Stock markets finished last week at record levels, with the NASDAQ in spitting distance of 16,000 – it’s Friday close at 15,990 is its second-highest ever – and the S&P 500 hit a new record, breaking 5,000 to end the week at 5,026. These high points reflect strong gains in some of the market’s largest companies (think Nvidia, Amazon, and Meta), as well as increasingly positive sentiment among investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For those happy investors, the only cloud is choosing the right stocks to take advantage of the rising tide. Even in bull runs – perhaps especially in bull runs – the markets toss up an imposing wall of data, the collective result of thousands of traders dealing in thousands of stocks, for millions of transactions every day, and that wall of data makes an imposing barrier for the retail investor to climb. Fortunately, there’s the Smart Score.

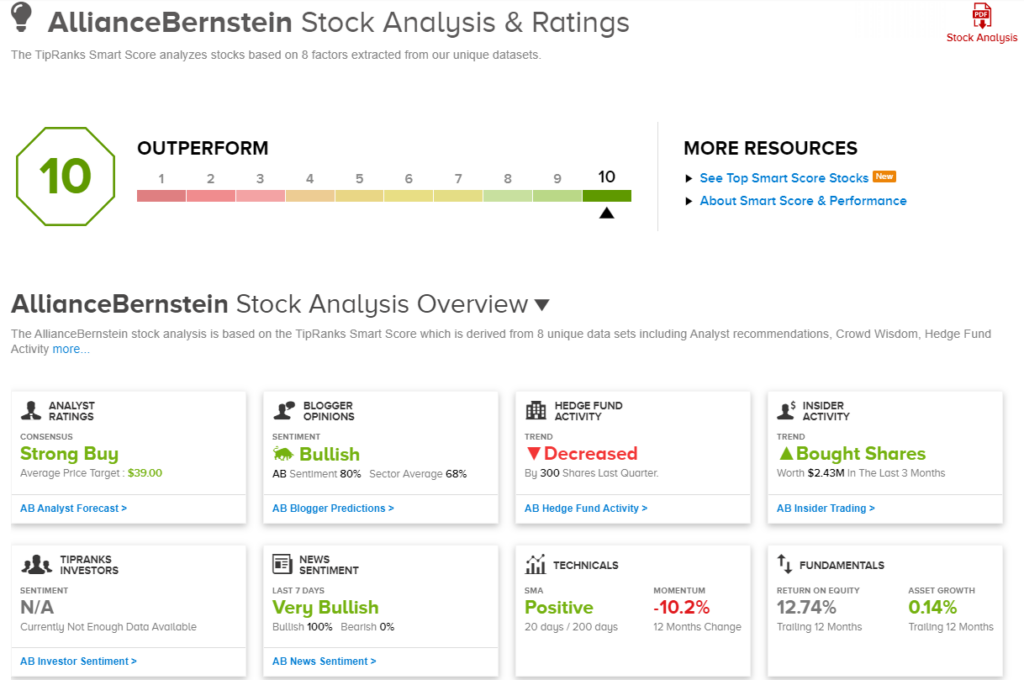

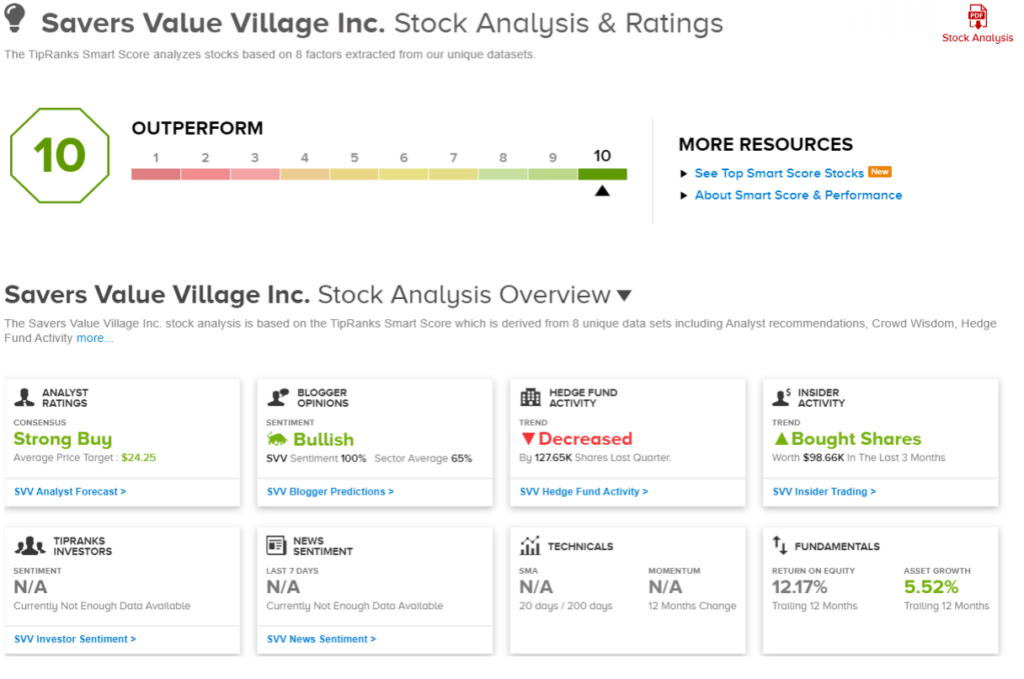

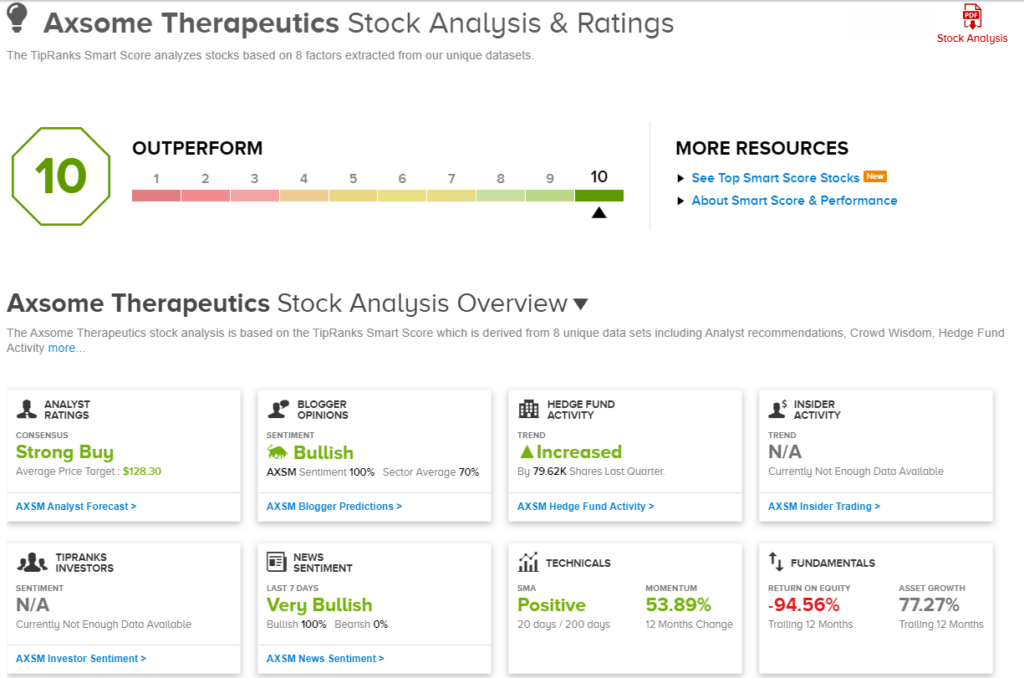

The Smart Score, using AI-driven algorithms and the TipRanks database, gathers and collates the accumulated data of the stock markets – and uses it to compare every stock to a set of factors that are proven to match up with future outperformance. The stocks are each given a simple score, on a scale of 1 to 10, with a ‘Perfect 10’ marking the shares that deserve a closer look.

So let’s do just that. Here are 3 top-scoring stocks that have hit all the right boxes in the Smart Score – and earned the ‘Perfect 10.’ In addition, each stock has earned a ‘Strong Buy’ rating from the Wall Street analysts. Here are the details.

AllianceBernstein (AB)

First up is a financial services sector company, AllianceBernstein. This asset manager works mainly with institutional and high-net-worth investors, but also with smaller retail clients. The firm is based in Nashville, Tennessee, and finished 2023 with $725.2 billion in total assets under management.

AllianceBernstein operates three distinct business segments, the eponymous asset manager, a private wealth management segment, and a research segment. These are administered by more than 4,700 employees, working from 54 office locations in 27 separate jurisdictions around the world. The company reported that 75% of its assets outperformed the markets during 2023.

This firm’s total AUM is not distributed evenly among the business segments. Private wealth management, with $121.3 billion under management, makes up just under 17% of the total, and the retail business, at $286.8 billion, makes up 39.5%. The largest segment of AllianceBernstein’s business is institutional asset management, which makes up nearly 44% of the total AUM.

AB reported its financial results for Q4 and full-year 2023 just last week, and showed a total of $1.09 billion at the top line. This was up more than 10% year-over-year, and came in $232.15 million better than had been expected. The asset management company realized adj. earnings of 77 cents, for a 10% y/y increase and $0.14 beat.

In a move of definite interest to return-minded investors, AllianceBernstein bumped up its common share dividend earlier this month, from 65 cents per share to 77 cents, marking an 18.5% increase. At an annualized rate of $3.08 per common share, the new dividend gives a forward yield of 9.27%.

This stock has caught the attention of Bank of America’s 5-star analyst Craig Siegenthaler, who notes that AB has been a solid performer in the past several years: “AB’s prior long-term outperformance has contributed to its +2% organic growth rate over the last five years, which tracks better than most of its peers. AB’s fixed income performance is broadly strong with 75/73/77% outperforming over 1/3/5Ys. This supports our more bullish outlook for AB’s fixed income flows, which also aligns with our industry thesis for fixed income reallocations.”

Looking ahead, Siegenthaler goes on to outline a sound outlook: “The potential for a net flow reacceleration driven by large fixed income reallocations in 2024-2025 and tangible expense saves through 2025 are the two critical points for our Buy thesis. Additionally, AB’s strategic relationship with EQH is an additional long-term profit driver which is underappreciated by investors in our view.”

Summing up, the Bank of America view here is a Buy, with a $50 price target pointing toward a 50.5% upside for the coming year. (To watch Siegenthaler’s track record, click here)

The Strong Buy analyst consensus on AB shares is based on 5 recent reviews with a 4 to 1 breakdown favoring Buy over Hold. The stock is selling for $33.21 and its $39 average price target implies an upside potential of 17% on the one-year horizon. (See AllianceBernstein’s stock forecast)

Savers Value Village (SVV)

Next up on our Perfect 10 list is Savers Value Village, the largest retail thrift store chain in the US and Canada. SVV is a for-profit chain, differentiating it from other well-known thrift chains such as Goodwill, and it went public on the trading markets last summer; the stock ticker, SVV, started trading on June 29.

Savers Value Village is based in Washington State, in Bellevue, and in addition to the US and Canada, also operates stores in Australia. In 2022, the last full year with data available, the company had total revenues of $1.44 billion, representing a 19% increase from 2021.

The last full quarter with results on record is 3Q23, reported in November. The top line at that time came to $392.7 million for the quarter, up 4.4% y/y. On a negative note, the Q3 top line was more than $3.5 million below expectations. Things are looking up for Q4, however, with preliminary sales numbers, released in January, coming in at $382.8 million. This is also a 4.4% y/y increase – and it is well above the $376.7 million which had been anticipated.

Analyst Randal Konik, covering this new stock for Jefferies, sees the Q4 prelim numbers as the key point, and bases his optimistic outlook on them. He writes of the stock, “We believe the tone from mgmt remains upbeat following the company’s solid preliminary 4Q sales results, and we continue to see an attractive long-term growth opportunity. To this end, SVV has a substantial unit growth opportunity and strong secular tailwinds. Combined with a track record of consistently positive SSS and stable margins, we believe shares are significantly undervalued at current levels.”

Konik’s comments back up his Buy rating on the stock, and he sets a price target of $30, suggesting a 50% upside potential for the next 12 months. (To watch Konik’s track record, click here)

Savers Value Village may be a relatively new stock on the public markets, but it has already picked up some love from the Street’s analysts. Based on unanimously positive reviews – 4, in total – the stock claims a Strong Buy consensus rating. SVV is currently priced at $20, and the average price target of $24.25 indicates a one-year upside of 21%. (See SVV’s stock forecast)

Axsome Therapeutics (AXSM)

Last on our list is a biopharmaceutical company, Axsome Therapeutics. This biopharma focuses on developing new treatments for diseases of the central nervous system (CNS), a class of diseases that are typically difficult to treat and frequently lack effective therapeutic agents. This gives the company a rich field of targets for drug development, and a potentially deep patient/customer base, but also requires long lead times and expensive clinical trials before any drug reaches approval.

That said, Axsome is reaching out for the brass ring. The company has two approved drugs on the market, and its clinical pipeline features several late-stage data releases and trial commencements. The company is shifting from a pure research orientation to a more commercial bent.

On the commercial side, Axsome last reported financial results from 3Q23. For that period, the company reported a total of $57.8 million in product revenue, for a 244% y/y increase. This total was composed of $57.1 million in product sales, and $0.7 million in royalty income.

The company’s leading sales generator is Auvelity, a rapid-acting anti-depressant medication. Unlike most anti-depressants, Auvelity has shown positive results in patients in as short a time as 1 week. In 3Q23, the company realized $37.7 million in sales from the drug, representing quarter-over-quarter growth of 36%. In its Q4 preliminary report, Axsome shows predicted sales of Auvelity at $49 million for the quarter and $130 million for the full year 2023.

Sunosi, the brand name of the drug solriamfetol, is a treatment for excessive daytime sleepiness in adults due to narcolepsy or obstructive sleep apnea, and is Axsome’s other approved medication. Sales of this drug were reported at $20.1 million for 3Q23, a y/y gain of 20%. The Q4 preliminary sales report shows a prediction of $22 million in quarterly sales and $74 million in full-year sales.

When we look at the clinical trial side, we find that Axsome has several events coming up at the Phase 3 stage. Waiting in the wings this year are several topline result releases. These include data from the Phase 3 SYMPHONY trial, a study of drug candidate AXS-12 in the treatment of narcolepsy; the Phase 3 ADVANCE-2 trial, a study of candidate AXS-05 for agitation due to Alzheimer’s; and the Phase 3 FOCUS trial, a study using solriamfetol to treat ADHD in adults.

Also coming up this year are several Phase 3 trial initiations. These include three Phase 3 studies of solriamfetol, in the treatment of several disorders. Targeted conditions include major depressive disorder, binge eating disorder, and shift work disorder. Finally, a pivotal Phase 2/3 trial of drug candidate AXS-05 is on track for this year, in the field of smoking cessation.

That’s a full plate for any biotech, and it has investors upbeat about Axsome. The company’s stock has gained almost 22% so far this year.

For analyst Leonid Timashev, of RBC Capital, Axsome’s solid sales growth in its approved products are the main theme, with a secondary theme coming from the ‘near-term ph. III’ activity. The 5-star analyst writes of the stock, “With the lead value driver Auvelity showing good Rx growth, we think sales can reach $296M in 2024, ahead of $272M consensus, driven by earlier than expected adoption as the rapid acting profile resonates with patients and prescribers. Overall, we think the company’s successful launch of Auvelity, stable cash flows from Sunosi, and underappreciated pipeline optionality make for an attractive mid-cap biotech with a floor value set by the commercial products and near-term ph.III and launch catalysts having the potential to drive additional share appreciation.”

Looking forward, Timashev rates AXSM shares as Outperform (Buy), with a $126 price target to indicate potential for a 30% share price gain going forward. (To watch Timashev’s track record, click here)

There are 11 recent analyst reviews on file for this stock, and the breakdown is a lopsided 10 to 1 favoring Buy over Hold. The shares have a $96.89 trading price, and the $128.30 average target price suggests a one-year upside potential of 32%. (See Axsome’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.