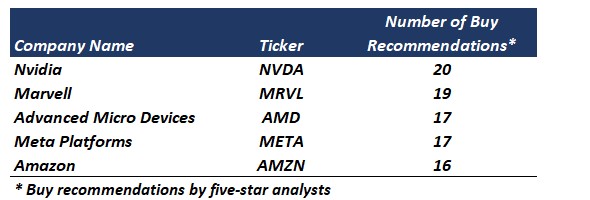

It won’t be wrong to call 2022 a bad year for equity investors. The slump in the prices of several top stocks eroded investors’ wealth. However, this decline has also created an excellent buying opportunity. With several stocks trading at a significant discount, choosing the right stock becomes difficult. Leveraging TipRanks’ Experts Center, we have zeroed in on five stocks that have received the maximum number of Buy recommendations (in the last three months) from the top Wall Street analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The data below shows that semiconductor and tech giant Nvidia (NASDAQ:NVDA) has received the maximum number of Buy ratings (20 Buys) from five-star analysts in the last three months. NVDA stock is followed by its semiconductor peers, Marvell Technology (NASDAQ:MRVL) and Advanced Micro Devices (NASDAQ:AMD).

Shares of the beaten-down social media giant Meta Platforms (NASDAQ:META) stock has received 17 Buy recommendations from five-star analysts. Meanwhile, e-commerce leader Amazon (NASDAQ:AMZN) has received 16 Buys during the same period.

Against this background, let’s examine why these five-star analysts are bullish about these stocks.

Is NVDA Stock a Buy or Sell?

The slowdown in the end market, demand uncertainty, and inventory issues weighed on NVDA stock, which is down over 52% year-to-date. However, five-star analyst Matt Ramsay of Cowen & Co. stated that NVDA’s problems are a thing of the past. Citing NVDA’s solid fundamentals and technological moats, Ramsay reiterates his buy recommendation on the stock. He raised the price target to $220 from $200, implying a 56.74% upside potential based on its closing price of $140.36 on December 28.

What’s the Prediction for MRVL Stock?

Industry-wide inventory corrections and weaker-than-expected January quarter guidance dragged MRVL stock down. This has led five-star analyst Harsh Kumar from Piper Sandler to lower his price target from $80 to $55. However, Kumar maintained his bullish stance and recommended a Buy on MRVL stock. The analyst also highlighted the strength of the U.S. cloud segment.

Is AMD a Buy, Sell, or Hold?

According to five-star analyst Chris Caso from Credit Suisse, AMD is a Buy. The analyst assumed coverage of AMD stock with a Buy recommendation and expects the company to benefit from growing market share gains in the server market and strength in the cloud market.

What Is the Price Target for Meta Stock?

Increased competition, a slowdown in ad spending amid macro headwinds, and regulatory challenges weighed on Meta Platforms’ stock. However, five-star analyst Brian White from Monness recommends a Buy on META stock with a price target of $150, implying 29.74% upside potential based on its closing price on December 28. White expects META to face challenges in the short term but expects it to benefit from the “secular digital ad trend and innovate in the metaverse” in the long term.

Is AMZN Stock a Buy or Sell?

Amazon’s stock is trading close to its 52-week low of $81.69, reflecting a slowdown in its growth and increased cost pressure. Five-star analyst Doug Anmuth from J.P. Morgan expects macro headwinds to continue to impact its consumer and cloud businesses. He maintains a buy rating on AMZN stock and expects it to benefit from the long-term shift toward online and cloud computing. Anmuth also cited AMZN’s low valuation as a reason for his bullish outlook.

Ending Thoughts

These five-star analysts have generated significant returns from their recommendations in the past and have a high success rate. Investors could follow their views to make informed investment decisions and maximize their returns.

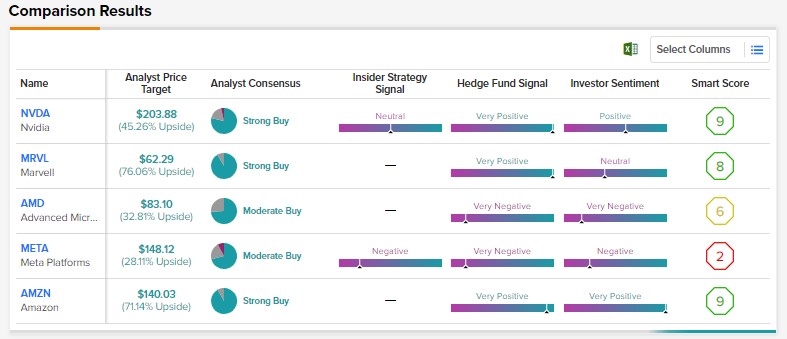

Meanwhile, using TipRanks’ stock comparison tool, let’s find out how these five stocks stack up against each other.

The tool shows that NVDA, MRVL, and AMZN have a Strong Buy consensus rating and an Outperform Smart Score on TipRanks. (Stay abreast of the best that TipRanks’ Smart Score has to offer.)

Meanwhile, AMZN stock has the highest upside potential (based on its average price target) among these five stocks.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.