In less than a week, semiconducting superstar Nvidia (NASDAQ:NVDA) is scheduled to report its earnings for its fiscal Q3 2024, and the news could be amazing. According to Wall Street forecasters, Nvidia is likely to report nearly five times more profit in fiscal Q3 2024, than it earned in last year’s fiscal Q3 2023. Investors are getting excited — up until yesterday at least, Nvidia’s stock price had enjoyed ten consecutive “up” days.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

But do you know who might be an even better semiconductors bet than Nvidia? Intel (NASDAQ:INTC) stock, that’s who.

At least, according to Japanese investment bank Mizuho & Co., that is.

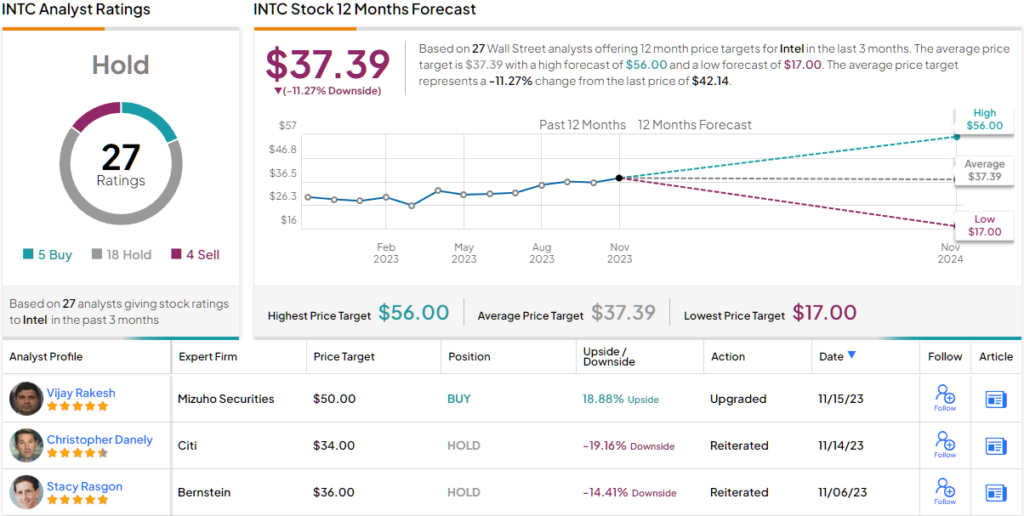

In a note just Wednesday, Mizuho’s Vijay Rakesh, a 5-star analyst rated in the top 1% of the Street’s stock pros, said he’s upgrading his rating on Intel stock to ‘buy’ and assigning the $40 stock a $50 price target that implies nearly 20% upside. What’s more, if Rakesh’s math is right, Intel could be worth even more than that – as much as $84 a share.

How does Rakesh come to this conclusion? Data centers is one reason. According to Rakesh, Intel lost its focus on data centers way back in 2021, leading to massive underperformance in the shares. But Intel’s back on track today, announcing “prolific product launches” that could result in data center chip sales alone bringing in $17.5 billion in revenue in 2024, and $19.9 billion in 2025, reversing a two-year slide in revenues from this business segment.

Rakesh also sees an “upcycle” in chips sales for personal computers. Here, too, two straight years of sales declines seem set to reverse as PC sales grow 5% in units-terms in 2024, then 9% in 2025. In the analyst’s opinion, this should yield sales of $34 billion next year, then $36.7 billion the year after that.

Rakesh also believes Intel’s moves to build a foundry business (making chips for other semiconductor companies) is ready to bear fruit. Still a sub-$1 billion business as recently as last year (and probably this year as well), the analyst believes that with 5nm chip production set to begin early next year, and 3nm production shortly thereafter, Intel’s on course to turn “Intel Foundry Services” into perhaps a $5 billion business by 2025.

Last but not least, Rakesh sees Intel “unlocking value” with its planned IPO of its Field Programmable Gate Array (FPGA) business two to three years down the road. As the No. 2 maker of FPGA chips (behind AMD but ahead of Lattice Semiconductor), Rakesh notes that Intel’s FPGA business is worth perhaps $22 billion currently, but could be worth as much as $72 billion by the time the business is IPO’ed. If he’s right about that, then this could add $17 per share in value to Intel’s share price — more than enough to lift Intel’s stock from $40 to $50 even if the analyst is wrong about everything else he wrote about!

In the final analysis, therefore, Rakesh is convinced that Intel stock is a buy at $40 a share. Granted, the stock may not look like much right now with its $171 billion market capitalization and negative earnings. But the analyst seems convinced that Intel is about to turn things around, and says the stock should sell for approximately 25 times projected 2024 earnings of $2.01 per share.

Investors who’ve suffered through Intel’s 40% plunge in share price over the last two and a half years can only hope he’s right.

The rest of the Street is less confident, however; based on 5 Buys, 18 Holds, plus 4 additional Sells, INTC stock has a Hold consensus rating. The average price target currently stands at $37.39, suggesting shares will drop ~11% over the next 12 months. (See INTC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.