Michael Werner is the head of the diversified financials team at UBS, covering exchanges and asset management companies – Today, we have picked two exchange companies, the London Stock Exchange Group (GB:LSEG) and Euronext NV (GB:0QVJ) from his list.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Werner has a vast experience in global capital markets, which comes in handy in the diversified financial sector.

Werner spent 15 years of his career at Sanford C. Bernstein, before joining UBS, where he has covered banking and financial institutions from the US, China, and Europe.

According to the TipRanks Star Ranking system, Werner is ranked 2,461 out of 7,978 analysts. He has a success rate of 54%, with 64 out of 119 ratings being successful. He has an average return of 3.1% per transaction.

The ranking system by TipRanks guides investors to choose the stocks backed by their favourite investors. The analysts are measured in three categories, which are success rate, average return, and statistical significance.

Let’s discuss the stocks in detail.

London Stock Exchange Group

London Stock Exchange Group is a financial markets infrastructure group, that also provides data and analytics services.

The company has a diversified business model with multiple income streams, which gives stability to revenues. The company’s data and analytics business contribute the most to its income.

Werner has focused on the data analytics segment of the company and believes that any increase in the guidance numbers due to the data analytics business would push the stock price higher.

Recently, the company started its buyback program for a value of £750 million, as announced in its interim results for 2022. The buyback, which will continue in multiple phases over the next 12 months, is being funded by the proceeds from the company’s divestment of its BETA business as promised earlier.

Looking ahead, the company expects strong momentum in the second half of this year, supported by stable revenues across all business segments and high cash generation.

London Stock Exchange share price forecast

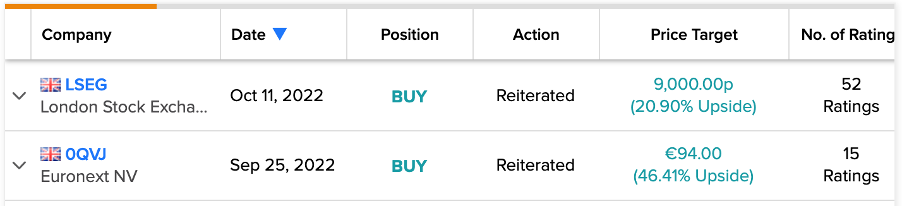

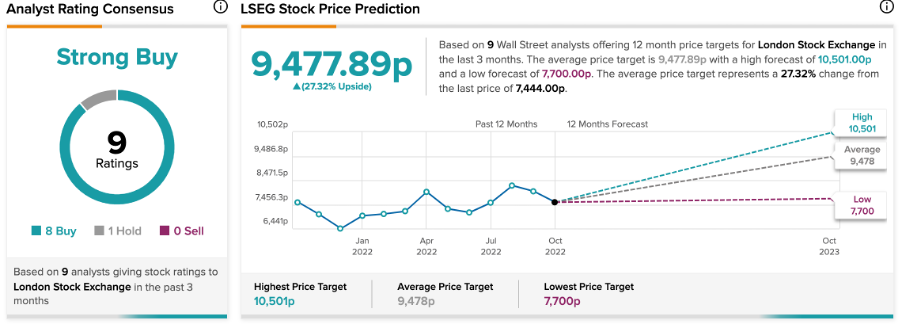

Yesterday, Werner raised his target price of the stock from 8,500p to 9,000p and maintained his Buy rating.

Overall, LSEG stock has a Strong Buy rating as per TipRanks’ analyst consensus. The stock has a wide coverage from analysts with eight Buy and one Hold recommendations.

The LSEG target price is 9,477.8p, which is 27.3% higher than the current level. The target price has a high forecast of 10,501p and a low forecast of 7,700p.

Euronext NV

Euronext NV is a pan-European stock exchange providing multiple trading and after-trade services.

The company’s stock has fallen around 35% in the last year, but long-term returns are not quite as bad, as the stock has grown by almost 5% in the last three years.

The company has set a new strategic plan called “Growth for Impact 2024”: as a part of this plan, Euronext acquired the Italian stock exchange, Borsa Italiana, in 2021, which has strengthened the company’s profile.

UBS commented, “The completed acquisition of Borsa Italiana by stock exchange group Euronext could be a source of short- and long-term growth opportunities, and boost the stock by more than 15%.”

Euronext NV share price forecast

According to TipRanks, Euronext stock has a Moderate Buy rating, based on recommendations from six analysts.

The Euronext target price is €96.75, which shows an upside potential of 52.4%.

Conclusion

Werner has Buy ratings on both stocks. These two stocks could be viable investment picks for investors.