The key to successful stock investing is simple to articulate, and more difficult to put into practice. It’s stock picking, just choosing the right shares that will bring profitable returns down the line. It doesn’t matter if you’re Joe Public, the retail investor, or a billionaire Wall Street legend; if you don’t fill up your portfolio with the right stocks, you won’t make any money.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While the Wall Street legends have made it their life’s work to know the ins and outs of the markets and to apply that knowledge to their own investing, the rest of us haven’t got that luxury. We need a tool to help us make sense of the market data.

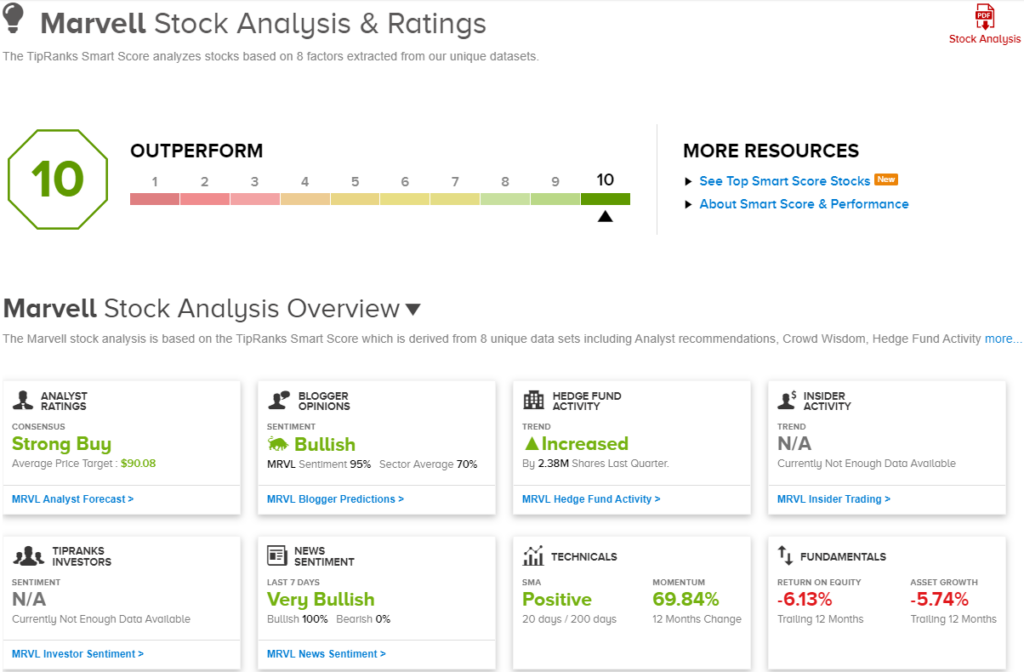

That’s where TipRanks’ Smart Score comes in. This data collection and collation tool is based on an AI- and natural language-powered algorithm and is designed to gather voluminous data from the markets and distill it into a simple rating for every stock. The Score is given on a scale of 1 to 10 and is based on a set of factors that have been proven to predict future outperformance. A ‘Perfect 10’ is the highest Smart Score, indicating a stock that’s worth a closer look.

So let’s do that. We’ve used the TipRanks platform to locate a pair of ‘Perfect 10’ stocks, names with the highest smart score; these two are tech stocks that also carry ‘Strong Buy’ consensus ratings and double-digit upside potentials. Here are their details, along with some analyst comments on them.

Marvell Technology (MRVL)

We’ll start in the world of silicon semiconductor chips, with Marvell Technology Group, a big player in the chip industry. Marvell, which boasts a market cap of $63 billion, is a designer and producer of semiconductor chips for data infrastructure, and its products have found application in a wide range of fields, from storage accelerators to data processing units to the automotive industry to network carriers to AI. Marvell has the right combination of deep system-level expertise and leading technology to make an impact across multiple industries.

The company’s chipsets and other products, particularly its coherent digital signal processors, are rapidly becoming indispensable on the AI scene. They offer data centers the processing speed needed by generative AI applications, and can even connect data centers that are located as far apart as 1,200 kilometers. It’s a transformative capability for data networking. The company made a splash at the OFC 2024 conference in San Diego, California at the end of March, releasing numerous optical technology products needed for optimization in the AI and data center sectors.

Turning to the financial results, Marvell reported a total of $1.43 billion at its top line in the last quarterly report, for fiscal 4Q24 (February quarter). That total was roughly flat year-over-year (up less than 1%), and came in just a hair over the estimates, beating by $10 million. The company’s quarterly bottom line, of 46 cents per share by non-GAAP measures, was also in line with the forecasts. Also in the quarterly report, Marvell announced a stock buyback program worth $3 billion. However, while the shares have performed well over the past year (up by 75%), investors were somewhat let down by a soft outlook, with Q1 adj. EPS expected to hit 0.23 +/- $0.05, some distance below consensus at $0.40.

That, though, hasn’t affected Craig-Hallum’s Christian Schwab’s positive thesis, with the analyst believing this chip maker presents a sound choice, primarily on its AI exposure going forward. Following a recent investor meeting with CEO Matt Murphy and IR Head Ashish Saran, the 5-star analyst wrote, “The meeting increased our confidence in MRVL’s: (1) strong leverage to AI growth via electro-optics and custom chips; and (2) troughing in legacy enterprise and telco segments. While the recent EPS estimate cuts (because of legacy) have lowered investor confidence, we expect upcoming AI event (April 11) to be a positive catalyst.”

To quantify his stance, the analyst gives MRVL stock a Buy rating with an $88 price target that suggests a one-year upside potential of 20%. (To watch Schwab’s track record, click here)

Overall, the Street is also very bullish here; Marvell’s Strong Buy consensus rating comes from 29 recent analyst recommendations that include 28 to Buy against a single Hold. The stock is trading for $73.20 and its $90.08 average target price implies it will gain 23% over the next year. (See Marvell’s stock forecast)

CyberArk Software (CYBR)

Now we’ll look at CyberArk, a tech firm specializing in software packages for identity security and access management. Few fields in tech are more important than this; maintaining online and general digital security is a vital interest for any company with a website, and protecting data has become an industry to itself. CyberArk’s platforms protect vital information and systems by allowing admins and webmasters to control who can enter online sites, databases, and software platforms – and further, by specifying how permitted users or entities verify their credentials and identities.

The Identity Security Platform, CyberArk’s flagship product, provides end-to-end access security to any digital resource or environment the user chooses. It can be operated from any location or any device, and can be activated by both humans and machines. The platform, and its technology, have found wide acceptance in a range of industries, including financial services, healthcare, retail, energy, and government. The common denominator is a need to maintain security for private data.

In addition to security and entry, CyberArk offers tools and platforms to secure privileged access, that is, managing accounts with varying levels of system access. Again, this is a vital niche, as corporate users will have workers with varying security needs and different levels of system access. These accounts need to be managed and monitored in order to maintain system and network security, based on individuals’ permissions. And once again, CyberArk makes this management available to admins both on-site and remotely, and from a variety of devices.

The ongoing, and increasing, need for high-end cybersecurity has provided solid support for CyberArk’s stock in recent months. The shares are up almost 21% so far this year, and up 84% for the last 12 months; this performance has strongly outpaced the gains seen on the NASDAQ over the same time.

In addition to its strong stock performance, the company has reported sound financials recently. The last quarterly report, detailing 4Q23, showed $223.1 million in total revenues, gaining almost 32% year-over-year and beating the forecast by $13.36 million. Of the total, $150.3 million in revenue came from subscription customers, up 70% year-over-year. CyberArk’s bottom line was reported as a non-GAAP EPS of 81 cents, beating the estimates by 34 cents per share.

All of this paints a picture of a company that has found its place and is exploiting a rich field of work opportunities – a picture that is set out clearly by BTIG analyst Gray Powell, who says of CyberArk, “In short, we see multiple factors (increased breach headlines, SEC regulations, cyber insurance, digital transformation) driving continued growth in the privilege account management market where CYBR holds a strong leadership position and is gaining share. In addition, the company is showing good momentum with tangential products such as EPM and Secrets Management (~20% of revenue combined). And more recently, CYBR’s access management product (~10% of revenue) has experienced elevated demand. Looking to 2024, we think Street estimates calling for 27% growth in ARR are very achievable. We think CYBR could ultimately deliver growth of 30%+ y/y, in an upside scenario.”

Powell goes on to give CYBR shares a Buy rating and a $317 price target that implies a one-year gain of 20%. (To watch Powell’s track record, click here)

There are 26 recent analyst reviews on record for CyberArk, with a 25 to 1 breakdown favoring Buys over Holds. The shares are currently priced at $264.25 and their average price target of $297.84 points toward share appreciation of 13% on the one-year horizon. (See CyberArk’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.