Privately held Juul Labs Inc. dominates the U.S. e-cigarette market. Other prominent players in the industry include Turning Point Brands, Inc. (NYSE:TPB) and Philips Morris International Inc. (NYSE:PM). Considering the increasing use of electronic cigarettes and other vaping products by youngsters, U.S. regulators are stepping forward to limit the damage these products can have on their health.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On Tuesday, Juul Labs agreed to pay $438.5 million as compensation to settle probes against allegations of promoting e-cigarettes among American youth. The company is accused of using advertisements and fruity flavors to lure young people.

In this matter, the Attorney General of Connecticut and a Democrat, William Tong, said, “Juul’s cynically calculated advertising campaigns created a new generation of nicotine addicts.”

Along with other marketing activities, the company has been directed to stop featuring people with less than 35 years of age in its advertisements. Also, it has been barred from selling its branded products to schoolchildren in more than 30 states in the United States.

The abovementioned settlement payment and the imposition of various restrictions would impact Juul Labs. Notably, this event could mean more business for other e-cigarette makers or act as an example for others to use due diligence while promoting their products.

A pictorial representation of Turning Point and Philips Morris, the two publicly traded e-cigarette stocks, is provided below.

Turning Point Brands, Inc. (NYSE:TPB)

The $409.9-million company primarily makes and distributes tobacco products. It also markets e-cigarettes and other vaping products like vaporizers and e-liquids through its NewGen products segment. This segment also works on the development of alternative vaping products.

In the second quarter of 2022, revenues for the NewGen products segment declined 45.1% year-over-year as its operations were hurt by the tightening regulatory environment.

According to TipRanks’ Risk Analysis tool, the company is exposed to 10 risks from the Legal & Regulatory category and seven risks from the Ability to Sell category. The total number of risks identified for the stock is 46.

Is TPB Stock a Buy?

If analysts and bloggers tracked by TipRanks are to be believed, Turning Point stock could be an attractive investment option for prospective investors, despite the company’s heavy risk profile.

Analysts are unanimously optimistic about the growth prospects of Turning Points and have a Strong Buy consensus rating based on four Buys. The average TPB stock price target of $39.25 represents 70.8% upside potential from the current level.

Also, financial bloggers are 100% Bullish on TPB stock versus the sector average of 65%.

Philips Morris International Inc. (NYSE:PM)

The company is popular for its tobacco, cigarettes, and smoke-free and nicotine-based products. This $145.9-billion company also manufactures electronic devices for the users of its products.

Is PM Stock a Buy or Sell?

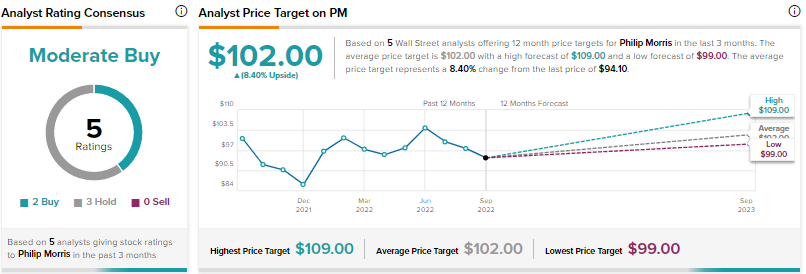

On TipRanks, the company has a Moderate Buy consensus rating based on two Buys and three Holds. Financial bloggers are 87% Bullish on the stock versus the sector average of 65%. It appears that both analysts and bloggers are cautious but optimistic about the stock. For prospective investors, a wait-and-watch approach could be a nice idea for now.

PM stock’s average price target of $102 reflects a mere 8.4% upside potential from the current level.

Further, the company is exposed to 26 risks, of which six are related to the Legal & regulatory category and four risks fall under the Ability to Sell category.

Concluding Remarks

In March 2022, the Federal Trade Commission (FTC) noted that the sales of e-cigarettes surged to $2.06 billion in 2018 from just $304.2 million in 2015. The federal agency noted that the sale of these products was very high amongst youngsters.

Back then, the Director of the FTC’s Bureau of Consumer Protection, Samuel Levine, said, “…this increase coincided with dramatic spikes in the market share of flavored products, higher concentrations of nicotine, and an industry attempt to evade a ban on free sampling.”

As of now, it appears that regulatory restrictions on e-cigarette and vaping product manufacturers are likely to increase so that these companies could be prevented from targeting the young generation as potential customers.

Read full Disclosure