Macro pressures, high interest rates, and growing competition are expected to weigh on the near-term performance of electric vehicle (EV) makers. That said, the long-term growth potential for the EV market remains attractive due to increased adoption across the globe, supported by the growing focus on clean energy and government incentives. Using TipRanks’ Stock Comparison Tool, we placed Tesla (NASDAQ:TSLA), Li Auto (NASDAQ:LI), and Ford (NYSE:F) against each other to find the most compelling EV stock, as per Wall Street analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tesla (NASDAQ:TSLA)

Shares of Elon Musk-led Tesla have pulled back 10% over the past month but are still up 94% year-to-date. While Tesla bulls remain confident about the EV maker’s technology and ability to grab further market share, other analysts are worried about the impact of price cuts and the growing competition on Tesla’s profitability.

Last week, Wedbush analyst Daniel Ives reiterated a Buy rating on TSLA with a price target of $350. Ives listed various factors that add to Tesla’s “golden EV success story,” including the company’s recently announced supercharger network deals, energy business, artificial intelligence (AI)-driven autonomous path, unmatched battery ecosystem, and increased production scale.

Further, the analyst expects Tesla’s supercharger business to roughly account for 3% to 6% of overall revenue, representing a $10 billion to $20 billion business by 2030. Overall, Ives believes that Tesla is in a “prime position” to further leverage the ongoing EV transformation, given that demand is holding up globally despite steep price cuts on the company’s models.

In contrast, Bank of America analyst John Murphy thinks that the magnitude of the month-over-month decline in Tesla’s July deliveries in China indicates that the price cuts implemented in late 2022 may have pulled forward demand rather than driving additional volumes. Murphy reiterated a Hold rating on TSLA with a price target of $300 on August 8.

Is Tesla a Good Stock to Buy Now?

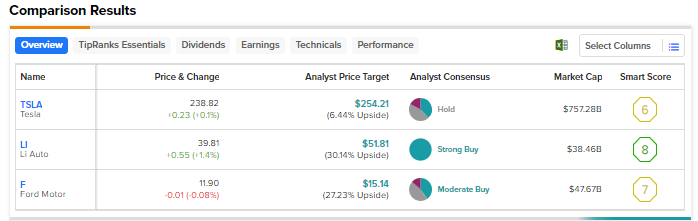

Overall, with 11 Buys, 13 Holds, and five Sells, Wall Street has a Hold consensus rating on Tesla stock. The average price target of $254.21 implies 6.4% upside potential.

Li Auto (NASDAQ:LI)

Chinese EV maker Li Auto posted stellar second-quarter results, with revenue rising nearly 228% year-over-year. The company swung to an adjusted net income of RMB 2.7 billion from an adjusted net loss of RMB 183.4 million in the prior-year quarter. However, investors seemed unhappy with the company’s third-quarter guidance. Li Auto expects Q3 2023 year-over-year revenue growth in the range of 246% to 256.4%.

On August 16, Bank of America analyst Ming Hsun Lee reiterated a Buy rating on Li Auto and raised the price target to $60 from $56, citing the continued expansion of the company’s product catalog. Li currently offers three extended-range electric vehicle (EREV) models (L7, L8, and L9) and expects its fourth EREV model L6 to contribute to the top line as soon as Q2 or Q3 2024.

Additionally, the company has expressed its intention to launch its inaugural battery electric vehicle (BEV) model Mega in Q4 2024, with deliveries scheduled for Q1 2024. It has also laid out plans for the introduction of three more BEV models, slated for delivery in the second half of 2024.

Keeping in view the full product line-up, Lee raised his 2023, 2024, and 2025 sales volume estimates by 1%, 5%, and 23%, respectively, to 355k, 600k, and 900k units. Accordingly, he also raised his 2023, 2024, and 2025 earnings estimates by 1%, 6%, and 13% respectively.

Commenting on the supply chain issues faced by Li Auto, Lee said, “Going forward, Li will focus more on management and communication with the supply chain and believes that suppliers will be more convinced and supportive as its volume grows further.”

Is LI Stock a Good Investment?

Wall Street’s Strong Buy consensus rating on Li Auto stock is based on nine unanimous Buys. The average price target of $51.81 suggests about 30.1% upside. Shares have risen 95% since the start of this year.

Ford Motor (NYSE:F)

Legacy automaker Ford reported upbeat results for the second quarter of 2023. The company’s adjusted EPS increased about 6% year-over-year to $0.72, with revenue rising 12% to $45 billion. The company also raised its full-year earnings guidance.

Nonetheless, investors were concerned about the performance of Ford’s “Model e” EV division. While the company’s traditional business unit, Ford Blue, and commercial business, Ford Pro, generated Q2 earnings of $2.31 billion and $2.39 billion, respectively, the “Model e” division posted a loss of $1.08 billion in Q2 2023.

Further, Ford CFO John Lawler said that EV adoption is taking at a slower pace than anticipated. The company now projects the loss for EV business to widen to $4.5 billion this year compared to $3 billion in the prior-year quarter, citing the pricing backdrop, investments in new products and capacity, and other costs.

On August 8, Tigress Financial analyst Ivan Feinseth reiterated a Buy rating on Ford with a price target of $22. Feinseth noted that robust performance from Ford Pro and Ford Blue continues to drive revenue and cash flow, enabling the funding of the company’s aggressive electrification initiatives.

Feinseth expects Ford to continue to benefit from its leading position in full-size pickup trucks and SUVs, the ongoing execution of its long-term EV production and battery technology development plans, and the introduction of new EV models.

Is Ford Stock a Buy or Hold?

Wall Street’s Moderate Buy consensus rating on Ford stock is based on six Buys, seven Holds, and two Sells. At $15.14, the average price target implies 27.2% upside. Shares have risen 2.3% year-to-date.

Conclusion

Wall Street is highly bullish on Li Auto, cautiously optimistic about Ford, and sidelined on Tesla. Analysts see solid upside potential in Li Auto stock from current levels, backed by its continued innovation, solid execution, and the ability to grab further market share in the Chinese EV market.