’s late-stage research pipeline. Bristow says of Sarepta, “Our view is that accelerated approval for SRP-9001 in Duchenne Muscular Dystrophy (DMD) by the May 29 PDUFA is highly likely (we increased our Prob of Approval to 85% from 60%) – we believe SRPT has sufficient data to support the use of shortened/truncated dystrophin (formerly known as microdystrophin) expression as a surrogate biomarker of function. Additionally, the early involvement of CBER director Peter Marks and Neurology head Billy Dunn in the regulatory process are soft positive indicators of a favorable outcome, in our view (supported by our regulatory KOL discussion).”

These comments fully support Bristow’s Buy rating on SRPT shares, and his $158 price target implies a one-year upside potential of ~31%. (To watch Bristow’s track record, click here)

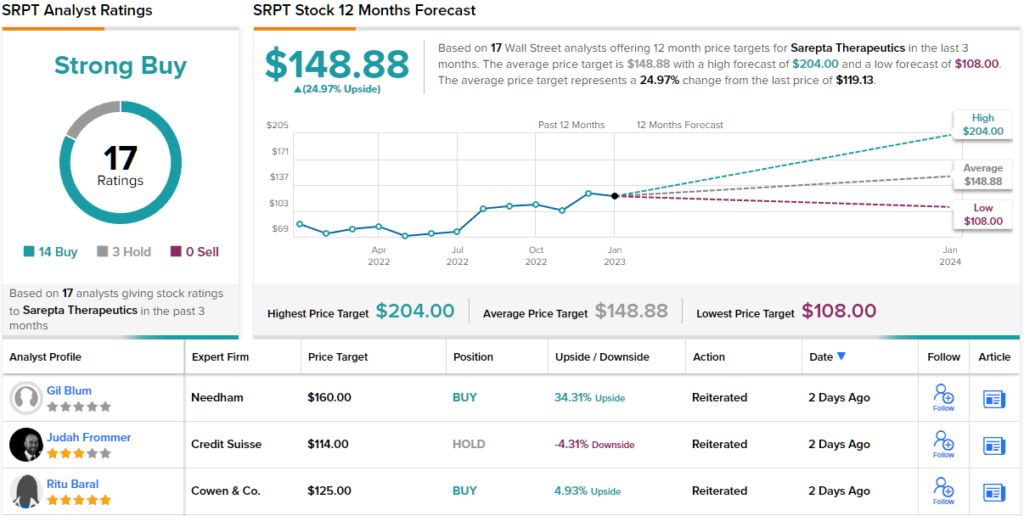

A healthcare stock with as many shots on goals as Sarepta – the commercialized medications, the late-stage pipeline, the pre-clinical tracks – is sure to attract investor and analyst interest, and SRPT shares have 17 recent reviews on file. These include 14 Buys and 3 Holds, for a Strong Buy consensus rating. The stock has an average price target of $148.88, suggesting ~25% upside from the current trading price of $120.13. (See SRPT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.