The telecom scene is home to some pretty cheap dividend payers that can help pad your quarterly passive income stream. Undoubtedly, the days of high rates may be numbered. And if they are, investors may need to return to stock markets to score yields above the 4.5% level. The good news (for prospective investors) is that today’s American telecom stocks are under significant pressure for various reasons, including macro headwinds.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

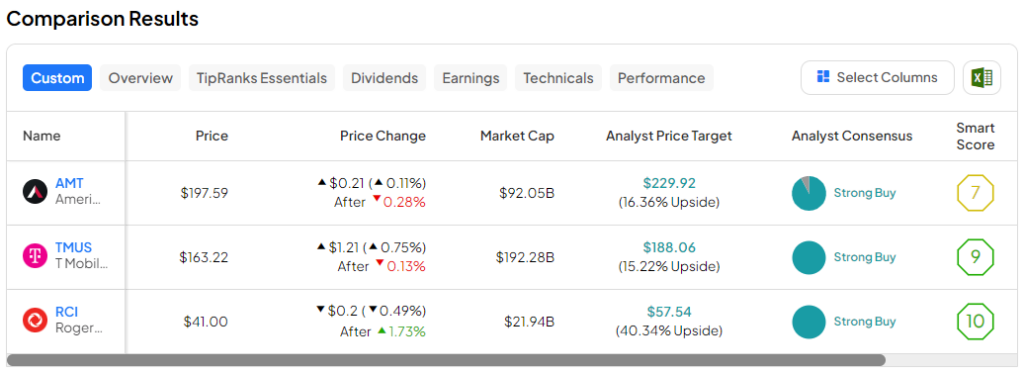

As rates fall, consumer pressures ease, and the next generation of connected devices go online, look for companies feeding the 5G (and beyond) wireless boom to find a way to gravitate higher again. Therefore, this piece will use TipRanks’ Comparison Tool to examine three Strong-Buy-rated telecom stocks that may make great value buys this season.

T-Mobile (NASDAQ:TMUS)

When it comes to telecom firms, it’s hard to name a company doing half as well as T-Mobile. The stock has risen more than 135% over the past five years, while some of its biggest legacy rivals have sunk deeper into the red. Better networks, lower prices, and perhaps buzzy promotions are key to increasing market share.

Though T-Mobile’s peers have been taking steps to catch up to the fast-running wireless king, T-Mobile is likely to continue leading the pack as it looks to expand its leading 5G wireless coverage further. Undoubtedly, T-Mobile remains the reigning king of 5G, and I don’t see anybody threatening the firm’s spot on the throne, at least not anytime in the near future.

You don’t simply boast a best-in-class 5G network overnight. It takes years, actually decades, of dedication and rampant investment. These years of wise investments have helped T-Mobile build a deep moat for itself. All things considered, I must say I share Wall Street’s enthusiasm and bullishness on the stock.

Moving ahead, T-Mobile seems to be positioning itself to offer better connectivity to cater to the next generation of (wireless) wearable devices. With recent partnerships combining the best of 5G and spatial computing (or mixed reality headsets), it’s hard not to view T-Mobile as a spatial computing enabler and one of the bigger beneficiaries of the Metaverse’s rise.

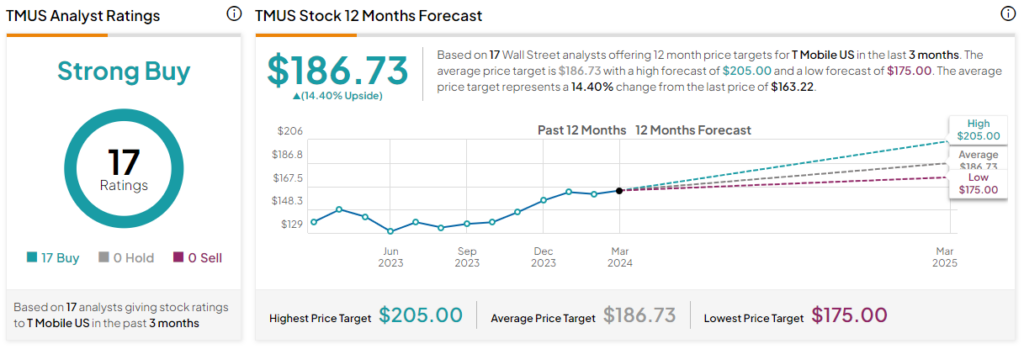

What Is the Price Target for TMUS Stock?

TMUS stock is a Strong Buy, according to analysts, with 17 unanimous Buys assigned in the past three months. The average TMUS stock price target of $186.73 implies 14.4% upside potential.

Rogers Communications (NYSE:RCI)

Rogers Communications is a Canadian telecom firm that also boasts an impressive Strong Buy rating from analysts. Unless you live in Canada, though, you’ve probably not heard of the company.

Unlike T-Mobile, which has been a winning investment over the years, Rogers Communications shares have been underperforming in recent years. Shares are down not just over the past five years but also the past 10 years. The stock is down 23.6% and 1%, respectively, over the past five and 10 years.

That’s some serious underperformance, and while the investors have collected a nice dividend (today, the forward yield sits at 3.62%), I think it’s safe to throw RCI stock into the dud category. Even when adjusting for dividends, the stock is still down nearly 10% in the past five years and up just 40% in 10 years.

However, where some see a dud dividend, others may see an opportunity to unearth some pretty deep value. Otherwise, why would most analysts have an upbeat view of the Canadian telecom company?

Perhaps the biggest reason to stick with Rogers Communications is the progress following last year’s merger with Shaw Communications, another Canadian telecom firm. The deal, which faced ample regulatory hurdles en route to completion, concentrated market power (specifically in Western Canada) in the hands of one company — a prominent concern for regulators but an opportunity for investors.

Moving ahead, analysts see synergies and strategic alignment as major pluses behind the deal. Edward Jones analyst David Heger noted that Rogers seems to be scoring cost savings faster than expected in his recent sitdown with BNN Bloomberg. In light of this, it’s hard not to be bullish on the long-time Canadian laggard of a stock that may be on the cusp of waking up.

Perhaps the savings could be passed on to customers? If not, perhaps shareholders stand to benefit most, likely in the form of fat dividend raises in the firm’s future. Either way, Rogers stock looks like a relative bargain at just 11.5 times forward price-to-earnings (P/E), well below that of TMUS, which goes for around 18 times forward P/E.

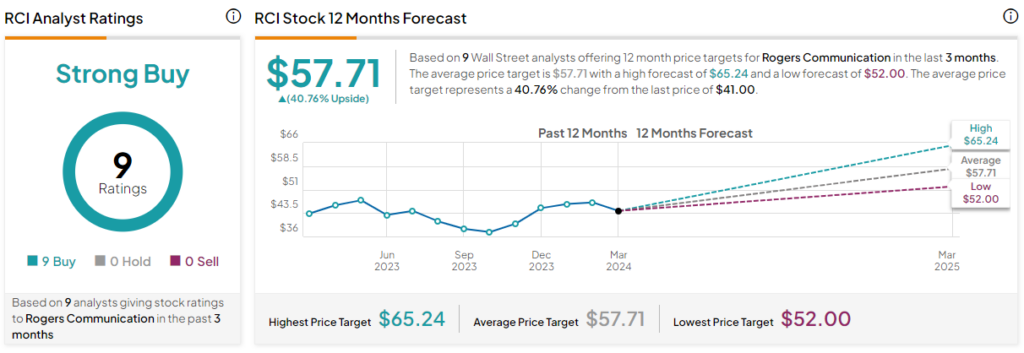

Perhaps the biggest draw to the stock, though, is the implied upside potential, which sits at more than 40% at writing.

What Is the Price Target of RCI Stock?

RCI stock is a Strong Buy, according to analysts, with nine unanimous Buys assigned in the past three months. The average RCI stock price target of $57.71 implies 40.8% upside potential.

American Tower (NYSE:AMT)

American Tower is a real estate investment trust (REIT) that leases cell towers to clients. In recent years, headwinds have caught up to the REIT, resulting in a near-47% haircut in shares from peak to trough. More recently, AMT shares have been back on the ascent, thanks to lower-rate hopes, a quarterly result that saw a mild top-line beat (Q4-2023 sales of $2.79 billion vs. $2.74 billion estimate), and upbeat guidance for the year ahead.

Undoubtedly, with such a low bar and a more upbeat tone for 2024, it’s hard not to be bullish on the REIT as it looks to add to its newfound momentum that brought shares up more than 20% off last year’s lows.

For the year ahead, American Tower seems ready to cash in on the growth in data centers. Given the profound rise of generative AI on the cloud (and its potential in edge computing), the data center seems like the place to be. As the company’s prior acquisition of data center play CoreSite pays off, the stage may very well be set for an epic comeback for an unappreciated cell tower REIT that’s about to wake up again.

At writing, shares trade at 26.7 times forward P/E, making it a tad pricier than the other two telecom plays in this piece. Regardless, I do find the 3.32%-yielder to be a long-term winner as it taps into the data center to jolt growth and diversify its business further.

What Is the Price Target for AMT?

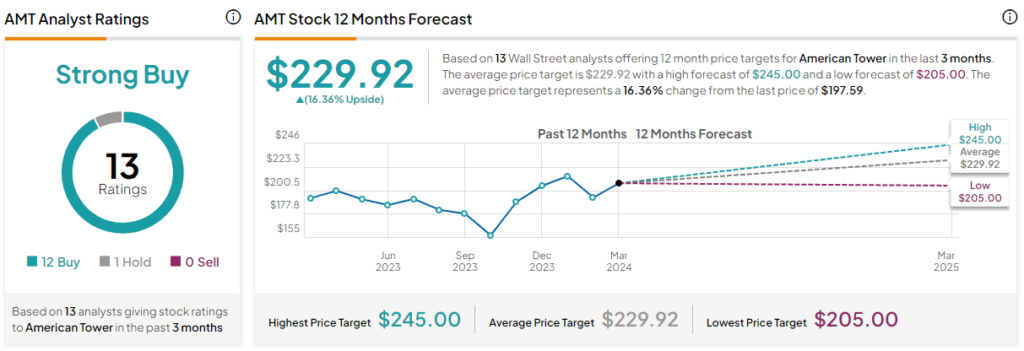

AMT stock is a Strong Buy, according to analysts, with 12 Buys and one Hold assigned in the past three months. The average AMT stock price target of $229.92 implies 16.4% upside potential.

The Bottom Line

The telecom scene seems rich with opportunities for value-conscious investors who like dividends or distributions. While I’m a big fan of all three, I’m most enticed by RCI stock, as Wall Street sees the most gains (~40%) over the year ahead. Based on its P/E, it’s also the cheapest of the trio.