Is it time to place a trade with The Trade Desk (NASDAQ:TTD) stock? The Trade Desk’s quarterly results suggest that it’s a great time to take action, as the share price fell quickly. My contrarian instincts are telling me that there’s a major opportunity here, and I am cautiously bullish on TTD stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Based in California, The Trade Desk offers a cloud-based platform that helps users manage digital advertising campaigns. Of course, The Trade Desk uses artificial intelligence (AI) since that’s practically required for technology companies in 2023.

TTD stock has a choppy chart and isn’t appropriate for volatility-averse investors. On the other hand, if you like to buy the dip in software stocks and can appreciate good financial results, today, you have a chance to conduct your due diligence on The Trade Desk.

Trade Desk Stock Was “De-Risked,” Or Was It Really?

As we’ll discuss in a moment, analysts are generally bullish on TTD. In fact, one analyst recently upgraded The Trade Desk’s rating, but maybe that upgrade was ill-timed.

Specifically, New Street analysts upgraded TTD stock from Sell to Neutral last week. According to TheFly, the New Street analysts feel that TTD shares have already been “de-risked” due to cautious commentary on brand advertising spending by Snap (NYSE:SNAP), Meta Platforms (NASDAQ:META), and Amazon (NASDAQ:AMZN), and also due to macro-level concerns and spending pauses prompted by Middle East conflict.

Those are fair points, no doubt, but New Street’s upgrade wasn’t enough to prevent a Q3 earnings disaster for Trade Desk stock, which is currently down ~17% today and was down more earlier. Evidently, Trade Desk shares weren’t “de-risked” enough to convince today’s traders to buy TTD stock.

You might be surprised, however, to discover how good The Trade Desk’s actual quarterly results were. On the other hand, investors want more than just adequate historical results nowadays; they also demand highly optimistic forward guidance.

Traders React Badly Despite TTD’s Earnings Beat

Here’s the rundown for 2023’s third quarter. The Trade Desk reported $493 million in GAAP revenue, up 25% year-over-year and ahead of the $487 million that Wall Street had expected. Turning to the bottom line, The Trade Desk posted adjusted earnings of $0.33 per share, beating the consensus estimate of $0.29 per share.

Those are the headline figures, but there are other highlights for Trade Desk’s quarter. For one thing, The Trade Desk’s customer retention rate remained over 95% in Q3 2023. Impressively, the company has maintained customer retention of 95% or more for nine consecutive years.

In addition, The Trade Desk repurchased $90 million worth of common shares during the third quarter. With that, as of September 30, 2023, The Trade Desk had $273 million available and authorized for further buybacks. So, if you’re a fan of companies that buy back their own stock, you might like TTD.

All of this sounds pretty good, right? However, The Trade Desk published current-quarter revenue guidance of “at least $580 million.” In contrast, the Wall Street consensus estimate was around $610 million.

Now, hold on a minute. “At least $580 million” could include $610, couldn’t it? Besides, even if Trade Desk only achieves $580 million in current-quarter sales, that would still represent a solid improvement over the $493 million generated during the third quarter and an 18% year-over-year growth rate.

Is TTD Stock a Buy, According to Analysts?

On TipRanks, TTD comes in as a Strong Buy based on 18 Buys and one Hold rating assigned by analysts in the past three months. The average TTD stock price target is $81.71, implying 27.6% upside potential.

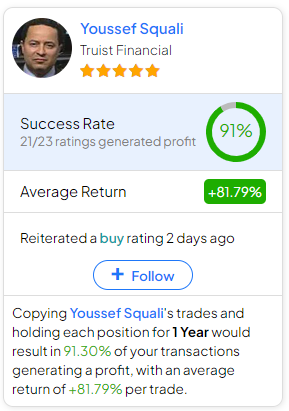

If you’re wondering which analyst you should follow if you want to buy and sell TTD stock, the most profitable analyst covering the stock (on a one-year timeframe) is Youssef Squali of Truist Financial, with an average return of 81.8% per rating and a 91% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Trade Desk Stock?

Short-term investors can be overreactive and downright irrational sometimes. Yet, that’s how buyable dips occur. Your task is to decide whether the dip in TTD stock is worth buying.

Frankly, The Trade Desk’s revenue guidance wasn’t too shocking, and it implies quarter-over-quarter and year-over-year sales growth. Moreover, Trade Desk shares might actually be “de-risked” now, as they’re trading at a substantial discount. Therefore, if you can handle the volatility, I’d say that TTD stock is worth considering now.