U.S. President Joe Biden recently signed the $858 billion National Defense Authorization Act into law. A very small but vital component of this massive spending bill is the National Defense Stockpile, for which $1 billion has been authorized to procure rare earth elements and other critical minerals and materials that are required to meet the defense, industrial, and essential civilian needs of the country. Two stocks, MP Materials (NYSE:MP) and Tronox Holdings (NYSE:TROX) stand to benefit from this new act.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Renewed Focus on National Defense Stockpile

The National Defense Stockpile, which comprises materials like Titanium, Lanthanum, Carbon Fibers, Antimony, and Neodymium, has depleted over the recent years, which is dangerous as this makes the country’s defense supply chain susceptible to shortages. Last year, a Defense News report highlighted that the stockpile’s value plunged significantly to $888 million in 2021 from $42 billion (adjusted for current dollar value) at its peak during the beginning of the Cold War in 1952.

The $1 billion authorization for the stockpile is in line with recommendations from a 2021 White House Report that highlighted that the country’s strategic stockpile had been neglected for many years and action needs to be taken to “recapitalize and restore” the National Defense Stockpile. The revived interest in the National Defense Stockpile is even more important amid the growing tensions between the U.S. and rivals China and Russia.

It’s worth noting that China dominates the mining and production of critical minerals and rare earth metals. For instance, China is the largest supplier of antimony, followed by Russia. Antimony is very critical for various military applications, including explosive formulations, night vision goggles, nuclear weapons production, and infrared sensors.

In September 2022, the U.S. Department of Energy (DOE) announced up to $156 million in funding from President Biden’s Bipartisan Infrastructure Law for building a first-of-a-kind facility to extract and separate rare earth elements and critical minerals from unconventional sources like mining waste. In December 2022, the DOE announced investments worth $5.3 million in five projects that will advance research supporting the domestic production of rare earth elements and other critical minerals.

Let’s have a look at two stocks that could benefit from higher demand for rare earth elements and critical minerals.

MP Materials (NYSE:MP)

MP Materials is the leading producer of rare earth materials in the Western Hemisphere. The company delivers about 15% of the global rare earth supply. The company’s long-term focus is on Neodymium-Praseodymium (NdPr), a vital input needed in electric vehicles, robots, wind turbines, drones, and several other advanced technologies.

While MP Materials is currently dependent on China for the processing of its mined rare earth materials, the company is making significant investments to restore the entire rare earth supply chain to America.

Is MP Materials Stock a Good Buy?

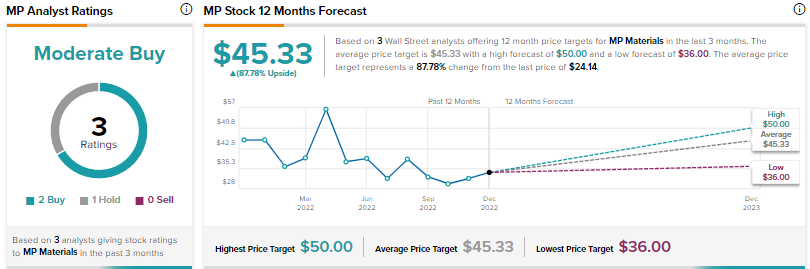

Wall Street’s Moderate Buy rating for MP Materials is based on two Buys and one Hold. The average MP stock price target of $45.33 implies nearly 88% upside potential.

Tronox Holdings (NYSE:TROX)

Tronox Holdings produces titanium dioxide and inorganic chemicals. Titanium dioxide is used in several industrial and commercial products, including paints, coatings, and plastics.

The company’s long-term strategic goal is to be vertically integrated and utilize all of its feedstock materials in its nine Titanium dioxide pigment facilities that it operates in the U.S., Australia, Brazil, the U.K., France, the Netherlands, China, and Saudi Arabia.

What is the Price Target for TROX Stock?

The Street’s Moderate Buy consensus rating for Tronox is based on five Buys, two Holds, and one Sell. The average TROX stock price target of $16.63 suggests 20.3% upside potential.

Conclusion

The U.S. is reviving its focus on its National Defense Stockpile to secure the supplies of rare earth elements and other critical materials used for defense and other applications. The country is also investing in its domestic rare elements supply chain to reduce its reliance on China.