Many investors may be willing to give the big tobacco companies a second look for their huge dividend yields and resilience in difficult economic conditions. With modest valuations, tobacco stocks may very well be one of the few places to shelter from inflation and macroeconomic headwinds. However, despite the juicy dividends and modest valuation metrics, tobacco stocks will always lie in a moral no man’s land. Indeed, the ethical concerns surrounding the tobacco industry have existed for quite some time. Such “sin stock” discounts could expand further as a new generation of young investors looks to put money into markets with a greater emphasis on ESG factors.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

ESG risks aren’t the only things that could weigh down the tobacco companies over the long run. Cigarette smoking seems to be in secular decline, and firms will need to pivot accordingly to less risky next-generation products. With e-cigarettes and smoke-free products taking the place of old-fashioned cigarettes, questions linger as to how today’s top cigarette stocks will look in the distant future.

Though tobacco giants like Philip Morris (NYSE:PM) are looking to tap new growth and improve their ethical image via less-toxic products, it seems unlikely that they’ll draw in the funds of new, young investors who seek to do good with every dollar they desire to invest.

Even if ethics are of no concern when going on the hunt for investments, there are considerable risks that could result in tobacco stocks stinking up your portfolio. Federal regulators, in particular, could stand in the way of the tobacco firms as they attempt to pivot.

Due to regulatory risks, I am bearish on tobacco stocks such as Philip Morris.

Tobacco Stocks: Regulatory Risks Could Hurt the Fundamentals

Regulatory unknowns are just one thing that can make a seemingly safe investment a worrisome one. According to The Wall Street Journal, the Biden administration could look to ban menthol cigarettes. Such types of cigarettes produce a cooling sensation that’s quite popular among younger users. Just north of 40% of American smokers smoke menthol. Such a ban could have a material negative impact on the top tobacco plays.

It’s not just a potential ban on menthol cigarettes that investors should watch for; other regulatory hurdles seeking to improve public health could weigh heavily on the fundamentals. Regulatory risks may make it too cloudy (or should I say smoky) to justify making the plunge into the high-yielding cigarette companies.

Indeed, some magnitude of regulatory risks is likely baked into share prices at these levels. At writing, Philip Morris stock already trades at a modest multiple with a recession on the horizon. The stock goes for 17.1 times trailing earnings and 4.7 times sales, making it one of the most affordable low-beta (currently at 0.71) dividend stocks with a yield north of 5%.

Innovation Could Help Cigarette Firms Become Less Sinful

It’s hard to shrug off a bad reputation as a long-time sinner, especially as a corporate entity. Cigarette companies have been viewed in a negative light for many decades for their addictive and harmful effects. Undoubtedly, no amount of marketing spending or lobbying will be able to change how the public views tobacco companies. Still, tobacco firms aren’t giving up. Philip Morris is one firm taking steps to become ESG-friendlier with lower-risk product offerings.

Indeed, it’s not too far-fetched to think that Philip Morris can repair its reputation as it continues to innovate its way en route to safer products. Philip Morris seeks to become majority smoke-free by 2025. That’s significant progress.

Big investments in product offerings such as HTP (heated tobacco products) are an intriguing growth area for the firm. Such less-harmful offerings comprise nearly a third of Philip Morris’ revenues. As the mix of HTP grows, the tobacco firm may not be as sinful as it used to be.

That said, a sin stock is a sin stock, and until a tobacco firm can reduce the health risk to zero, it may not be able to win over socially-responsible investment dollars.

Is PM a Good Stock to Buy, According to Analysts?

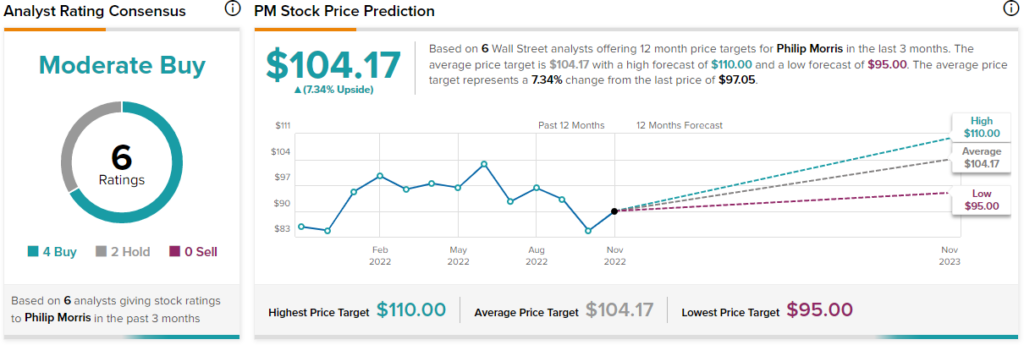

Turning to Wall Street, PM stock comes in as a Moderate Buy. Out of six analyst ratings, there are four Buys and two Holds. The average Philip Morris price target is $104.17, implying upside potential of 7.3%. Analyst price targets range from a low of $95.00 per share to a high of $110.00 per share.

The Bottom Line on Tobacco Stocks

Philip Morris may be on the right track as it looks to reduce its negative impact on society. Still, I think investors can get better value elsewhere. Regulatory risks make the tobacco stock investment story too smoky for my portfolio.