Along with the markets’ recent pullback, so has Cathie Wood’s flagship Ark Innovation ETF (ARKK) handed back some of the year’s prior gains. Nevertheless, it has still outpaced the broader markets this year. And despite growing bearish macro concerns, looking at how Wood expects the landscape to shape up, the ARK Invest CEO is optimistic her innovation-first approach will continue to deliver.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

“I do think that what’s happening this year is that the market is starting to look over the Fed’s moves… into falling interest rates,” Wood recently said. “I think we’re on the other side of that massive interest rate increase, which did destroy a lot of performance. That’s the most important thing. And we are ready for prime time.”

In anticipation of that “prime time,” Wood has been busy loading up on the stocks she believes are set to outperform. Amongst them are 2 equities priced under $5 that might just be too cheap to ignore right now, so we’ve decided to give them a closer look.

In fact, it’s not only Wood who favors these names. Using the TipRanks database, we found that both are also rated as ‘Buys’ by the analyst consensus. Let’s take a closer look.

Velo3D, Inc. (VLD)

Wood is all about disruption, so it’s only natural we’ll start with a company that offers just that. Velo3D is an additive manufacturing company at the forefront of revolutionizing the metal 3D printing industry. The company specializes in the production and distribution of 3D printers, but these are not of the standard variety.

Velo3D’s industrial 3D printers are geared toward enterprises engaged in the fabrication of metal components. What sets Velo3D apart is that its printers offer engineers the capability to craft intricate, mission-critical parts utilizing an advanced, fully integrated metal additive manufacturing solution, all without compromising on design, dependability, or performance. While Velo3D’s solutions may not find much utility in household settings, they have gained traction among some of the most forward-thinking corporations, including SpaceX, Lam Research, and Honeywell.

However, despite its cutting-edge technology and impressive clientele, VLD stock has not fared well this year, showing a 35% year-to-date decline. That has come against a backdrop of the company’s CFO recently resigning to pursue other opportunities – never an investor-pleasing move – and a disappointing recent quarterly readout.

In Q2, revenue rose by 28% year-over-year to $25.13 million, yet fell short of expectations by $2.09 million. Adj. EPS of -$0.10 missed the forecast by $0.02. The company also reduced its 2023 revenue guide from between $120-$130 million to a range of $105-$115 million. The Street was looking for $122.1 million.

Nevertheless, Wood has never been shy about showing conviction, even when the chips are down. During September, through her ARKQ and ARKX ETFs, she bought 1,890,995 VLD shares. These ETFs now hold a combined total of 9,191,073 shares, currently valued at almost $10.5 million.

The company also has a fan in Lake Street analyst Troy Jensen, who sees better days ahead for this disruptor.

“We view Velo as the technology leader in metal additive manufacturing given the company’s SupportFree printing and complete stack approach with leadership in print preparation, hardware, and quality assurance (Flow, Sapphire, and Assure),” the 5-star analyst explained. “We believe Velo3D has created a significant competitive advantage in metal additive manufacturing, and we anticipate this will unlock impressive growth and broader market acceptance.”

“The company is still in the relatively early days of its evolution with a smaller revenue base, but visibility is improving, and we believe scale efficiencies are needed for Velo to reach healthy profitability levels. We believe the company’s success with SpaceX and other high-performance users has opened the door to new growth opportunities and broader market acceptance,” Jensen went on to add.

These comments form the basis for Jensen’s Buy rating, while his $2.20 price target offers one-year upside of ~94% from the current share price of $1.14. (To watch Jensen’s track record, click here)

This small-cap firm has slipped under the radar a bit, and only has 2 recent analyst reviews. They both agree, however, that it’s a stock to buy, making the Moderate Buy analyst consensus unanimous. (See VLD stock forecast)

Ginkgo Bioworks (DNA)

We’ll continue with an innovation-focused name. Founded in 2008 by a group of MIT scientists, Ginkgo Bioworks specializes in synthetic biology and genetic engineering, designing and producing custom microorganisms for a wide range of applications.

Ginkgo calls itself the ‘Organism Company’ and drawing parallels between DNA and computer code, has developed a synthetic biology platform with the aim of making cell programming as accessible as computer programming. Its platform enables the rapid and cost-effective development of biological solutions, such as producing novel enzymes, flavors, fragrances, and even biofuels, with the aim of addressing some of the world’s most pressing challenges.

Ginkgo has been in the headlines recently due to notable collaborations with some of the world’s biggest companies. This week, the company announced that it is set to develop RNA-based drug candidates with pharma giant Pfizer. That disclosure comes hot on the heels of an announcement of a five-year partnership with Google Cloud, which will allow Ginkgo to develop and use AI tools for biology and biosecurity, boosted by Google’s computing power. Ginkgo also stands to rake in $56.3 million in milestone payments over the next 3 years.

It’s probably safe to say Wood must be happy with these developments. She has substantial holdings here. Over the past 2 months via her ARKG and ARKK ETFs, she has purchased 12,742,134 shares, bringing her total holdings in these ETFs to 168,935,169 shares combined. These command a current market value of ~$300 million.

For TD Cowen analyst Steven Mah, the Google collaboration is a big selling point. He writes, “This partnership with Google will help catalyze a number of opportunities within biosecurity, which could have more near-term commercial value vs. downstream weighted drug discovery efforts. We believe investors should be assigning value to the biosecurity business which has historically been viewed as just non-dilutive cash generation related to COVID.”

“DNA now pairs unmatched data generating infrastructure with immense bandwidth (at a discount),” Mah further said. “+$56M in milestones over 3 yrs (likely attainable) largely offsets the spend on compute. We are excited by DNA’s positioning to execute in Life Sciences AI & biosecurity.”

Overall, Mah sees huge upside here. Along with an Outperform (i.e., Buy) rating, his Street-high $12 price target suggests shares, which are currently trading at $1.75, will be changing hands for a 584% premium a year from now. (To watch Mah’s track record, click here)

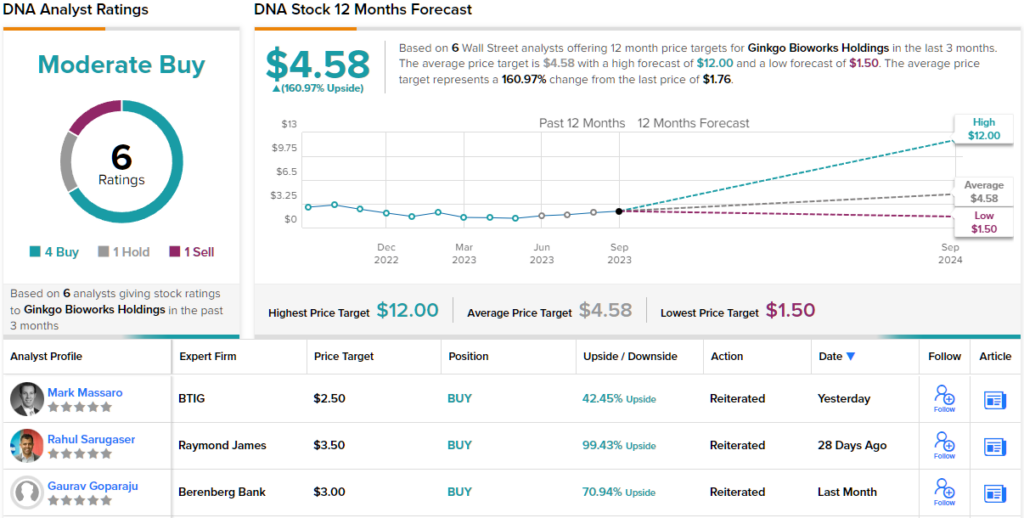

The Street’s overall take is not quite as exuberant but still offers plenty of upside; going by the $4.58 average target, the shares will deliver returns of ~161% over the coming year. Rating wise, based on 4 Buys against 1 Hold and Sell, each, the stock claims a Moderate Buy consensus rating. (See DNA stock forecast)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Penny Stocks Screener.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.