The S&P 500 has been reaching new highs recently. The record levels reflect positive investor sentiment on stocks, and the common wisdom would tell us that the bulls that began running in the final months of 2022 are not yet spent – and that there is still time to buy in.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

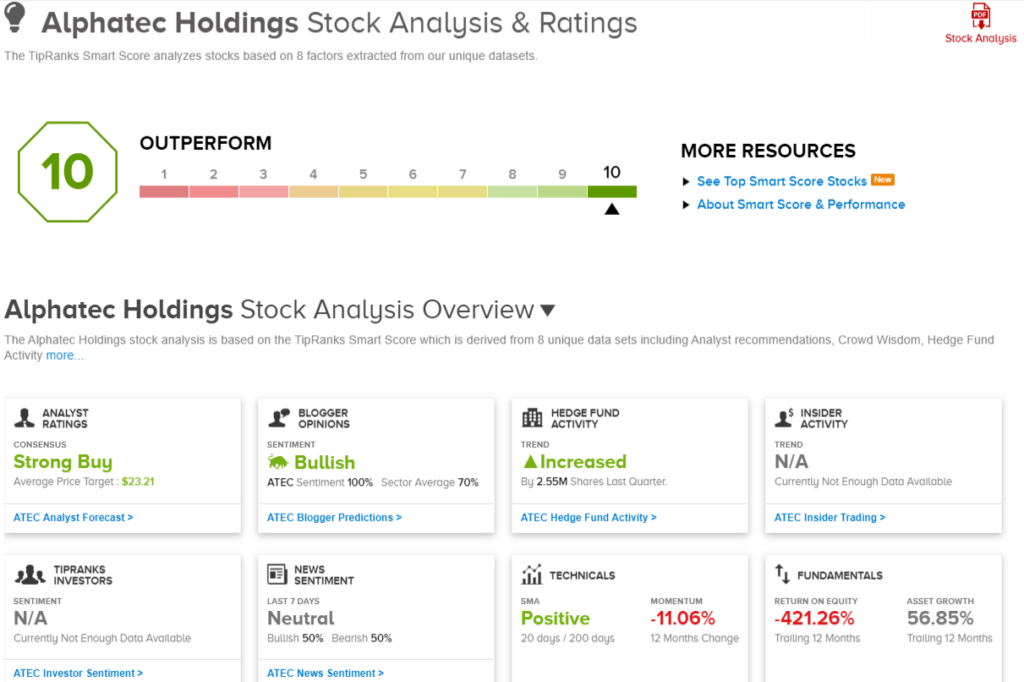

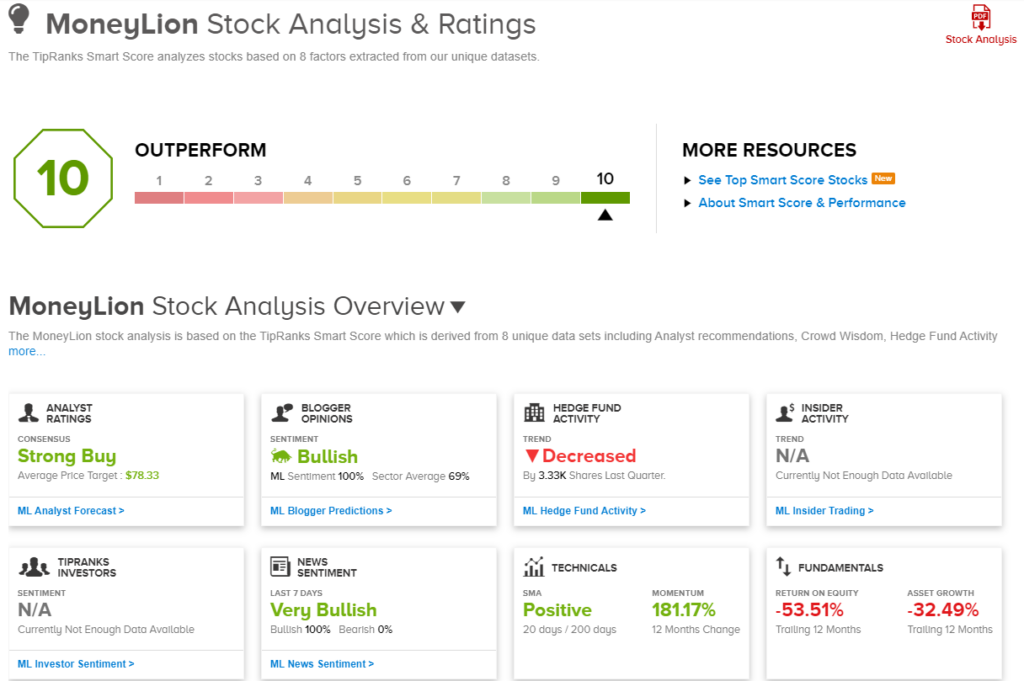

The only question is, which stocks are right to capitalize on the bullish mood? That’s where the Smart Score data tool can help. Designed by TipRanks to use a combination of natural language processing and a sophisticated AI algorithm, the Smart Score collects and collates the volumes of raw data generated on the trading floors – and turns it into a single score that can tell the average investor, at a glance, what a stock’s main chance looks like.

The Smart Score achieves this by comparing every publicly traded stock to a set of factors that have proven themselves as predictors of future outperformance – and then it gives those stocks a score, on a scale of 1 to 10. It’s a complex tool with a simple read-out, and the ‘Perfect 10’ scores indicate shares that deserve some closer scrutiny.

So let’s do that. Using the databanks at TipRanks, we’ll look at 2 high-scoring stocks, ‘Perfect 10’ shares that Wall Street’s analysts think have solid growth potential, more than enough to take advantage of a bull run. Here are the details.

Alphatec Holdings (ATEC)

We’ll start in the world of medical technology, specifically, in the area of spinal surgery. Alphatec owns technologies that have brought advances to the field, introducing multiple medical devices and techniques for spinal stabilization operations. The company’s tools and methods are specialized, with different methods used in various parts of the spine, from the neck all the way down to the pelvis. The company aims to make its products the new standard in spinal surgery.

The company saw some important highlights recently, as reported in its 4Q23 release. These included a 27% increase in training new surgeon users in 2023, for a total of 500 new users in the year, as compared to the prior year. In addition, the company expanded its lateral approach platform, by conducting the full launch of the LTP (lateral transpsoas) + Midline ALIF approaches – a new surgical methodology. Also, the company launched a new medical device, the Calibrate LTX, a lateral expandable implant. These were among 15 new products and line extensions launched during 2023.

Alphatec’s spinal surgery tools and methods are finding growing acceptance in the medical community – leading to solid financial results for the company. The same 4Q23 report showed a total of $138 million in quarterly revenue, for a 30% year-over-year gain that beat the forecast by more than $5.6 million. Full-year revenue for 2023 came to $482 million.

Medical tech has high overhead, however, and Alphatec runs a quarterly net loss. In 4Q23, that loss came to 37 cents per share, 4 cents per share deeper than in the prior-year quarter, and 11 deeper than had been expected.

Despite the net loss incurred in Q4, Canaccord Genuity analyst Caitlin Cronin remains upbeat on the company, pointing out Alphatec’s revenue gains and its growing penetration into the spinal surgery market. The analyst writes, “ATEC posted another impressive quarter to end 2023, with top-line revenues above expectations and solid strides toward its long-term operating leverage goals… 2024 should carry a similar narrative, as management expects 23% y/y growth and +560bps of adj. EBITDA expansion. Additionally, we believe ATEC is well positioned to continue to benefit from what it estimates is ~35% of the spine market recently disrupted via the mergers of Globus/ NuVasive, OrthoFix/SeaSpine, and the private buy out of ZimVie’s spine business.”

Summing up, Cronin adds an optimistic outlook going forward with this stock: “Indeed, the fundamentals here remain robust as management continues to deliver strong execution on operating leverage amidst robust productivity trends. We remain LT fundamental buyers.”

In addition to the Buy rating on ATEC shares, Cronin gives the stock a $25 price target that suggests an 86% gain on the one-year horizon. (To watch Cronin’s track record, click here)

Overall, this stock gets a Strong Buy from the Street’s analyst consensus – and it is unanimous, based on 6 positive reviews set in recent months. The shares are trading for $13.42, and their $24.20 average price target implies a one-year upside potential of 80%. (See Alphatec’s stock forecast)

MoneyLion (ML)

Next up is MoneyLion, a fintech company that operates in the world of personal banking. The company offers a combination of services, including lending, financial advisories, and investing options, on the consumer market. The company’s target customer base is the large segment of American consumers who live from paycheck to paycheck; the company aims to streamline financial options for these customers, giving them access to better money management and savings while boosting their creditworthiness.

MoneyLion offers its customers checking and savings accounts, access to personal loans, and fast access to regular paychecks. Customers can use the Instacash service to access their own funds, when needed, even in advance of payday, while the online apps make it easy to monitor accounts and use extra funds for investments. The company has over 12 million total customers, can provide more than 150 million leads in its customer data platform, and can handle more than 60 million customer inquiries per quarter.

In an important step, announced on February 6, MoneyLion entered into a partnership with the Big Four accounting firm Ernst & Young. The goal of the partnership is to make MoneyLion’s financial platform more widely available to the banking sector generally – and to accelerate growth in revenue and profits through an expanded and diversified customer acquisition strategy. Digital tech can bring enormous benefits to the banking sector, and MoneyLion is moving to turn this alliance into an engine for growth and innovation.

Turning to MoneyLion’s financials, we find a company that is showing an upward trend in revenue growth. The 3Q23 top line hit just over $110 million, a company record that was up 24% year-over-year – although it did miss the forecast by $3.13 million. MoneyLion reported a Q3 adjusted EBITDA of $13 million, also a company record.

This fintech’s sound performance caught the attention of B. Riley analyst Hal Goetsch, who is upbeat on the new EY partnership and its implication going forward. He says of the company and its initiatives, “We believe this partnership will have traction in 2024 and help drive ML platform revenues in its enterprise (B2B) segment. Late last year, ML foreshadowed that it was planning to take its marketplace and personal financial management offerings to a much broader set of banks and financial institutions to help them drive digital adoption. What we had not anticipated is that ML was planning to partner with such a significant partner as EY to launch this effort. We think the alliance is a meaningful catalyst in 2024 and beyond for ML.”

Goetsch goes on to give ML a Buy rating, with a $102 price target that points toward a robust one-year upside of 97%. (To watch Goetsch’s track record, click here)

Once again, we’re looking at a stock with a unanimous Strong Buy consensus rating; ML has 4 recent positive analyst reviews. The stock has a selling price of $51.86 right now, and its average price target, at $78.33, suggests it will appreciate by 51% in the next 12 months. (See MoneyLion stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.