Two Wall Street analysts score a 100% success rate on Alcoa Corp. (NYSE:AA) and Northern Oil and Gas (NYSE:NOG). Analysts undertake thorough research on companies in their coverage and give recommendations based on the impact of both macro and micro factors. No wonder these analysts have succeeded in making appropriate calls on AA and NOG stocks. Let’s take a look at both of the companies and the analysts’ impressive recommendations on these stocks.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Alcoa Corp. (NYSE:AA)

Alcoa Corp. manufactures bauxite, alumina, and aluminum products. Alcoa missed its Q3FY22 expectations, while also posting an adjusted loss. Alcoa (12.5% gain), along with other aluminum manufacturing stocks, soared on Friday as the company pushed to ban the trade (import and export) of metals with Russia. Also, news of a possible reopening of the Chinese economy means the demand for metals will strengthen.

Analyst Carlos De Alba of Morgan Stanley has a 100% success rate on calls on Alcoa Corp. The analyst has given a mix of Buy and Hold ratings on AA stock based on the macro backdrop. Notably, the five-star analyst has earned an impressive 92.85% average return per rating on his calls to date. AA stock has lost 29.2% so far this year.

Is Alcoa Stock a Good Buy?

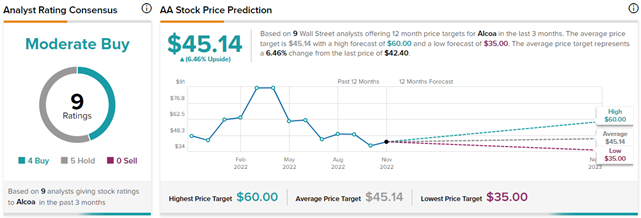

On TipRanks, Alcoa stock has a Moderate Buy consensus rating. This is based on four Buys versus five Hold ratings. The average Alcoa price forecast of $45.14 implies 6.5% upside potential to current levels.

Northern Oil and Gas (NYSE:NOG)

Next up is Northern Oil and Gas, which engages in the acquisition, exploration, development, and production of crude oil and natural gas properties. NOG is slated to release its Q3FY22 results on November 8, after the market closes. The Street expects NOG to report adjusted earnings of $1.75 per share, significantly higher than the prior year period’s figure of $0.84 per share.

Analyst John M. White of Roth Capital has a 100% success rate on his Buy calls on NOG stock. What’s more, White’s views have generated a humongous 93.55% average return per call since September 2020.

Is NOG Stock a Good Buy?

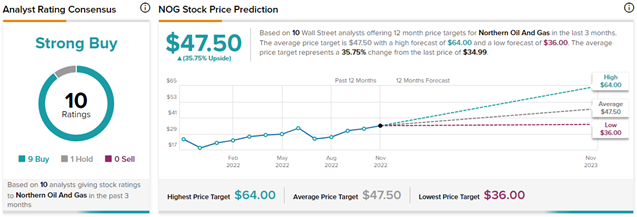

With nine Buys and one Hold rating, NOG stock enjoys a Strong Buy consensus rating. On TipRanks, the average Northern Oil and Gas price target of $47.50 implies 35.8% upside potential to current levels. Amid the war-driven surge in energy prices, NOG stock has gained 64.7% year to date.

Ending Thoughts

From the above analysis, we can see that if an investor had followed either of these analysts’ views on AA or NOG, he or she would have earned over 90% of the average return on their investments to date. Notably, TipRanks accumulates the recommendations of several Top Experts, which can be considered while making investment choices to maximize returns. Investors may choose to follow analysts’ calls to make informed investment decisions.