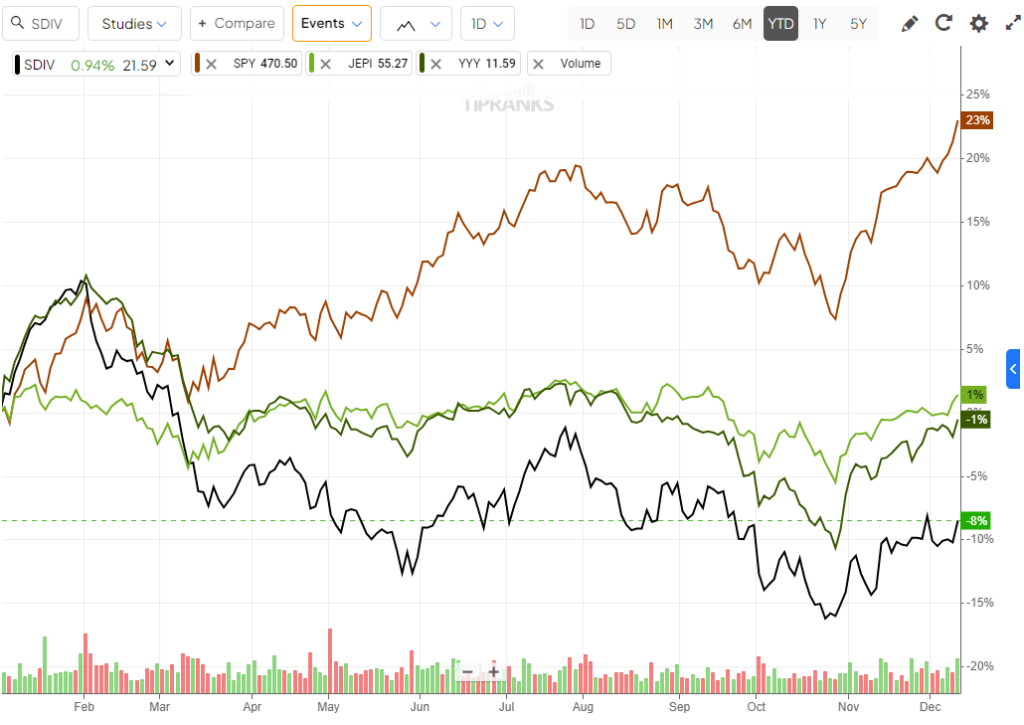

In 2023, high-yield stocks exhibited a notable underperformance relative to the broader market. This contrast is vividly apparent when examining the performance of some of the most popular high-yield ETFs in comparison to the S&P 500.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI), Amplify High Income ETF (NYSEARCA:YYY), and Global X SuperDividend ETF (NYSEARCA:SDIV) returned 1%, -1%, and -8%, respectively, year-to-date. Even if you add their impressive dividend yields of 9.1%, 12.7%, and 12.6%, all three ETFs lagged behind the S&P 500 on a total-return basis, as the popular index posted a robust 23% gain over the same period, excluding dividends.

Why Did High-Yield Stocks Underperform in 2023?

The recent underperformance of high-yield stocks can be attributed to the rapid interest rate hikes implemented by the Federal Reserve over the past year. High-yield stocks often underperform in a rising interest rate environment, as their appeal diminishes relative to alternative fixed-income investments.

More specifically, as interest rates increase, investors may opt for safer fixed-income securities that offer competitive returns with lower risk. The narrowing yield spread between high-yield stocks and bonds makes the incremental risk associated with stocks less attractive.

Another reason explaining their underperformance is that rising rates impact their discounted cash flow valuations, leading to lower present values for future cash flows. However, this phenomenon applies broadly to all equities, so I’ll emphasize the first explanation for now.

Why Are High-Yield Stocks Looking Attractive Moving Into 2024?

Moving into 2024, high-yield stocks are looking quite attractive as the anticipated reversal of the impact from previous rate hikes comes into play. After a fierce rate-hiking cycle that endured nearly two years, the Fed is expected to start cutting rates in 2024. This is a common expectation among most major banks on Wall Street.

In such a scenario, high-yield stocks will immediately become more attractive when anticipating declining interest rates. As fixed-income yields drop, the relatively higher yields from dividend-paying stocks become appealing. It’s the opposite effect of rising rates, as noted earlier.

How to Pick High-Yield Stocks for 2024

Expecting a more favorable performance next year than 2023, high-yield stocks are in the spotlight. The challenge now lies in identifying the “best” high-yield stocks for 2024. Of course, this is a highly subjective question. If you ask 100 different investors for their “Top 10 Picks,” you will get 100 different lists.

Despite its subjective nature, I’ve curated a set of criteria designed to filter through high-yield stocks, resulting in a carefully selected list of 10 exceptionally promising options.

Dividend Yield: Go for Stocks That Yield at Least 6.0%

I’ve set a baseline requirement for a stock’s dividend yield at 6%, considering it a solid mark for it to be classified as “high yield.” I believe this rate is just right for catching investors’ attention, especially when interest rates are on the decline.

Currently, the Federal Reserve’s target range for the federal funds rate is at a 22-year high of 5.25%-5.5%. If rates drop (by anywhere from 1% to 2.75%), as predicted by major Wall Street banks, any stock with a yield of 6% or more should stand out to investors looking for better returns in a landscape of shrinking bond yields.

Dividend Growth Streak: At Least Five Years

In an effort to filter out companies with temporarily inflated yields that may not accurately represent their ongoing performance, I’ve established a minimum dividend growth streak of five years. For instance, consider a company currently paying out substantial dividends due to reaching the peak cycle in its industry.

Although it presently boasts a high dividend yield, this might be short-lived as the industry normalizes. By implementing a minimum five-year dividend growth streak, we not only eliminate the likelihood of including such transient cases but also ensure that the highlighted companies prioritize rewarding shareholders, given the sustained growth in their dividends.

Leverage: A Net Debt/EBITDA Ratio No Higher Than 3.5x

In the final stage of my research, I implemented a stringent filter to ensure that the chosen high-yield stocks exhibit a net debt/EBITDA ratio not exceeding 3.5x. This presents a noteworthy challenge, as the definition of a “reasonable” net debt/EBITDA level varies from one company to another, influenced by their distinct business models. Some companies heavily leverage debt, while others do not.

Consider this filter a deliberate effort on my part to systematically screen out companies with substantial debt burdens. This approach aims to enhance the probability of these stocks maintaining their dividend growth streak, which has already endured for five years or more. I believe that the 3.5x is good enough to eliminate high-yield, high-leverage stocks that could potentially face a dividend cut, especially if they choose to incur additional debt.

Blending All The Requirements

If we blend the above criteria and apply them to every single stock in the U.S. stock market, we come out with a great list of 10 top high-yield stocks worthy of consideration for the upcoming year, 2024. Here is the full list, along with the respective metrics for each filter we applied.

| Company Name | Div Yield | Dividend Streak (Years) | Net Debt / EBITDA (Latest Quarter) |

| Verizon Communications Inc. (NYSE:VZ) | 7.06% | 19 | 3.2 |

| Altria Group Inc. (NYSE:MO) | 9.47% | 15 | 1.8 |

| Enterprise Products Partners L.P. (NYSE:EPD) | 7.64% | 7 | 3.3 |

| Pioneer Natural Resources (NYSE:PXD) | 6.32% | 6 | 0.5 |

| Devon Energy Corporation (NYSE:DVN) | 6.46% | 6 | 0.8 |

| Cheniere Energy Partners L.P. (NYSE:CQP) | 7.67% | 7 | 3.4 |

| Walgreens Boots Alliance Inc. (NYSE:WBA) | 8.35% | 48 | 2.6 |

| CNA Financial Corporation (NYSE:CNA) | 6.91% | 7 | 1.9 |

| Hess Midstream LP (NYSE:HESM) | 8.08% | 5 | 2.9 |

| Innovative Industrial Properties (NYSE:IIPR) | 8.13% | 5 | 0.8 |