Wars are dominating the global headlines these days, but not all of them involve bullets and bombs. President Trump’s recently announced tariff policy has the potential to kick off a ‘tariff war,’ which could easily spill over into a trade and economic war. And make no mistake, this economic battlefield can be just as disruptive.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Even as these overlapping economic conflicts rattle the oil sector – injecting heightened volatility and making the outlook harder to predict – Bank of America’s U.S. oil and gas analysts believe there are still solid opportunities to be found.

“Oil markets are on the frontlines of two economic wars, one on trade which has engulfed all financial markets, and the other on price, as damaged OPEC+ cohesion has led to an unexpected round of supply hikes into a weak macro. Our house view is de-escalation is the most likely path forward on both fronts. We recommend positioning with a combination of defense and value rather than defense in isolation,” the analysts wrote.

Putting their outlook into action, the Bank of America analysts have picked out two oil stocks they believe are worth snapping up, even as the sector churns. According to TipRanks’ database, Wall Street agrees; both names come with Strong Buy consensus ratings. Let’s dive into the picks and hear what the analysts have to say.

Diamondback Energy (FANG)

The first oil stock on our list of Bank of America picks is Diamondback Energy, a large-cap, $39 billion player in the exploration & production segment of the North American oil and natural gas industry. Diamondback operates in the Permian Basin of west Texas, near the Texas–New Mexico border, and focuses its operations on exploiting horizontal wells in the Wolfcamp, Spraberry, and Bone Spring formations of the larger Permian. Diamondback has its headquarters in Midland, Texas, and describes its work as the ‘acquisition, development, exploration and exploitation of unconventional, onshore oil and natural gas reserves.’

Following that path, Diamondback has developed expertise in unconventional work modes, including horizontal drilling, hydraulic fracturing, and tapping multiple intervals. The company uses these methods to reach proven oil and gas reserves in known reservoirs that had previously been classed as unworkable. This strategy, and these methods, have in recent years made the Permian Basin the largest hydrocarbon production region in the continental US, and have made Texas a major player in the global energy industry.

In an interesting recent development, Diamondback announced on April 1 that it had completed the acquisition of ‘certain subsidiaries’ of Double Eagle, an oil and gas player in the Midland Basin of Texas. The acquisition transaction involved both stock and cash, with Diamondback acquiring the Double Eagle assets in return for 6.9 million shares of FANG as well as $3 billion in cash. The move adds a high-quality asset inventory to Diamondback’s existing positions.

On February 24 of this year, Diamondback declared its most recent dividend payment. This declaration set the common share dividend at $1 for 4Q24. The $4 annualized payment gives a forward yield of 3%. Diamondback has been paying out dividends to shareholders since 2018, and is known for adjusting the payment to maintain affordability and for paying out special dividends when it is able. The current $1 payment is described by the company as a base payment.

Turning to look at Diamondback’s last set of quarterly results, which covered 4Q24, we find that the company reported total revenue of $3.71 billion, beating the forecast by $160 million and growing 66% year-over-year. At the bottom line, Diamondback’s quarterly EPS, of $3.64 by non-GAAP measures, was 26 cents per share better than had been expected. The company is a strong cash generator, and reported $2.3 billion in quarterly net cash provided by operating activities. Free cash flow in the quarter came to $1.3 billion.

This stock has caught the attention of Bank of America’s Kalei Akamine, who lays out a strong case for FANG as a quality investment, writing, “Within the largest and most liquid caps in our coverage universe, we believe that Diamondback offers the best combination of value and defense… We believe that FANG’s lower dividend breakeven ($36 WTI) and higher FCF Yield (9.6%), give it an advantage… While FANG has a levered balance sheet (1.6x net debt to forward 4 quarter EBITDA AT $60 WTI), a sustained drop in oil prices is not our base case, keeping our focus on near-term free cash flow capacity, where again FANG stands out from the pack.”

Akamine goes on to rate FANG as a Buy, with a $170 price target that implies an upside potential of 29% on the one-year horizon. (To watch Akamine’s track record, click here)

This oil company’s stock currently holds a Strong Buy rating from the Street’s analyst consensus, based on 22 recent reviews that break down to 20 Buys and 2 Holds. The shares are priced at $132.01 and the $189 average target price suggests that the stock will gain 43% in the next 12 months. (See FANG stock forecast)

Chord Energy (CHRD)

Next up, Chord Energy is another of North America’s independent hydrocarbon exploration and production companies. Chord works in the Bakken Shale formation of the large Williston Basin. This geographical basin, straddling parts of Montana, the Dakotas, Manitoba, and Saskatchewan, has proven to be a rich field for oil and gas extraction; the Bakken Shale, in particular, is known for its strong production. Chord’s land holdings and active E&P operations are located mainly in North Dakota, but also extend into Montana.

This company has focused on a high-quality exploration and production model, building a portfolio of top-tier assets that are capital-efficient and can be worked at low cost. The company has approximately 1.3 million net acres of land holdings, with 5 operating rigs. Of the total hydrocarbon reserves under Chord’s holdings, 57% are known to be crude oil. Chord works its holdings through the use of horizontal drilling and hydraulic fracturing techniques.

Like Diamondback above, Chord pays out a dividend. The current common share payment is set at $1.30 and was declared this past February. The dividend, which was paid out on March 26, annualizes to $5.20 per common share and gives a 5.75% forward yield. Chord is known to supplement its regular dividend with a variable payment.

In the 4Q24 earnings report, the last released, Chord’s revenue came to $1.45 billion, up just over 50% year-over-year and some $410 million better than the forecast. The company’s bottom-line earnings, given as a non-GAAP EPS of $3.49, were 68 cents above the estimates. Chord reported an adjusted free cash flow for the quarter of $276.9 million.

Chord is part of BofA analyst Noah Hungness’s coverage universe, and he is impressed by the company’s ability to complete difficult well operations. Writing of Chord’s operations and return potential, Hungness says, “In the last few months CHRD has drilled and completed its first 4-mile lateral coming in $1mn below budget while the 2nd well was drilled a day ahead of schedule. With recent operational success in mind and CHRD accelerating 4-mile lateral develop by spudding seven (up from three) wells this year, we see significantly lower risk to 4-mile development. As such we price in the low end of our new base case range that assumes 80% of the program are extended laterals (50% 4 mile, 30% 3 mile) by 2027 lowering our sustaining capex est by $100mn to $1.3bn, an $8/sh tailwind to our valuation. Looking forward, we see a company with a peer-leading balance sheet that will help to navigate a volatile oil macro-outlook and a catalyst rich path forward with recent developments not yet priced in that should differentiate Chord from peers.”

Going forward, the analyst gives Chord’s stock a Buy rating. He complements that with a price target of $114, suggesting that CHRD has a 26% gain waiting for it this year. (To watch Hungness’s track record, click here)

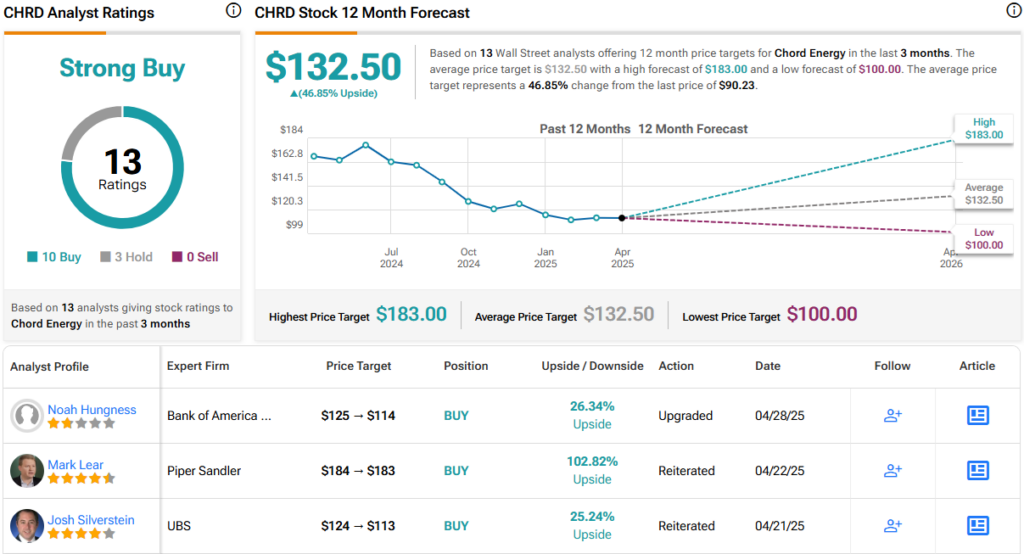

The 13 recent analyst reviews here are split 10 to 3 in favor of Buy over Hold, for a Strong Buy consensus rating. The stock’s $90.23 trading price and $132.50 average target price together suggest an upside of 47% for the year ahead. (See CHRD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.