Successful investment portfolios are naturally built on successful stocks – but how are investors supposed to pick the stocks that are poised for success?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

That’s where the Smart Score comes in to play. This is a data collection and collation tool, based on AI-driven algorithms. The Smart Score sifts through thousands of publicly traded stocks, rating each one against a set of 8 data-dependent factors that have proven to correlate with future share outperformance. In short, the Smart Score develops a data-driven outlook for every stock, and distills that down to a single, simple, score – a smart score, that shows where the stock is likely to head in the near-term.

The Smart Score is given on a scale of 1 to 10, with the ‘Perfect 10’ indicating a stock that deserves a closer look. These are the shares that are sending all the right signals, and ticking all the right marks.

It’s not just the Smart Score that’s pointing out portfolio-worthy stocks, however. Wall Street’s analysts have also been tapping the stocks they see as winners – and when the analysts’ choices and the Smart Scores match up, it’s a clear indicator that investors should take notice.

So, here are three stocks that feature both a ‘Perfect 10’ from the Smart Score – and a Strong Buy from the analysts’ consensus. Let’s take a closer look.

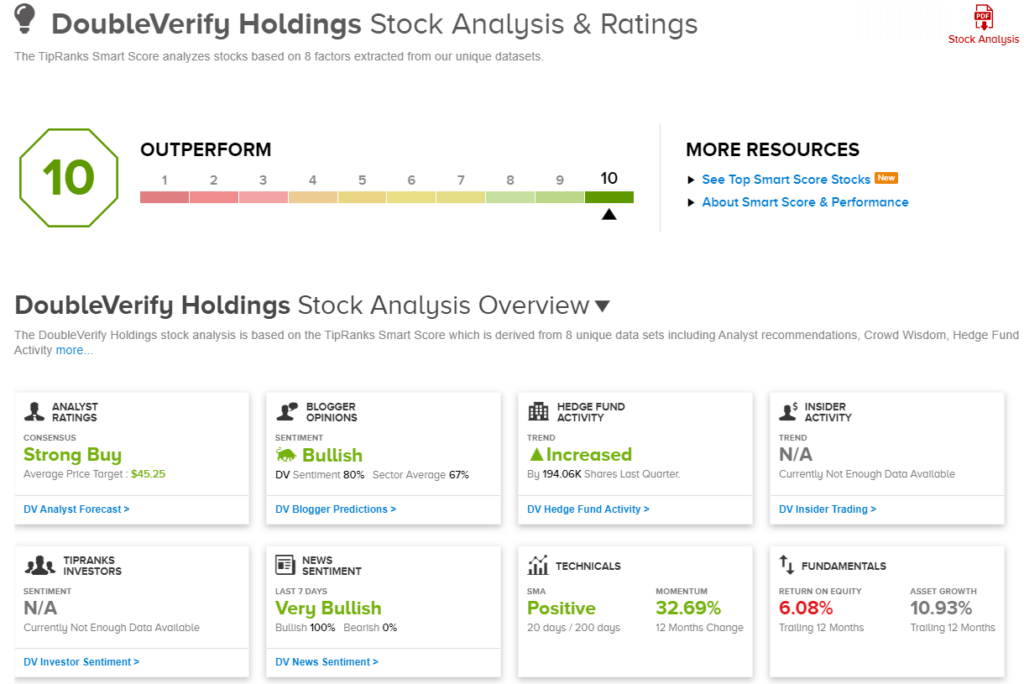

DoubleVerify Holdings (DV)

The first stock we’re looking at, DoubleVerify, is a software company, offering a line of measurement and analytic products for digital advertisers, designed to improve safety and security in online advertising ecosystems. DoubleVerify works to preserve the ‘fair value exchange between buyers and sellers of digital media,’ with unbiased data and analytics. The company counts hundreds of the Fortune 500 firms among its client base.

DoubleVerify was an early leader in the field of digital ad verification, and its media authentication products have found use and application in fields as varied as financial services, retail, travel, telecom, and pharmaceutical research. The company combines efforts in both fraud verification and brand reputation, to build trust among advertisers and consumers.

The company has a global reach, operating in such major tech and financial centers as New York, San Diego, London, Berlin, Tokyo, Tel Aviv, and Singapore. Its operations are profitable, and revenues have been trending upward for several years now.

In the most recent reported quarter, 2Q23, DoubleVerify showed a top line of $133.7 million, up nearly 22% year-over-year and some $253K above the estimates. On the bottom line, there was a split; DV’s GAAP EPS of 7 cents was 1 cent ahead of the estimates, while the non-GAAP EPS of 13 cents came in 1 cent below expectations.

During the quarter, DoubleVerify announced it had entered an agreement to acquire the AI-powered digital campaign optimization company Scibids. The transaction will be carried out in both cash and stock, to a total of $125 million, with a potential earnout based on achievement of performance milestones over 2023.

This stock has caught the attention of Stephens analyst Nicholas Zangler, who sees DoubleVerify’s growth potential as the key story here. He writes of the stock, “An increasing desire for brands and agencies to optimize digital ad spend amongst various channels and content has fueled client wins and measured impression volume growth at DV… We believe DV is capable of growing revenues at a +20% CAGR over the next several years attributable to several industry/company-specific tailwinds including the proliferation of CTV and retail media channels, recent/upcoming product launches with various social media providers, an expanding solution set and elevated fee structure, new enterprise clients wins, international growth, and utilization by SMBs.”

“Amongst the ad-tech peer group, DV commands a premium multiple, justified in our view given elevated growth rates, a sizable TAM, and limited competition,” Zangler further added.

Looking ahead, Zangler rates DV as Overweight (a Buy), and gives it a $47 price target to imply a 41% upside for the next 12 months. (To watch Zangler’s track record, click here)

The Strong Buy consensus rating on DV is unanimously positive, based on 12 recent analyst reviews. The stock has a current price of $33.40, and its $45.25 average price target suggests it will gain 35% in the next 12 months. (See DV stock forecast)

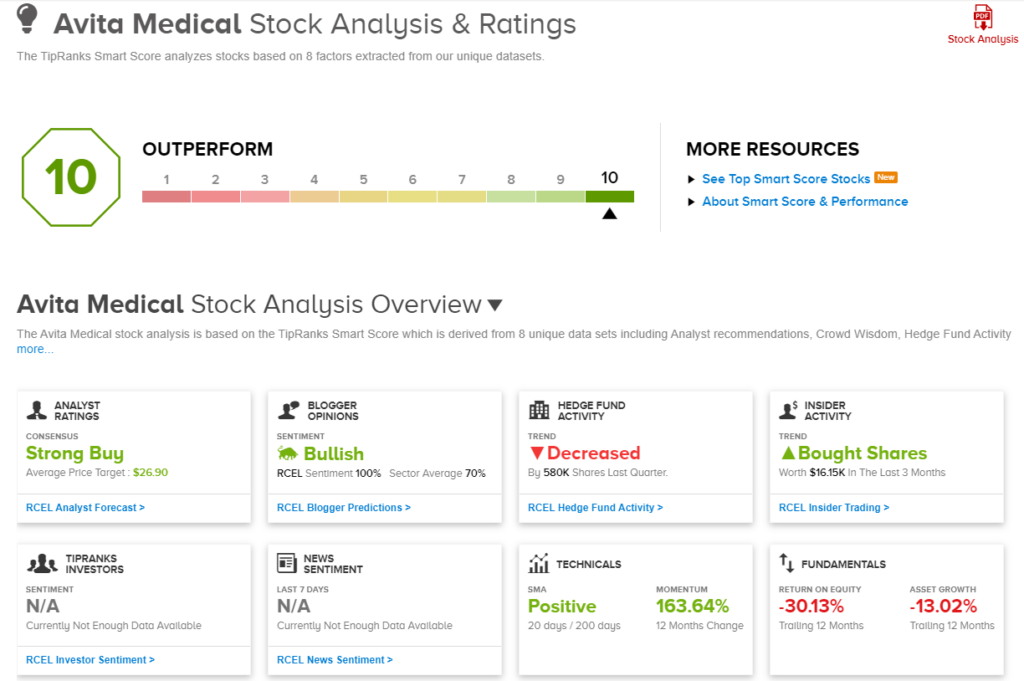

Avita Medical (RCEL)

Next up is Avita Medical, a clinical and commercial stage biopharma company working on regenerative medicine products. The company has developed a proprietary technology designed to use regenerative properties of the patient’s skin to create innovative treatment solutions. Regenerative medicines of this type have traditionally been used for burn treatments; Avita is working to expand those indications to include chronic and traumatic wounds and scar revision.

Avita has used its development platform to create RCELL, a proprietary skin treatment system to meet the high unmet medical needs of therapeutic skin restoration. The RCELL system has approval from the FDA for the treatment of several conditions, including acute thermal burns, full-thickness skin defects, and repigmentation in vitiligo, the latter two gaining approval in June. RCELL was introduced in the US in 2018, and marked the first new PMA-approved burn care treatment in more than 20 years.

Having an approved product – especially one that can be readily adapted for additional indications – is a dream for biopharma researchers. Avita has realized a revenue stream from the RCELL system, and its ability to expand its use promises to expand the revenues. The company realized $10.5 million in Q1 of this year, for a 40% increase over the year-ago quarter and beating the forecast by almost $260K.

In his coverage of this stock for Cantor Fitzgerald, analyst Ross Osborn notes that RCELL has potential to alter the entire skin care medical field, and writes, “Our Overweight (i.e., Buy) rating is based on three key points: (1) the RECELL System is a disruptive technology, in our eyes; (2) we believe Avita is at an inflection point given that the two new expanded indications significantly increase the company’s TAM (total addressable market); and (3) we view the company’s shares as attractively valued.”

That Overweight rating is backed by a price target of $23, suggesting that the stock is on track to gain 23% over the coming year. (To watch Osborn’s track record, click here.)

Once again, we’re looking at a stock with a unanimously positive Strong Buy consensus rating, this one based on 6 positive analyst reviews. RCEL shares are trading for $18.64; the stock has a $26.90 average price target that implies a 44% upside on the one-year horizon. (See Avita Medical’s stock forecast.)

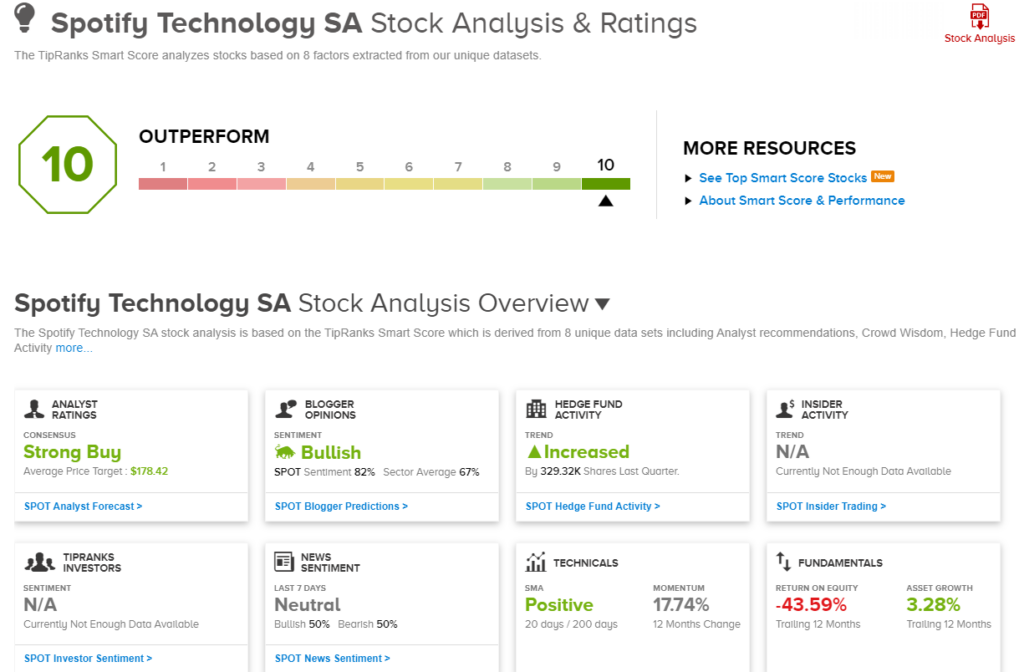

Spotify Technology SA (SPOT)

Last on the ‘Perfect 10’ list is Spotify, the online tech firm beloved of music fans. Spotify specializes in online music streaming, offering a ‘freemium’ service, a basic level of streaming available to all customers free of charge – with upgrades and additional features, including ad-free streaming, available to paid subscription users. Even free users, however, will benefit from Spotify’s chief benefit, its use of AI to create personalized playlists.

Spotify has a global reach, with availability throughout the Americas and Europe, in the Austro-Pacific, and in much of Asia and Africa. The company has been expanding its reach by adding products to attract more listeners/users, adding podcasts in 2015 and following with audiobooks in 2022.

By the numbers, Spotify can boast of 551 million users, a total that includes some 220 million subscribers, and operates in 184 markets, giving credence to the company’s boast that it is the world’s most popular audio streaming service. Spotify’s listeners can choose from more than 100 million music tracks, 5 million podcasts, and over 350,000 audiobooks on the platform.

In its last quarter, 2Q23, Spotify missed on its financial results. The company reported 3.2 billion Euros at the top line, or $3.5 billion in US currency. This was up 10.8% y/y, but missed the forecast by over US$27 million. At the bottom line, the company’s EPS of -$1.71 was more than a dollar below the estimates.

The outlook also failed to impress, and shares went through a bit of a selloff in the aftermath. Nevertheless, Deutsche Bank analyst Benjamin Black believes that the company’s proven ability to attract customers will fuel future growth. He sees the stock’s selloff as ‘overdone,’ and writes of it, “We came away from the print modestly more constructive, as top-of-funnel metrics continue to outpace expectations, 3Q gross margin guide came in above consensus (though admittedly in line with buyside bogeys), and operating losses narrowed once again. Of course, revenue guidance came in slightly below expectations, but that is mostly a function of FX… The hair on the print was however ARPU, down 3% y/y FXN on the back of product mix shift, a drag that likely persists going forward. That said, with pricing set to be another growth driver, we expect ARPU to begin to inflect positively from 3Q onward. Advertising on both the music and podcasting side improved throughout 2Q and so far in 3Q results have continued that trend.”

Black puts a Buy rating here, and his $180 price target points toward an upside potential of 25% for the coming 12 months. (To watch Black’s track record, click here)

Leading tech firms always pick up plenty of Wall Street attention, and Spotify has 24 recent reviews on file, including 19 to Buy and 5 to Hold. The shares are selling for $144.12, and the $178.42 average price target implies the shares will gain 24% by this time next year. (See Spotify stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.