In this piece, I evaluated two ridesharing stocks, Uber Technologies (NYSE:UBER) and Lyft (NASDAQ:LYFT), using TipRanks’ comparison tool to determine which is better.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Uber is a transportation conglomerate that primarily allows people to hail a taxing using an app on their phone, although it also offers a food-delivery service. Lyft offers mobility as a service, ride-hailing via an app, vehicles for hire, rental cars, a bicycle-sharing system, motorized scooters, and food delivery in the U.S. and some cities in Canada.

Shares of Uber have rallied 85% year-to-date, bringing their 12-month gain to 61%, while Lyft shares have gained 5% year-to-date but remain in the red for the last year, off 27%.

To have something to compare to when looking at each stock’s valuation, it’s important to note that the U.S. transportation industry is trading at a price-to-earnings (P/E) ratio of 41.1 versus its three-year average of 167. Further, it’s trading at a price-to-sales (P/S) ratio of 2.5, slightly lower than its three-year average of 2.9. Now, with this background knowledge, let’s proceed to analyze both stocks.

Uber Technologies (NYSE:UBER)

Despite posting its first profitable quarter, Uber is trading at a P/S multiple of 2.7 versus its four-year mean P/S of 4.6. Although Uber shares have already rallied 85% year-to-date, the low P/S multiple and the small post-earnings decline after its first profitable quarter suggest a bullish view may be appropriate for Uber in the near term.

For the second quarter, Uber reported a 14% increase in revenue to $9.2 billion and net income of $394 million or 18 cents per share versus the consensus estimate of $9.3 million in revenue and a loss of 1 cent per share. In the year-ago quarter, Uber reported net losses of $2.6 billion or $1.33 per share.

Additionally, adjusted EBITDA rose 152% year-over-year to $916 million, while gross bookings rose by 16% year-over-year. For the third quarter, Uber expects gross bookings of $34 billion to $35 billion and adjusted EBITDA of $975 million to $1.025 billion, both ahead of the consensus.

Unfortunately, $386 million of Uber’s reported net income was the result of net unrealized gains from the revaluation of the company’s equity investments, which is not a sustainable source of income. However, management told CNBC that they expect every quarter to be profitable on a generally accepted accounting principles (GAAP) basis going forward, a key milestone for every company.

Despite that, Wall Street was disappointed with the $100 million revenue miss. Zooming out from the most recent quarter, though, Uber’s annual trends look solid as well, with steady revenue, profit, and free-cash-flow growth.

What is the Price Target for UBER Stock?

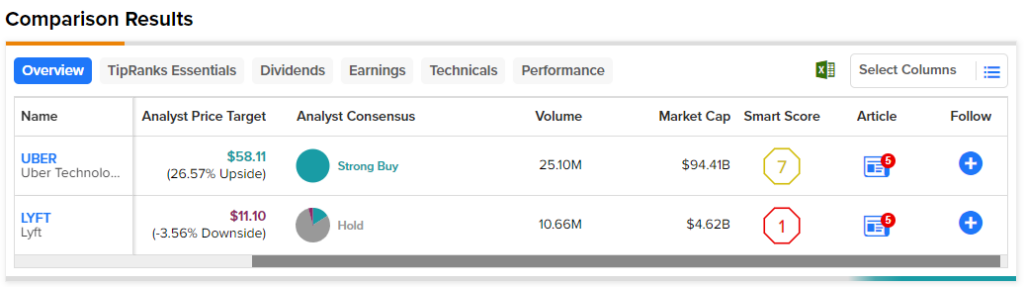

Uber Technologies has a Strong Buy consensus rating based on 29 Buys, zero Holds, and zero Sell ratings assigned over the last three months. At $58.11, the average Uber Technologies stock price target implies upside potential of 26.3%.

Lyft (NASDAQ:LYFT)

Lyft remains unprofitable and is trading at a P/S multiple of 1.05 versus its five-year mean P/S of 4.0. However, a closer look at the company’s fundamentals reveals real reasons for the lower multiple, suggesting a bearish view might be appropriate.

Lyft is scheduled to release its second-quarter earnings results after the market closes on August 8. In May, the company released weaker-than-expected guidance for the second quarter, projecting revenue of about $1 billion to $1.02 billion. Analysts were expecting $1.08 billion in revenue. Also, Lyft guided for adjusted EBITDA of $20 million to $30 million in the second quarter, versus the consensus of $49.3 million.

A deep dive into Lyft’s fundamentals reveals a potentially inferior version of Uber. While Uber’s numbers have mostly trended in the right direction over the last few years, Lyft’s have not. As Uber grew its revenue steadily, including a more than 80% increase from 2021 to 2022, its net losses gradually shrank (this excludes 2020, when everything was shut down).

However, while Lyft managed 36% revenue growth in 2021 and 28% in 2022, its net losses have failed to budge, widening from $1.1 billion in 2021 to $1.6 billion in 2022. While the company has plenty of cash to sustain its losses for years, it’s difficult to see a path to profitability when Lyft’s net income margin remains at -37.3% despite its growing revenue.

What is the Price Target for LYFT Stock?

Lyft has a Hold consensus rating based on four Buys, 20 Holds, and one Sell rating assigned over the last three months. At $11.10, the average Lyft stock price target implies downside potential of 3.7%.

Conclusion: Bullish on UBER, Bearish on LYFT

Uber hit a major milestone with its first quarter of GAAP profitability and management’s expectations of profitability in each quarter going forward. While the stock has rallied tremendously this year, its P/S multiple has shrunk dramatically despite the new profitability, implying, in my opinion, that there’s nowhere for Uber to go but up from here. Meanwhile, time will tell whether Lyft can be as successful as Uber, but for now, it’s nowhere near profitable.