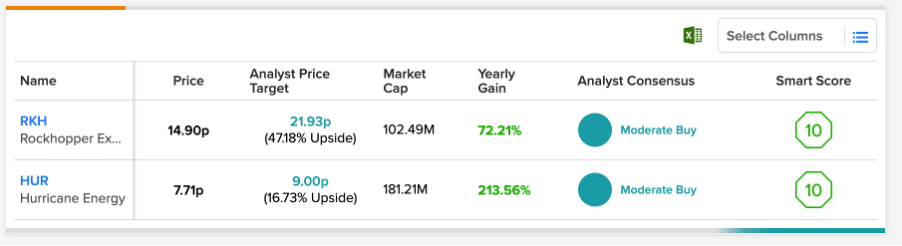

Oil and gas companies, Rockhopper Exploration (GB:RKH) and Hurricane Energy (GB:HUR) have a perfect score of 10 as per the TipRanks Smart Score Tool.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This tool is designed to give an investor confidence to choose safe stocks that can provide comfort in uncertain times. According to this tool, all the stocks are measured on various parameters and a score is assigned between 1 and 10.

It’s been quite an amazing year for energy stocks in general. The increasing prices of oil and gas are benefiting these companies.

Both Rockhopper and Hurricane have shown tremendous growth in their share prices in the last year, and, based on their perfect scores, the trend is expected to continue.

Let’s discuss the stocks in detail.

Rockhopper Exploration Stock

Rockhopper is a UK-based oil and gas exploration company, mainly operating in the Falkland Islands and the Greater Mediterranean region.

The stock recently came into the news when it surged around 80% in one day after the company received compensation of £160 million in an arbitration dispute with Italy.

The case was started in 2017 after the government of Italy banned the company’s drilling activities in the Ombrina Mare oilfield in the Adriatic Sea. This win is a positive milestone for the company after devoting a lot of time and effort to it.

The company is now mainly focused on the Falklands’ Sea Lion project, which has 500 million barrels of highly marketable recoverable oil. The company owns a 30% interest in the project and is betting big on this, with the expectation of significant value generation for all stakeholders.

Is Rockhopper a good investment?

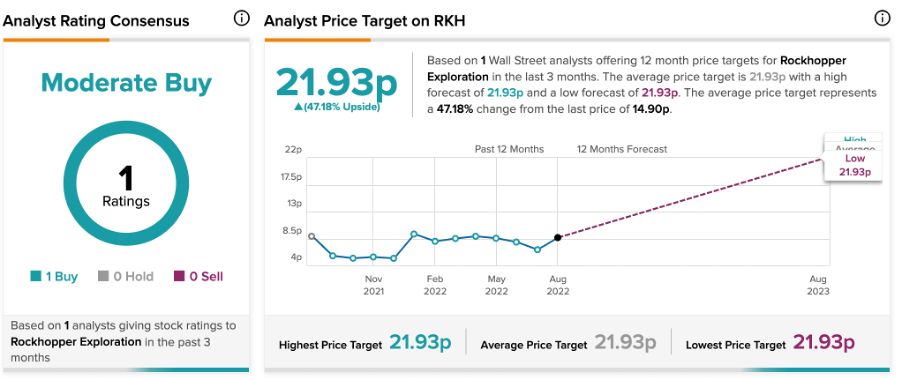

According to TipRanks’ analyst rating consensus, Rockhopper stock is a Moderate Buy.

The stock has one buy rating from analyst Charlie Sharp of Canaccord Genuity. Sharp is bullish on the energy and utility sector and has an average return of 70.5% on this stock.

The RKH target price is 21.93p, implying an upside of 47.1%.

Hurricane Energy Stock

Hurricane Energy is an oil and gas company that explores resources from natural basement reservoirs. The company has a presence in the UK region with a focus on the Atlantic margin, west of Shetland.

The company’s shares have recovered massively in the last year with almost 250% return. This was a result of the combined effect of the company’s strong performance along with the current oil market demand.

2021 was truly a year of transformation for the company. It was able to convert its losses from $625 million in 2020 to profits of $18.2 million in 2021. The company is now able to focus more on growth opportunities instead of just being able to survive financially.

Another highlight for Hurricane is that it has paid its outstanding debt of $78.5 million in July 2022 and is now a debt-free company. Being a smaller company in terms of operations, this is an amazing feat. The company’s healthy cash situation, stable operations, and rising oil prices make the outlook look promising.

Hurricane Energy share price forecast

According to TipRanks’ analyst rating consensus, Hurricane Energy stock is a Moderate Buy, based on one buy rating.

The HUR target price is 9p, which shows a change of 16.7% from the current price level.

Conclusion

The advantage of investing in small-cap stocks is that the investors will be a part of their companies’ journey when and if they become big players in the long run. Considering this, both the stocks could be good portfolio addition from the energy sector.

With great returns also comes great risks. The energy stocks are defeating the markets currently but are also facing headwinds from rising inflation which increases the cost of producing oil.