TSMC, or Taiwan Semiconductor Manufacturing Company (NYSE:TSM), will announce its second quarter financials on July 20. However, the continued weakness in demand and lower utilization suggest that the world’s largest chip maker’s earnings could once again plunge.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

TSMC – Q2 Expectations

Based on TSMC monthly sales data, the company’s Q2 revenue came to around $15.8 billion, said Mehdi Hosseini of Susquehanna in a note to investors dated July 14. This is above the midpoint of the management’s guidance range of $15.2 billion to $16 billion. Moreover, it also compares favorably to the analysts’ consensus estimate of $15.44 billion.

However, Q2 revenues are expected to decline year-over-year and sequentially, reflecting soft end-market demand amid weak macroeconomic conditions.

A decline in sales, a lower capacity utilization rate, and higher electricity costs in Taiwan will likely weigh on its margins and, in turn, its bottom line. Analysts expect TSMC to post earnings of $1.07 a share in Q2, much lower than the EPS of $1.53 in the prior-year quarter. Further, the consensus estimate indicates a sequential decline in its earnings. In the previous quarter, TSMC delivered earnings of $1.31 per ADR (American Depositary Receipt).

Analysts Weigh In

On July 10, Mizuho Securities analyst Kevin Wang said that sentiments on TSMC stock remain “very muted to mixed” ahead of Q2 earnings due to the weaker consumer end market demand, primarily in PCs and smartphones, which is “outweighing” the near-term demand from Nvidia (NASDAQ:NVDA) for GPUs.

However, the analyst sees TSMC as a compelling long-term play due to its low valuation and an expected rebound in sales growth in 2024, reflecting solid demand for AI (Artificial Intelligence) GPUs, a recovery in demand, and higher pricing.

Echoing similar sentiments, Hosseini said that despite near-term pressure on revenues, he maintains a bullish outlook on the stock due to the low valuation and new product ramp-up. Moreover, the analyst expects gross margins to bottom out soon while earnings will recover.

Is TSM a Buy or a Sell?

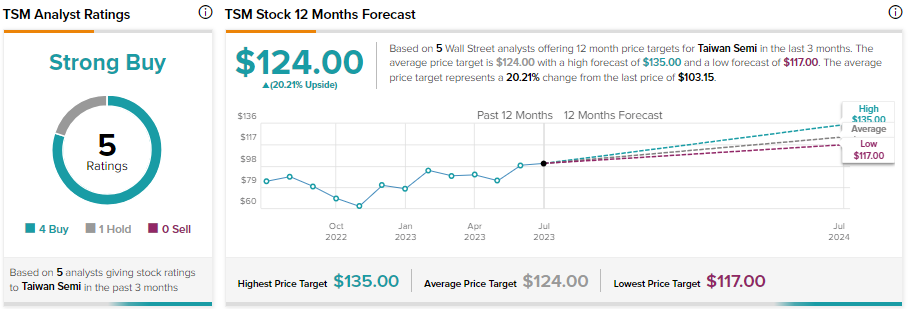

Wall Street is bullish about TSM stock ahead of the Q2 print. The AI opportunity, expected rebound in sales, cost savings measures, and low valuation keep analysts optimistic about its prospects despite short-term demand weakness.

TSM stock has received four Buy and one Hold recommendations for a Strong Buy consensus rating. Analysts’ average price target of $124 implies 20.21% upside potential from current levels.