In this piece, I evaluated two EV stocks, Tesla (TSLA) and Rivian Automotive (RIVN), using TipRanks’ Comparison Tool to see which is better. A closer look suggests a bullish view of Tesla and a neutral view of Rivian.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Known for the Roadster, Model S, Model E, and now the Cybertruck, Tesla manufactures and sells all-electric vehicles, solar energy systems, and energy storage products. The company also operates a network of Supercharger stations. Meanwhile, Rivian is known for the R1S, an all-electric, mid-size SUV, and the mid-size, light-duty R1T pickup truck.

Shares of Tesla have plunged 20% year-to-date and are down 18% in the past year. Rivian Automotive stock has plummeted 37% year-to-date and is down 34% in the past 12 months.

Tesla’s and Rivian’s declines are indicative of the broader market for EV stocks, most of which have declined dramatically amid concerns about potentially weakening demand for EVs.

Rivian is not profitable, so we’ll compare the companies’ price-to-sales (P/S) ratios to gauge their valuations against each other. We’ll also look at Tesla’s price-to-earnings (P/E) ratio for additional information.

Tesla (NASDAQ:TSLA)

At a P/E of 54.1x, Tesla is trading toward the lower end of its typical range, which has fluctuated between 39x and 83x since May 2022. The higher forward P/E of 68.4x suggests analysts expect the company’s earnings to decline, in line with expectations of lower sales more broadly for EVs. However, a bullish view seems appropriate in light of the other factors explained below.

At a P/S of 6.8x, the profitable Tesla is trading at a significant premium to the unprofitable Rivian, which is absolutely warranted. On a P/S basis, Tesla is trading toward the bottom of its range (again, this range goes back to May 2022) of about 4.8x to 13x.

Importantly, Tesla isn’t just an EV stock. It also sells solar panel systems and energy storage, both areas where it gets little to no recognition. Tesla’s second-quarter earnings results showed a record 9.4 GWh of energy-storage deployment during the quarter. Further, Energy Generation and Storage revenue doubled from $1.5 billion a year ago to $3 billion in the latest quarter.

While Automotive revenue dwarfed energy generation and storage, it did decline as expected, falling from $21.3 billion a year ago to $19.9 billion in the second quarter.

However, the massive growth in Energy Generation and Storage is reason enough to be bullish on Tesla stock over the long term. This is especially true when paired with the Automotive business, which remains nicely profitable despite the recent price cuts and pricing war in China. In the second quarter, Tesla had a total GAAP gross margin of 18%, roughly flat with the year-ago margin of 18.2% despite those price cuts.

Tesla also recently won a massive multi-billion-dollar contract for energy storage in California. The company will provide more than 15 GWh of Megapack to Intersect Power, further igniting growth in the Energy Storage segment.

What Is the Price Target for TSLA Stock?

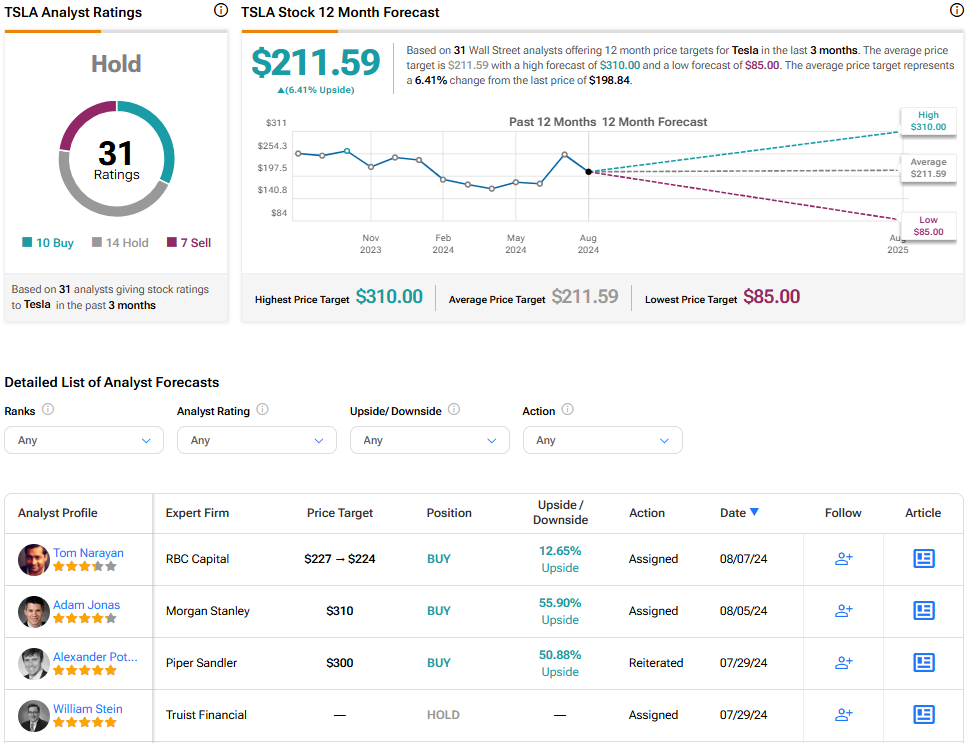

Tesla has a Hold consensus rating based on 10 Buys, 14 Holds, and seven Sell ratings assigned over the last three months. At $211.59, the average Tesla stock price target implies upside potential of 6.4%.

Rivian Automotive (NASDAQ:RIVN)

At a P/S of 2.9x, Rivian’s valuation has been sliding steadily lower since normalizing at around 9.5x in March 2023. However, the search for the next Tesla may not be over yet, as it seems too early to invest in Rivian shares. Thus, a neutral view seems appropriate — until more information gradually comes in.

Rivian shares fell after the company missed earnings estimates for the second quarter, coming in at an adjusted loss of $1.25 per share on $1.2 billion in revenue versus expectations of $1.24 per share in losses on $1.17 billion in sales.

Unfortunately, Rivian’s net losses grew during the recent quarter, rising to $1.5 billion, or about $32,000 to $32,700 per vehicle. However, management said on the earnings call afterward that the loss was about $6,000 less per vehicle, showing that the company is making progress.

In its letter to investors, Rivian management said it expects “a modest gross profit” in the fourth quarter. The company also reiterated its full-year guidance of producing 57,000 EVs, although that’s a slight decline from last year’s result of 57,232 vehicles.

There’s no denying that this latest earnings report was mixed, so it may contain some causes for concern. For example, while the vehicle-production guidance may end up being conservative, just the fact that management is guiding for fewer vehicles than last year bears watching. The widening losses also bear monitoring.

Additionally, while an outlook of a gross profit toward the end of the year is good news, Rivian is still miles away from GAAP (generally accepted accounting principles) profitability. In late June, Rivian’s finance chief, Claire McDonough, said Rivian’s lower-cost, second-generation EVs will help push the firm toward profitability. She made the comments following a factory overhaul and vehicle redesign that aims to slash the cost of materials for those vehicles by 45%.

While the company has launched those second-generation EVs, it’s just too early to say how successful they will be and whether those expectations will come to fruition. Over the long term, though, McDonough said the company expects a gross margin of 25% with an adjusted core profit margin in the high teens.

As such, there’s no guarantee yet that Rivian’s vehicles will be able to stand up to Tesla’s. Tesla’s Cybertruck became the best-selling electric truck in the U.S. during the second quarter, beating Rivian’s R1T pickup.

What Is the Price Target for RIVN Stock?

Rivian Automotive has a Moderate Buy consensus rating based on 12 Buys, eight Holds, and two Sell ratings assigned over the last three months. At $18, the average Rivian stock price target implies upside potential of 22.3%.

Conclusion: Bullish on TSLA, Neutral on RIVN

While Rivian is making progress toward profitability, there’s no guarantee that it will be the next Tesla. However, the fact that it’s following a similar game plan of rolling out its more expensive vehicles first, followed by less expensive models designed to improve profitability, is promising.

Nonetheless, Tesla remains the stalwart automaker in the EV space and, thus, a much safer investment, especially at current valuations. Rivian may receive a bullish view at some point, but it feels a bit too early to invest at its current valuation. I’d like to see lower multiples before becoming more constructive on the shares.