If there was any notion that caused social media drama this year, it was the idea that Elon Musk was set to buy one of the biggest social media outlets: Twitter (TWTR). Yet despite all the outrage and deep concern, new reports suggest that that deal is on hold, and may ultimately be canceled.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I’m pulling back to neutral on Twitter, pending how this all turns out. If Musk leaves Twitter behind, and for the reasons stated so far, it represents a much bigger problem ahead for Twitter than most likely expect.

The last 12 months in trading for Twitter were mostly down, until word about Musk stepped in. When the company was at its lowest, hovering around the $35 range, word of Musk’s involvement sent the company on an upward trend back to around the $50 level. It’s retracted since then, spurred on by the latest news.

That news is that Musk has temporarily halted his bid to buy Twitter, and the reason is distressing. Musk halted the deal, noting that he was awaiting the results of several studies that will determine the exact level of fake or otherwise spam-related accounts on the platform.

Earlier reports suggested that total was under 5%. The new studies should determine just what proportion of the platform’s accounts are false, and therefore worthless.

Wall Street’s Take

Turning to Wall Street, Twitter has a Hold consensus rating. That’s based on one Buy and 26 Holds assigned in the past three months. The average Twitter price target of $52 implies 26.2% upside potential.

Analyst price targets range from a low of $34 per share to a high of $60 per share.

Investor Sentiment Shaky

Right now, Twitter has a Smart Score of 2 out of 10 on TipRanks. Given the recent revelations that halted the Musk purchase, if perhaps temporarily, we can appreciate why. Investor sentiment metrics, meanwhile, suggest that most agree with TipRanks’ assessment of Twitter’s odds of outperforming the market.

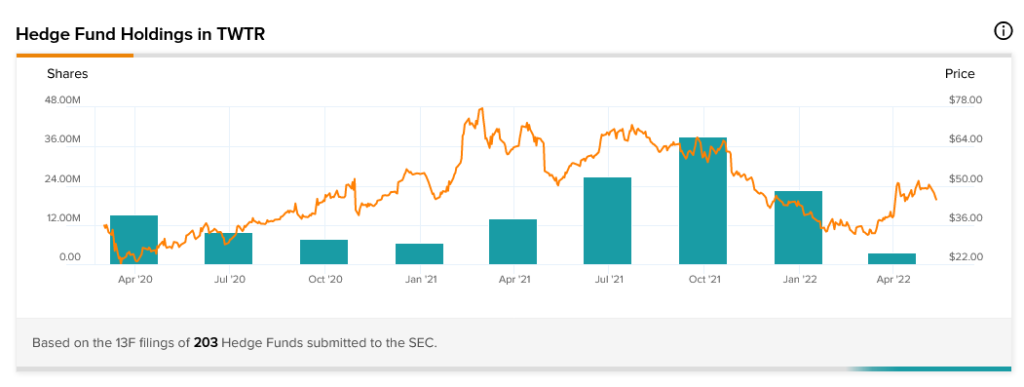

Hedge fund involvement, as measured by the TipRanks 13-F Tracker, has cratered. Hedge funds were getting out of Twitter rapidly before, as seen in the space between September 2021 and December 2021’s substantial drop. The drop between December 2021 and March 2022 is actually worse.

Hedge funds went from just over 38.9 million shares in September 2021 to just under 23 million in December 2021. Then, in March 2022, that dropped to just under 3.5 million shares total.

Insider trading isn’t much better. While insiders bought a lot more Twitter in the last three months than in much of the year before, it’s still heavily weighted to the sell side. In the last three months, sell transactions outweighed buy transactions 20 to 11. For the full year, meanwhile, sell transactions outweighed buy transactions 71 to 24.

Retail investors, at least those who hold portfolios on TipRanks, have a lot more faith in the company. Portfolios with Twitter in them increased 0.5% in the last seven days, but they’re up a whopping 20.4% in the last 30 days.

Musk: The Linchpin to Twitter’s Future

Right now, there are basically two Twitters. There’s the Twitter that might be if Musk buys it, takes it private, and then brings it back to the market. Then, there’s the Twitter that is right now and will continue to be without Musk.

The Twitter that is right now, without Musk, was on a massive slump, heading downhill, and facing serious competition from other social media platforms.

Worse, other social media platforms that could better monetize their user base. Platforms that weren’t reliant on short blurbs of text alone, backed up by occasional videos and pictures.

The general manager of consumer Keyvon Beykpour and the general manager for revenue Bruce Falck both recently departed the company. Reports noted that Beykpour and Falck were both removed due to misses on audience and revenue growth goals.

Musk’s plans for Twitter were about as ambitious as could be, though some might think they strain credulity. Musk wanted to blast Twitter’s revenue up five-fold, increasing to $26.4 billion by 2028. A range of new initiatives would help provide this boost, including charging some commercial and government users to tweet.

New products, new revenue streams, and more would have followed under Musk.Without him, those products and initiatives depart as well. That leaves Twitter in a terrible position. It will be back to being behind its competitors like Facebook (FB), YouTube (GOOGL), and even TikTok.

Concluding Views

It’s impossible to issue an opinion on Twitter right now either way,. It will remain that way until the results of the Twitter studies return. Then, Musk can reveal his plan to go ahead or call off the Twitter buy.

Thankfully, Musk remains “committed” to going ahead. If Musk continues, and the old offer holds, then investors can expect a much better return.

However, if Musk halts the buy altogether, then that’s the bad news. Twitter goes back to being an also-ran in a congested field of social media opportunities.

Right now, I’m neutral, but be ready to move.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure