Ridesharing and delivery giant Uber Technologies’ (NYSE:UBER) stock has tumbled just like the overall stock market. Uber is the largest player in the Global Mobility and Food Delivery space, both of which have massive growth potential. It continues to post record revenues and should continue to do so for many years to come. I will surely take the Uber ride as the current share price looks attractive, and long-term growth looks solid.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Uber is a Market Leader Gaining Market Share

Within Mobility, Uber is the largest player in eight of its top 10 markets, with a market share ranging from 50%-65%. On top of that, in food delivery, Uber has a leading position in seven of the top 10 GDP markets globally.

Uber remains a counter-cyclical bet in a weakening macroeconomic backdrop. The competitive environment currently is the best it has ever been as smaller competitors are forced to shut operations in the wake of lackluster consumer spending, rising interest rates, and drying venture capital money.

Wiping out of smaller competition has led to a higher supply of drivers on the Uber platform (now back to pre-pandemic levels). This, in turn, will result in better customer experience in the form of lower wait times as well as lower surge pricing. Higher inflation is also attracting more gig-economy workers onto the Uber platform, driven by the need to earn extra income.

In 2022, Uber mobility is estimated to cross the $50 billion mark in gross bookings on its platform. To achieve that, it is critical to have a very strong supply of drivers on the platform. I believe Uber has a unique advantage, which no other competitor currently has. It offers multiple options which ensure higher utilization and earnings potential for drivers.

A person can choose to drive for mobility or food delivery as well as delivery of convenience & groceries. In just Q3 2022 alone, drivers earned $11 billion from the Uber platform. A robust supply of drivers on the platform leads to lower wait times and costs for customers, attracting more customers.

Given Uber’s brand appeal (about 50% of the population aged 18 or older has used an Uber in the U.S.) and some of the Uber-specific advantages mentioned above, the barriers to entry for a new player are significantly high.

Uber’s Profitability Roadmap

On November 1, Uber posted robust revenues that grew 72% year-over-year to $8.34 billion, driven by 26% growth in gross bookings to $29.1 billion. Its adjusted loss of $0.61 per share, however, fell short of the consensus estimate of -$0.17 per share. It also reported an all-time quarterly high adjusted EBITDA and adjusted EBITDA margin.

The big question is, where could operating margins finally settle? For the Mobility business, management has a long-term EBITDA margin target of 10% (of gross bookings). In Q3, Uber achieved an EBITDA margin (as a % of gross bookings) of 6.6%. Management noted that its Mobility business is now profitable in almost every major market for Uber, with EBITDA margins well over the long-term targeted range of 10% in its top five markets.

For the Delivery business, management has a long-term EBITDA margin target of 5% (of gross bookings). In Q3, Uber achieved an EBITDA margin of 1.3%. Uber has achieved adjusted EBITDA profitability in 10 of its top 20 food delivery markets, with EBITDA margins of well over 5% in its top five markets. All the above data suggest that Uber is already moving on its path to profitability.

What is the Price Prediction for UBER Stock?

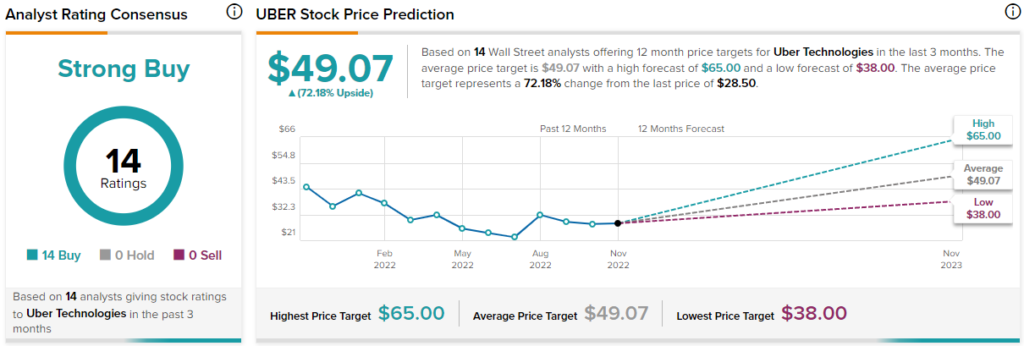

Uber’s average price forecast of $49.07 implies a whopping 72.2% in upside potential from current levels. The Wall Street community is clearly optimistic about the stock. Overall, UBER commands a Strong Buy consensus rating based on 14 unanimous Buys.

Concluding Thoughts: Consider Buying Uber Stock

Year-to-date, Uber stock has lost more than 35% of its market capitalization. In terms of valuation, UBER is trading at an EV/sales ratio of 2.1x, higher than the peer group average of 1.7x. Nonetheless, the premium is justified given its favorable industry-leading position and larger total addressable market or TAM. Yet, it is trading at much lower levels compared to the peak 11x EV/sales ratio seen in the last 24 months.

I think it’s only a matter of time before the stock rebounds and maybe make new highs. Given its solid business moat, market-leading position, double-digit revenue growth, as well as improving cashflows, I think the current levels are extremely attractive to accumulate Uber stock.