Investing is all about finding the best returns, and that means finding the best stocks. But how can the average retail investor know which stocks are ‘right,’ and which fail to measure up? The market generates a vast amount of raw data, and it can take eons to make sense of it.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

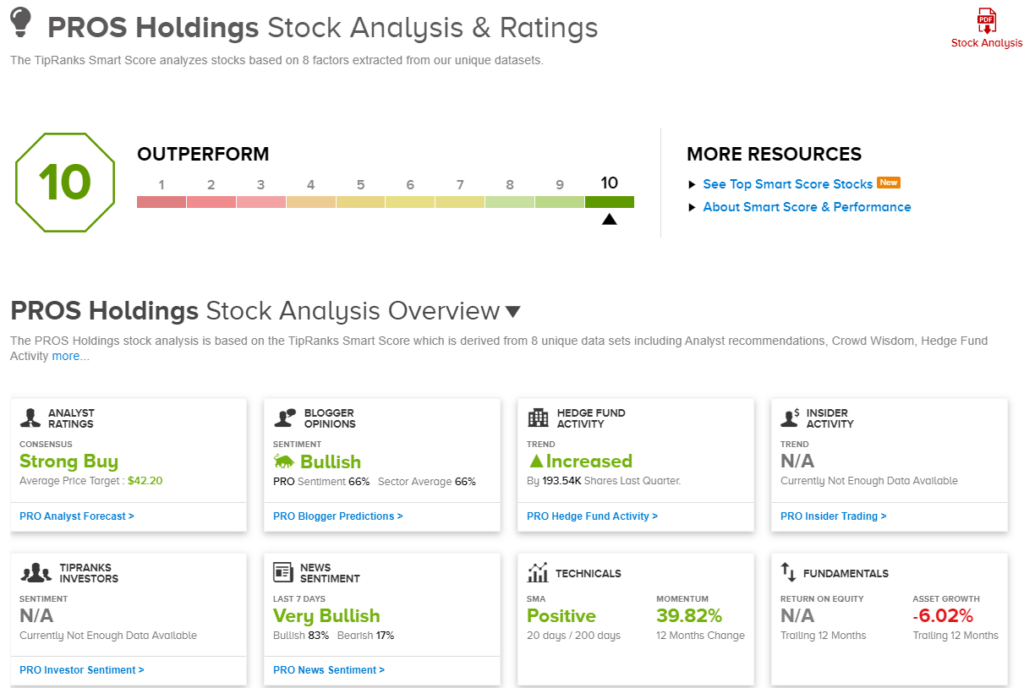

Most of us don’t have the time to do all the digging required, so we can turn to the Smart Score for some help. This is an AI-powered data sorting tool, that collects and collates the market data on thousands of stocks and millions of trades and grades every stock according to a set of factors known to correlate with future high performance. Every stock is then given a score, on a 1 to 10 scale, indicating its relative strength compared to those factors. A ‘Perfect 10’ denotes a stock that investors should definitely give a second look.

And when the Smart Score’s Perfect 10 list lines up with professional analysts’ Strong Buy ratings, that’s the clearest possible sign for investors to follow.

We’ve opened up the TipRanks database to look for just those stocks, the Perfect 10s that also have Strong Buy ratings from the Street’s stock watchers. To narrow the list a bit further, we’ll limit it to names that also delivered strong results in this year’s Q2 earnings season. Here are the details.

CECO Environmental (CECO)

We’ll start in the green economy, with CECO Environmental. This company is focused on developing new technologies for environmental air pollution control, energy, and fluid handling and filtration, and the installation of such technologies in practical settings. CECO has customers in a wide range of industrial sectors, including aerospace, automotive, brick making, cement, chemicals, fuel refining, and even such specialties as glass manufacturing and noise control.

CECO operates through a network of brands and subsidiaries, and is always looking to expand both its network and its product lines. In a recent announcement, the company revealed its latest move in that direction, with news that it had, on August 23, completed its acquisition of the water recycling and energy conservation firm Kemco. CECO also made an upward adjustment to its full-year 2023 revenue guidance, bumping it up to $525 million. Achieving that level will translate to 24% year-over-year growth.

CECO is already delivering, when it comes to business results. In its last quarterly report, covering 2Q23, CECO had a top line of $129.2 million, up 23% y/y and $11.4 million ahead of expectations. Along with the solid revenue, CECO’s quarterly orders came to $162.9 million for a 44% y/y increase, and the company’s backlog of $391 million was a company record – and was up 35% from the previous year. The company’s non-GAAP diluted EPS of 15 cents per share was in-line with the forecasts.

This green-tech firm has caught the eye of Amit Dayal, 5-star analyst with H.C. Wainwright, who is impressed by the breadth of CECO’s business, in both the products and services offered and the geographical footprint of the firm, adding that acquisition activity will enhance both.

Dayal writes of the stock, “We believe a combination of favorable macro tailwinds, operational improvements, presence in important emerging geographies (Middle East, India) for the industrial water, industrial air, and energy transition segments, and immediate contribution from recently undertaken M&A has positioned the company very favorably to continue growing profitably. The company added $163M in orders during the quarter to take backlog to $391M from $356M in the prior quarter. Investors should expect the company to continue undertaking strategic M&A to broaden its portfolio of offerings. We believe the strength in CECO’s outlook and consistent execution over the last few quarters should bring greater investor attention to the stock.”

Going on from here, Dayal rates CECO shares as a Buy, backing this with a $22 price target that implies a one-year gain of 38%. (To watch Dayal’s track record, click here.)

The 5 recent analyst reviews on this stock are all positive, giving it a unanimous Strong Buy consensus rating. CECO shares are trading for $15.97 and have an average price target of $20.75, suggesting a 30% one-year upside potential. (See CECO’s stock forecast.)

PROS Holdings, Inc. (PRO)

Next up on our Perfect 10 list, PROS Holdings is a software company in the cloud computing world. The company offers products featuring price optimization, revenue management, and sales effectiveness, powered by AI and designed to streamline retail transactions for both merchants and customers. PROS’ clients include companies in the airline, automotive, consumer goods, energy, manufacturing, and logistics industries.

By the numbers, PROS puts up some impressive operational statistics. To start with, in the last quarter, the company boasted 99.98% uptime for the platform, an important achievement that ensures a seamless experience for users. The company’s platform processed approximately 5.9 million transactions per minute last quarter, for a quarterly total of 775 billion transactions – and 2.5 trillion transactions in the trailing 12-month period.

Solid operations have led to upward trends in both revenue and earnings for PROS Holdings over the past few years. In the company’s 2Q23 report, it showed a top line of $75.8 million, beating the forecast by $3.1 million and growing by over 10.8% y/y. The company’s EPS figure came in at a loss, of 29 cents per share – but that loss was 7 cents per share better than had been anticipated.

This stock is covered by Nehal Chokshi, 5-star analyst with Northland Securities, who describes PRO as one of his Top Picks. Chokshi is particularly impressed by the company’s ability to leverage its multichannel business for solid revenue increases, writing, “We believe the principal driver behind PRO’s ability to accelerate to and sustain total 16% to 21% revenue growth is PRO being a system of intelligence niche player in sales optimization that is levered to the accelerating pace of enterprise digital transformations and shift to self-service B2B commerce. Specifically, we think PRO’s platform more closely resembles the next evolution of enterprise systems to systems-of-intelligence, from more ‘static’ systems-of-record/systems-of-engagement.”

At the core of PRO’s vertical specific software solutions that is driving market share gains in each served market is the utilization of data science and infrastructure architecture amenable to changing algorithms, powered by artificial intelligence and expertise with omnichannel commerce,” Chokshi went on to add.

These comments form the basis for an Outperform (Buy) rating, while Chokshi’s $51 price target points toward a gain of 47% in the next 12 months. (To watch Chokshi’s track record, click here.)

Overall, PROS Holdings has a Strong Buy consensus rating from the Street’s analysts, based on 6 unanimously positive reviews. The stock’s $42.2 average price target and $34.62 trading price combine to suggest a 22% potential upside for the coming year. (See PROS Holdings’ stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.