TipRanks offers a quick solution to find stocks that have a greater chance to generate returns higher than market averages: Top Smart Score Stocks. This tool measures the stock’s potential based on eight key factors and assigns a score between 1 and 10. It is worth mentioning that stocks with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Using this tool, we’ve chosen two stocks that have a “Perfect 10” score — Take-Two Interactive Software (NASDAQ:TTWO) and McKesson (NYSE:MCK). Let’s take a closer look at these two companies.

Take-Two Interactive

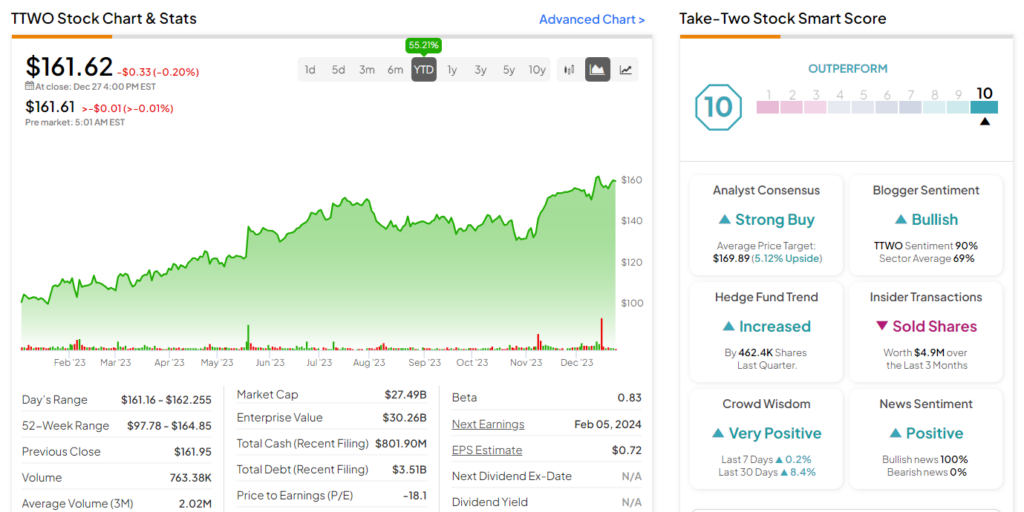

Take-Two Interactive engages in the development, publishing, and marketing of interactive software games. This stock was added to the “Perfect 10” list yesterday.

The stock has a Positive signal from hedge funds. Our data shows that hedge funds bought about 462,400 shares of the company in the last quarter. The stock also enjoys bullish Blogger sentiment and Positive News Sentiment on TipRanks.

The company’s upcoming release of the game GTA VI is expected to have a positive impact on its financial performance. Last week, Jefferies analyst Andrew Uerkwitz raised the price target on Take-Two Interactive to $195 from $165 while maintaining a Buy rating.

Is Take-Two a Buy or Sell?

TTWO stock has a Strong Buy consensus rating on TipRanks. This is based on 16 Buy and two Hold recommendations. The average price target of $169.89 implies 5.12% upside potential from current levels. The stock has gained about 55.2% so far in 2023.

McKesson

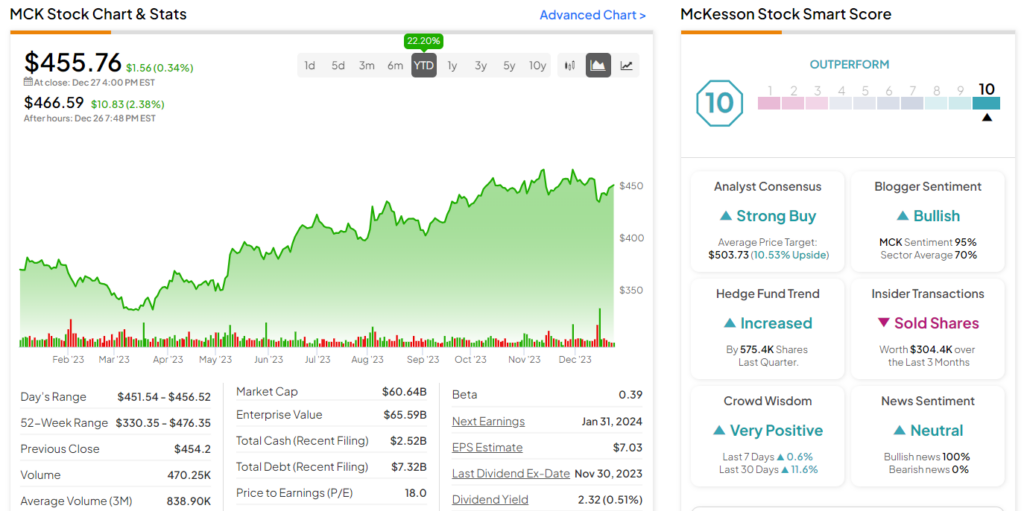

McKesson distributes pharmaceuticals and provides health information technology, medical supplies, and care management tools. This stock was added to the “Perfect 10” list yesterday.

Our data shows hedge funds are currently bullish on McKesson stock as they bought 575,400 shares of the company last quarter. The stock also exhibits Bullish bloggers’ sentiment and a Positive News Sentiment.

The company’s strong U.S. distribution network helps ensure consistent growth. Furthermore, the rising demand for GLP-1 medications has the potential to propel MCK stock higher in the near term.

Earlier this month, Citi analyst Daniel Grosslight raised the price target on MCK stock to $530 from $525 and reiterated a Buy rating.

Is MCK a Good Stock to Buy?

McKesson stock has a Strong Buy consensus rating on TipRanks, based on nine Buy and two Hold recommendations. The average price target of $503.73 implies 10.5% upside potential from current levels. The stock has witnessed a 22.2% year-to-date rally.

Ending Thoughts

Investors seeking stocks with upside potential might want to consider TTWO and MCK. Their perfect 10 Smart Scores on TipRanks, positive sentiments from hedge funds, and bullish analyst sentiment indicate the possibility of outperformance compared to the broader market. It’s worth noting that investors can use TipRanks’ Experts Center tool to discover top stock picks as well.