Rising interest rates and macro challenges have triggered a bearish sentiment for growth stocks, including electric vehicle (EV) stocks. However, high fuel prices and incentives offered by various countries to boost EV adoption bode well for EV makers and EV infrastructure companies. Despite the ongoing turmoil, Wall Street is optimistic about two EV stocks – XPeng (NYSE:XPEV) and ChargePoint Holdings (NYSE:CHPT).

As per research firm Canalys, global EV sales increased 63% to 4.2 million in the first half of this year despite tough economic conditions. Amid this favorable demand backdrop, let us discuss two of Wall Street’s “Strong Buy” picks.

XPeng (XPEV)

Chinese EV stocks have been battered this year for multiple reasons, including delisting concerns, supply chain issues due to the COVID-19 resurgence in China, as well as political developments in the country.

Amid production and supply chain disruptions, XPeng delivered 29,570 EVs in Q3, up 15.2% year-over-year but down 14.1% compared to Q2 2022. The company’s deliveries in the upcoming quarters are expected to benefit from the inclusion of its G9 flagship SUVs. XPeng’s G9 is its fourth production model and was launched in September. As per the company, mass deliveries for G9 are scheduled to begin in late October.

Is XPeng a Buy or Sell?

At the XPeng 2022 Tech Day event held on October 24, the company provided additional details on its newly launched XNGP assisted-driving system. Following the event, Bank of America analyst, Ming Hsun Lee, reiterated a Buy rating on XPEV stock with a price target of $31.

Lee stated, “With XPeng’s latest smart driving roadmap, it accomplishes single-scenario driving assistance in 2022, targets to complete full-scenario driver assistance in 2023-2025, and aims for full autonomous driving in and beyond 2025.”

At the Tech event, XPeng also discussed XNet, its next-generation perception architecture that will help the company make advances in autonomy.

Overall, Wall Street has a Strong Buy consensus rating for XPeng stock based on nine Buys versus two Holds. The average XPEV price target of $46.32 implies a whopping 483.4% upside potential. Shares have plunged 84% year-to-date.

ChargePoint Holdings (CHPT)

ChargePoint Holdings offers networked EV charging system infrastructure, connected through cloud-based services. The company boasts one of the largest networks of EV charging stations in North America and Europe. ChargePoint is well positioned to deliver strong growth in the years ahead as EV infrastructure is crucial for ensuring increased EV adoption.

ChargePoint’s revenue jumped 93% year-over-year to $108 million in Q2 FY2023 (ending July 31, 2022), crossing the $100 million mark for the first time. The mid-point of the company’s full-year revenue guidance indicates revenue growth of 96%.

ChargePoint continues to introduce new solutions to capture further demand. It recently launched the CP6000 charging solution, specially designed for the European market.

What is the Target Price for CHPT Stock?

Last month, Credit Suisse analyst Maheep Mandloi initiated coverage on ChargePoint Holdings stock with a Buy rating and a price target of $22. The analyst’s optimism for ChargePoint is based on the incentives under the Inflation Reduction Act, the company’s first mover advantage with integrated solutions, and its capital-light business model.

Moreover, the analyst feels that CHPT stock is trading at an attractive valuation following the significant pullback this year.

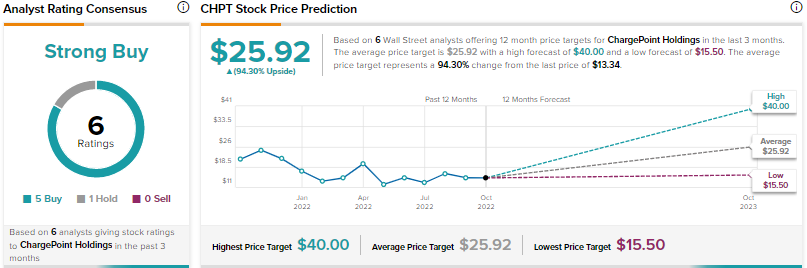

Overall, Wall Street has a Strong Buy consensus rating for ChargePoint Holdings based on five buys and one Hold. The average CHPT stock price target of $25.92 suggests 94.3% upside potential. Shares are down 30% year-to-date.

Conclusion

Risk-tolerant investors who can look beyond the current volatility can opt for XPeng and ChargePoint as two interesting picks in the EV space. Rising EV penetration in key markets across the globe bodes well for these companies.