The drama engulfing Twitter (TWTR) right now means quarterly earnings are merely a sideshow to the developing story between the company and Elon Musk. The stock’s trajectory appears to be entirely dependent on the Musk saga, to such an extent that Q2 misses on both the top-and bottom-line barely moved the needle in the subsequent session.

In what marked Twitter’s biggest revenue miss ever, the microblogging platform generated sales of $1.18 billion – falling by 1% from the same period last year – compared to the $1.32 billion anticipated by Wall Street. Non-GAAP EPS of -$0.08 also came in a way off the adj. EPS of $0.14 the analysts had in mind.

mDAUs (monetizable daily active users), a vital metric in the social media space, grew by 16.6% from 2Q21 to reach 237.8 million, just below the 238.08 million consensus estimate.

The company partly laid the blame for the revenue drop on the difficult operating environment which has in turn also affected the ad industry. Uncertainty around the Elon Musk tussle was also cited as an issue, and given the pending Musk deal/October Delaware court battle – the company is suing Musk for walking back on his agreement to buy the company for $44 billion, or $54.20 per share – there was no accompanying conference call.

How the trial goes will determine the stock’s trajectory, says Wedbush’s Daniel Ives, who like most observers, thinks Twitter has a “clear upper hand legally speaking.” As for the quarter, in light of a peer’s abject display, Ives thinks the performance was not all that bad.

“Overall, we would characterize the DAU metrics as better than feared and holding up relatively firm in this environment,” said the 5-star analyst. “When compared to the nightmare quarter of SNAP, it shows digital ad spending is not falling off a cliff like feared which is a positive for others in the space such as Facebook, Pinterest, and Google.”

For now, Ives remains on the sidelines with a Neutral rating and $30 price target, indicating shares will decline ~24% over the coming months. (To watch Ives’ track record, click here)

Rosenblatt’s Barton Crockett is more upbeat, although conceded the stock is subject to how the court case goes.

“Results predictably exhibited sector macro headwinds that felled Snap and that could impact other Internet companies slated to report,” Crockett said. “We see fundamentals as a side show, in the expectation that Twitter is very likely to have support from the Delaware Court to compel Elon Musk to complete the pending acquisition at the agreed $54.20 price.”

Accordingly, Crockett sticks with a Buy rating and $52 price target, leaving room for one-year gains of 30%. (To watch Crockett’s track record, click here)

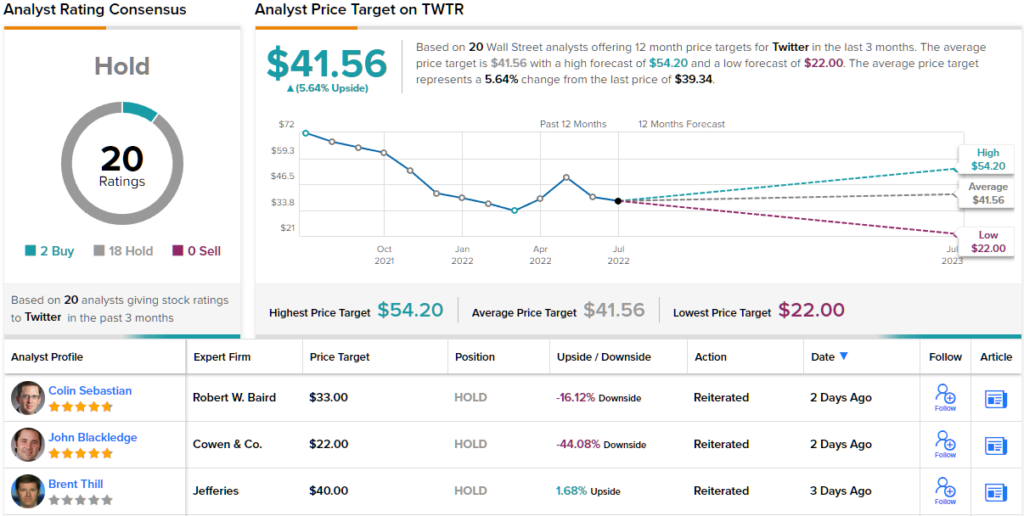

Most on the Street are sitting this one out; barring 2 Buys, all 18 other recent reviews are to Hold, naturally making the consensus view a Hold. Going by the $41.56 average target, shares will appreciate by a modest 6% in the months ahead. (See Twitter stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.