The key to earning in the stock market is to find an equity that shows the right profile based on a mix of attributes that will predict success. Finding them can be tough, especially given the sheer volume of data generated by the market. With thousands of stocks, hundreds of thousands of traders, and a legion of Wall Street analysts all putting their own sometimes contradictory views into the ring, getting down to brass tacks is no easy task.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

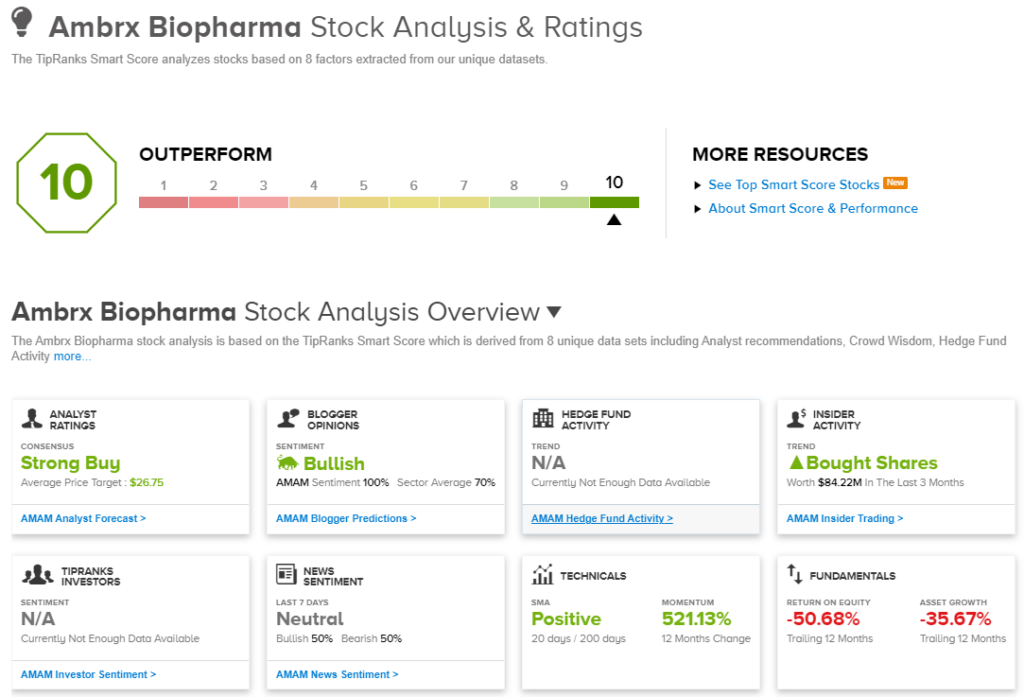

That’s where the TipRanks Smart Score can become a trader’s best friend. The Smart Score is a data sifting and collating tool, based on a proprietary algorithm that measures every stock against a series of factors, 8 in all, that have been correlated with market gains. The factors are taken together and distilled into a single score on a 1 to 10 scale, giving every stock a simple, single-digit score that points toward the stock’s general health and potential performance.

We can take a look under the hood of the Smart Score system to pull up the details on two stocks that have ticked all the boxes – and earned the ‘Perfect 10’ score. Here they are, presented along with comments from the Street’s analysts. Let’s see why they’ve earned their accolades.

Corteva, Inc. (CTVA)

The first stock on our list is Corteva, an agricultural company that spun off from the chemical firm DowDuPont in 2019, taking the venerable parent firm’s agricultural segment public as an independent entity. Today, Corteva produces seeds and agricultural chemicals, products that can help farmers increase their acre-productivity and overall agricultural output. The company’s product line features the fungicides, herbicides, and insecticides necessary to protect crops, along with high-performance seeds, under the brand names Pioneer and Brevant, to maximize output.

Corteva is a pure-play agriculture firm, working in a sector that is absolutely essential, and numbers back that up. The company boasts more than 10 million customers across 140 countries, and generated $17.46 billion in total sales last year. The company’s shareholders were major beneficiaries of that success, as the company generated some $1.4 billion in total returns to shareholders for 2022.

The company’s success continued into the first quarter of this year. The 1Q23 financial results showed a top line of $4.88 billion, $143 million above expectations and a 6% improvement from the prior-year Q1 revenue. At the bottom line, quarterly earnings came in at $1.16 per share by non-GAAP measures, for a 20% y/y gain – and a beat of 23 cents per share compared to the forecasts.

Among the bulls is Canaccord analyst Bobby Burleson who notes the company’s strong position in its core seed and agrichemical businesses. He sees high potential for the firm going forward and writes of Corteva, “We see the company’s seed trait technology and expanding biological crop protection and nutrition portfolio supporting strong revenue and profitability growth, while helping enable agriculture’s transition to sustainable production methods. Our outlook for healthy EBITDA growth through 2024 (12% CAGR ’22-‘24E) justifies a valuation premium for Corteva…”

These comments back up Burleson’s Buy rating on the stock, and his $75 price target implies upside potential of 31% for the year ahead. (To watch Burleson’s track record, click here)

The Strong Buy consensus rating on CTVA is based on 13 recent analyst reviews, including 11 Buys and 2 Holds. The shares are priced at $57.30, with an average price target of $72.83 suggesting a 27% gain heading out to the one-year horizon. (See CTVA stock forecast)

Ambrx Biopharma (AMAM)

The second stock we’ll look is a clinical stage biopharmaceutical company, Ambrx. This firm is researching new treatments for dangerous cancers, including breast cancer and prostate cancer. The company uses an expanded genetic code technology platform in its development efforts, and its pipeline is currently focused on antibody drug conjugates (ADCs), a class of engineered therapies designed to attack specific cancers while sparing healthy cells.

Ambrx has an active research pipeline, with two proprietary drug candidates currently in the research clinic, and two additional candidates under investigation through partner programs. On the clinical side, the company has in recent months reported positive results from a mid-stage trial; just last December, the stock leaped over 1000% after announcement of positive data from the phase 2 study of ARX788 in the treatment of metastatic breast cancer. These are the signs that investors look for, in pre-revenue biopharma companies.

ARX788, an anti-HER2 ADC, is currently under investigation in the treatment of breast cancer, gastric/GEJ cancer and other solid tumors. Earlier this year, the company announced that in a Phase 3 study in the treatment of HER2+ metastatic breast cancer (conducted by partner, NovoCodex Biopharmaceuticals), interim analysis showed the drug had met the primary efficacy endpoint, displaying clinically significant survival benefits when compared to the control group.

ARX517, the company’s second leading candidate, is a prostate-specific ADC, and the subject of Phase 1 testing. Results announced this year have indicated that ARX517 is also showing statistically significant activity, in this case causing important decreases in PSA levels in patients with advance prostate cancer.

Covering this stock for B. Riley Financial, analyst Yuan Zhi is impressed by Ambrx’s leading pipeline tracks. The analyst points out near-term catalysts for each, and writes, “[We] believe there is an increasing market opportunity for ARX517 in mCRPC with and without prior Pluvicto treatment and for ARX788 in HER2+ mBC after Enhertu. We recommend investors build positions ahead of the anticipated clinical updates of ARX517 at ESMO’23 (in October) and ARX788 at SABCS’23 (in December). Following what we believe to be likely positive data readouts from the oncology platform, we would anticipate value appreciation of other early-stage assets in AMAM’s pipeline via partnerships with significant up-front payments.”

In Zhi’s view, this adds up to a Buy rating, and a $26 price target that suggests a one-year potential upside of 58% for the stock. (To watch Zhi’s track record, click here)

Ambrx only has 5 recent analyst reviews on file, but they break down 4 to 1 in favor of Buy over Hold and give the shares a Strong Buy consensus rating. The average price target of $26.75 implies 12-month share appreciation of 62% from the current trading price of $16.46. (See Ambrx stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.