Uber Technologies (NYSE:UBER) announced a new advertising division and launched Journey Ads. Through its ad unit, brands can partner with the company for advertising on Uber, Uber Eats apps, and beyond. This comes after rival Lyft (NASDAQ:LYFT) unveiled a similar kind of service, Lyft Media, in August 2022.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Both Uber and Lyft are diversifying their revenue sources and focusing on profitability by expanding into the digital ad category. Moreover, these mobility-as-a-Service providers are poised to benefit from higher travel demand and the reopening of offices.

However, higher ride share prices, an increase in wait time, driver shortages, and an inflationary environment could pose challenges.

What is the Prediction for Uber Stock?

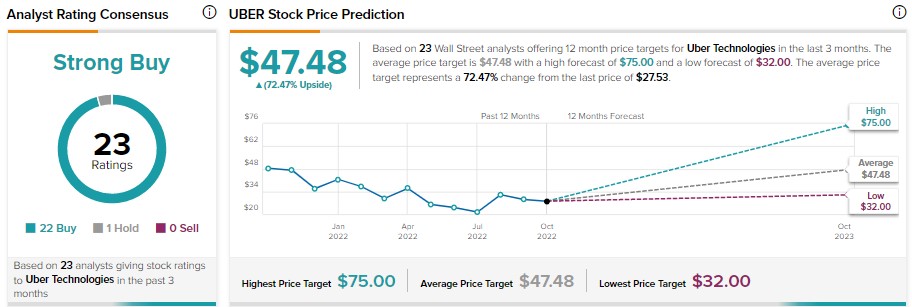

Uber stock commands a Strong Buy consensus rating on TipRanks based on 22 Buy and one Hold recommendations. Meanwhile, these analysts’ average price target of $47.48 implies 72.5% upside potential.

Needham analyst Bernie McTernan expects “Uber will benefit from the reopening of the economy in Mobility” and its pass subscription. McTernan is bullish about UBER stock, while his price target of $52 implies 88.9% upside potential.

While analysts are bullish, hedge funds and insiders have been selling Uber stock. Hedge funds sold 4.8M UBER stock last quarter. Meanwhile, insiders sold Uber stock worth $4.2M during the same period. Uber stock carries a Smart Score of two out of 10, implying it could underperform the broader market.