We’re in the homestretch of 2023. The end of the year is in sight, a new year is coming up, and it’s a perfect time for investors to start reviewing their portfolio composition. In other words, it’s time for some stock picking.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

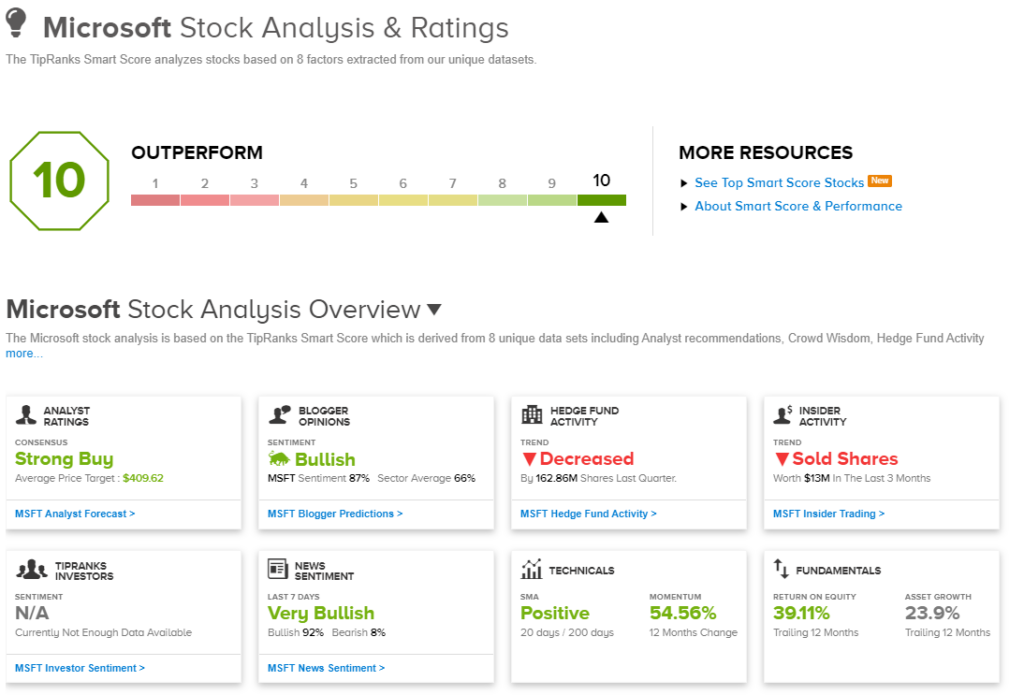

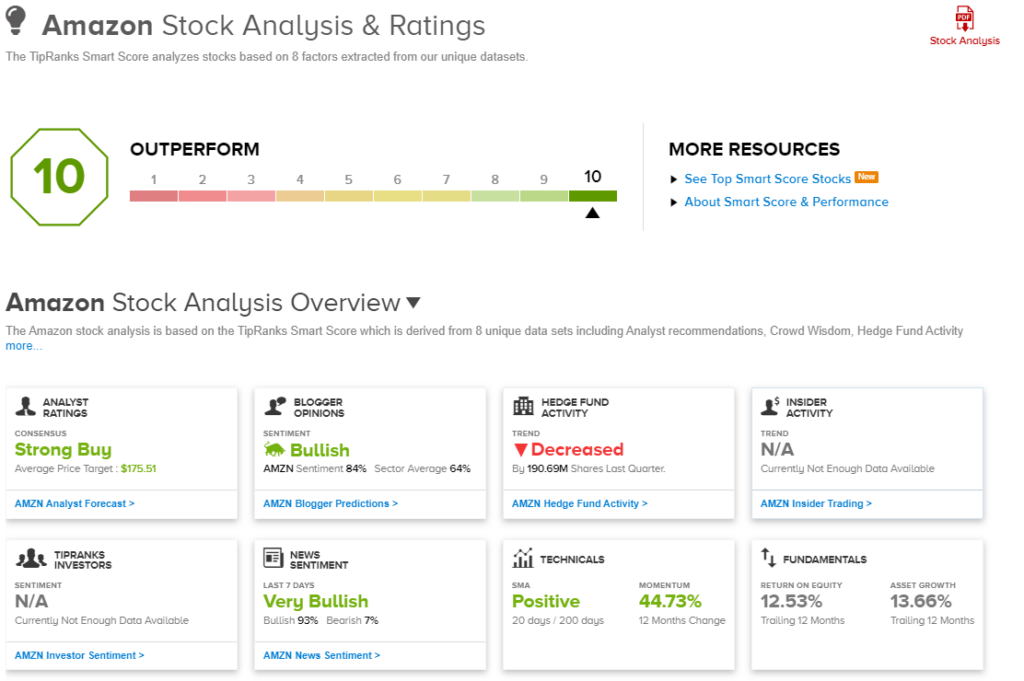

Stock picking has long been thought of as an art, but the savvy investor knows that there is also plenty of science to it. And for those willing to embrace the science, TipRanks has the Smart Score, an AI-driven data sorting tool, based on sophisticated natural language algorithms. The tool gathers the reams of data thrown up by the stock markets – the transactions, the stock movements, the traders’ moves, all of it. This data is sorted and rated according to a set of factors known to match with future share outperformance – and distills the results into a single-digit ‘Smart Score’ that points toward each stock’s likely way forward.

Recently, two blue-chip stock stalwarts have turned up on the Smart Score’s ‘Perfect 10’ list, the shares that ticked all the right marks. These are major names in Big Tech, and they have certainly earned the attention they’ve gotten. Both are among the handful of trillion-dollar-plus companies, and both have made a huge impact on the ways we live and work. Here they are, in focus, for a closer look, based on data from the TipRanks platform and the analyst commentaries.

Don’t miss

- Billionaire Steve Cohen Goes Big on These 2 ‘Strong Buy’ Stocks — Here’s Why You Should Follow

- ‘Time to Hit Buy,’ Says Bank of America About These 2 Stocks

- Oppenheimer Expects the S&P 500’s Advance to Continue Into 2024 — Here’s Why These 2 Stocks Might Be Worth Buying

Microsoft Corporation (MSFT)

We’ll start with Microsoft, the iconic computer and technology company. Microsoft is the leader in the world of PC operating systems, an instantly recognizable iconic brand, and, with its $2.75 trillion market cap, the world’s second-largest publicly traded company. The firm has been involved in personal computing for nearly 50 years and has its hands in everything from word processing software to web browsers to AI. On that last note, the company is a major investor in OpenAI, the creator of the popular ChatGPT bot; Microsoft’s investment in OpenAI over the past several years has totaled more than $13 billion.

The company can afford investments on that scale. Microsoft’s successes, its dominance of the markets in OS and office software, have pushed it to the top tier of the business world. It brought in $211.9 billion in total revenue for its last fiscal year, 2023, which ended on June 30; that total was up 7% year-over-year.

Looking forward, Microsoft is investing heavily in AI technology. The company is improving its Bing search engine, in a direct challenge to Google, using the ChatGPT bot as a generative AI brain to give Bing natural language capability. In addition, Microsoft is incorporating AI technology into both its Edge web browser and its Azure business cloud platform. The company’s Intelligent Cloud business is already a $24 billion segment.

Late last month, we saw financial results for Microsoft’s fiscal 1Q24. The release showed that the company had top-line revenues of $56.5 billion, a year-over-year gain of 13%, and beat the forecast by almost $2 billion. At the bottom line, Microsoft posted $2.99 in diluted EPS, beating the estimates by 34 cents per share and growing 27% year-over-year. Cloud computing services helped to drive these positive results; as noted, the Intelligent Cloud brought in over $24 billion of the total revenue, gaining 19% year-over-year.

Among the bulls is 5-star analyst Kirk Materne, of Evercore ISI. Materne writes, looking at Microsoft’s recent quarterly results, “While the focus now shifts to the drivers behind these results, including whether or not we are past the Azure ‘bottom’ or whether there were one-time items that resulted in the beat, we believe that the narrative gets even stronger into the rest of FY24 as some optical headwinds reverse and comps soften, and Microsoft’s position in the enterprise market continues to get stronger as customers look to consolidate spending. As we look out into CY24, we believe that AI will be a tailwind as Microsoft starts implementing its M365 Copilot monetization strategy, as will continued traction in Azure and the integration of ATVI into Microsoft’s gaming business.”

Extrapolating from the current position, Materne gives MSFT shares an Outperform (i.e. Buy) rating, with a $400 price target to point toward a one-year upside of 8%. (To watch Materne’s track record, click here)

Big tech stocks always pick up plenty of analyst attention, and Microsoft has 31 recent reviews on file. These feature a decidedly lopsided 30 to 1 Buy/Hold split, for a Strong Buy consensus rating. The stock is selling for $369.67, and its $408.76 average price target implies a 10.5% gain in the next 12 months. (See Microsoft’s stock forecast)

Amazon (AMZN)

The second stock we’ll look at is Amazon, another instantly recognizable tech name with an equally iconic brand. Not as old as Microsoft, Amazon got its start in the ‘90s as an online bookstore. The firm is a survivor of the dot-com bubble, and in the early 2000s began expanding its services from books to include essentially the whole of the online retail world. Shoppers can find almost anything they want via Amazon, which has become the world’s largest online retailer. Across all of its domains, Amazon moved a total gross merchandise value of $693 billion last year.

That’s not just big business; it’s huge – and it’s pushed Amazon into the number-four spot among Wall Street’s largest companies. The firm has a market cap of just over $1.5 trillion and had an operating cash flow of $71.7 billion for the 12 months ending this past September 30.

Amazon’s scale and success have given it a firm foundation for expanding its operations away from pure retail. The company offers its customers a vast array of online services, including online TV streaming and cloud computing, as well as audiobooks, home automation, and even groceries. The company has made use of AI tech to streamline and improve its services. The Amazon.com website is one of the internet’s most trafficked sites, with more than 2 billion visits per month.

That scope is reflected in Amazon’s public financial results. The company’s most recent quarterly release, for 3Q23, showed revenues of $143.1 billion, a total that was up 13% from the prior year and was more than $1.5 billion better than had been expected. The revenue result reflected a set of solid retail gains growth, including 11% in North America and 16% internationally. The company’s cloud services, AWS, showed a 12% retail gains growth in the quarter.

Amazon’s quarterly bottom line, a 94-cent diluted EPS, was 35 cents ahead of the estimates – and compared favorably to the prior-year quarter’s 28-cent result.

Covering Amazon for Tigress Financial, Ivan Feinseth sees the company standing to gain from its brand recognition, its scale, and its ability to leverage AI technology. The 5-star analyst writes, “Our target price, multiples, and growth rates are supported by AMZN’s strong brand equity and dominant industry position combined with its massive cash position and cash flow, enabling ongoing investments in its growth initiatives to support the integration of generative AI as a major growth driver and business optimizer combined with ongoing innovation in AWS and opportunities for massive AI integration across all business lines along with its increasing fulfillment capabilities.”

Feinseth’s target price of $210 suggests a 47% upside on the one-year horizon, and supports his Buy rating on the stock. (To watch Feinseth’s track record, click here)

Amazon is that rare beast – a stock with plenty of coverage where everyone is in agreement. It has garnered 40 analyst reviews over the past 3 months – all Buys – naturally making the consensus view here a Strong Buy. The shares have a $143.20 trading price, and a $175.51 average price target implying potential for a 22% one-year gain. (See Amazon stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.