Even though most market watchers would agree that a recession is looming over the next hill, there are still stocks that ‘tick the right boxes,’ flashing buy-signs for investors. The Smart Score tool from TipRanks is perfect for sorting these choices from the pack.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Smart Score algorithm measures every stock according to a set of key metrics, 8 in all, that include a series of sentiment gauges as well as fundamental and technical factors, all of which are known to correlate with future outperformance – and then it distills that collated data in to a single-digit score, on a scale of 1 to 10, putting a stock’s ‘main chance’ at investors’ fingertips.

We’ve used the Smart Score filters to sift through the TipRanks database and find 3 top-rated stocks that tick all the right boxes, with each showing a ‘Perfect 10,’ the top rating from the Smart Score. Here are their details, presented along with some commentaries from Wall Street’s analysts.

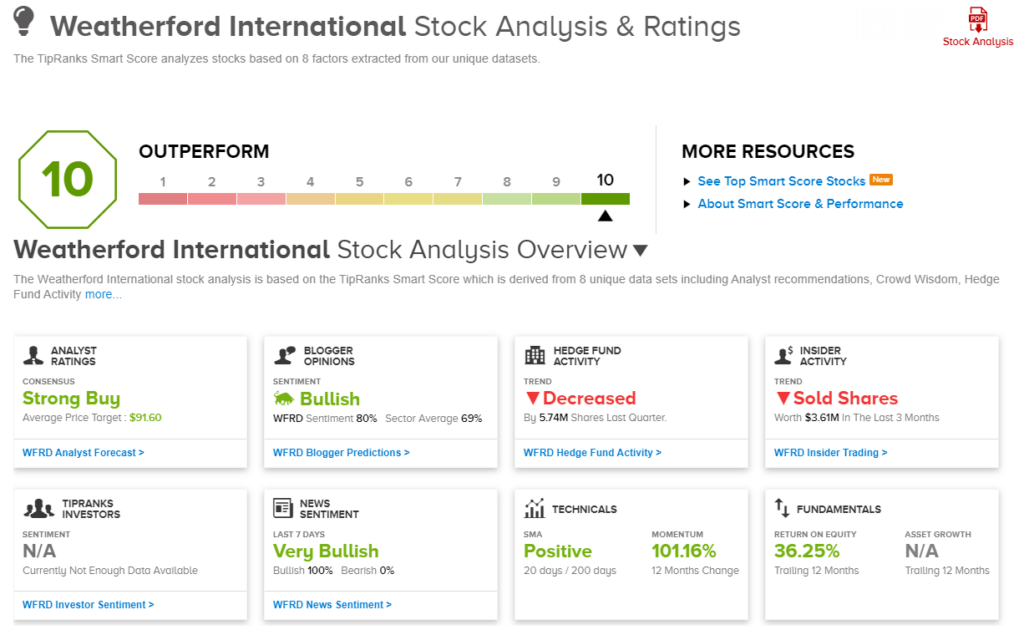

Weatherford International (WFRD)

We’ll start in the energy industry, with Weatherford International. This company is an oilfield services provider, one of the many such firms that provides equipment and know-how for the evaluation, drilling, and completion of oil and natural gas wells. The big oil companies typically own the land and the resources under it and fund the drilling ops; oilfield services companies like Weatherford bring the specialized knowledge and personnel needed to get the wells into production.

Weatherford, which boasts a market cap of approximately $4.25 billion, is one of the world’s largest oilfield servicers. It’s been in business for over 50 years, and operates in more than 75 countries. The company bills itself as bringing the digital age – including high-end automation technology – to bear on the traditional industrial tech of the hydrocarbon extraction industry.

A solid position in an essential industry has served Weatherford – and its investors – well. In the company’s last reported financial quarter, 1Q23, Weatherford had strong gains at both the top and bottom lines. Revenue came in at $1.19 billion, for a year-over-year gain of 26%, and beat the forecasts by $62.3 million. At the bottom line, the company had $72 million in net income, a powerful turnaround from the $80 million net loss reported in 1Q22. The non-GAAP EPS figure of 97 cents beat Wall Street’s estimates by 19 cents.

While Weatherford is showing strong results now, that was not always the case. As recently as 2019, the company was compelled to file for bankruptcy under Chapter 11, and the debt restructuring process lasted from July to December of that year. In June of 2020, the company announced multiple changes to upper management, bringing in a new top-level executive team. Since then, the firm has focuses on profitability and cash flow generation, with sound results. In the 1Q23 report, Weatherford showed a free cash flow of $27 million, up from a $64 million cash burn in the prior-year period.

Looking at the Smart Score, we find that Weatherford benefits from a ‘very positive’ news sentiment, supported by 100% positive coverage, while the financial bloggers’ published reviews are 80% bullish compared to a sector average of 69%. The company also gets a boost from technical factors; the simple moving average is positive, indicating an upward share price trend, and the company’s 12-month momentum registers 101%.

This company’s turnaround has caught the eye of Raymond James analyst James Rollyson, who writes, “Weatherford’s new leadership has spent the better part of the past three years shifting the company’s focus to profitability and reestablishing credibility with investors. In our review of results, margins, and the balance sheet, we would say the mission has been successful. The focus on profitable work in recent years has paid dividends in terms of EBITDA margins, returns, and free cash flow conversion rates relative to peers. The strong leverage to international markets positions the company well to continue posting solid growth, along with improving margins and free cash flows, for which our estimates suggest a mid-single-digit FCF yield for 2023 and high-single-digit yield for 2024.”

Rollyson gives WFRD a Strong Buy rating, along with a $100 price target that implies a one-year share appreciation of 70%. (To watch Rollyson’s track record, click here)

Rollyson is no outlier; WFRD shares have a Strong Buy consensus rating from the Street’s analysts, based on 6 unanimously positive share reviews. The stock is trading for $58.78 and its $91.60 average price target points toward a 56% gain on the one-year horizon. (See WFRD stock forecast)

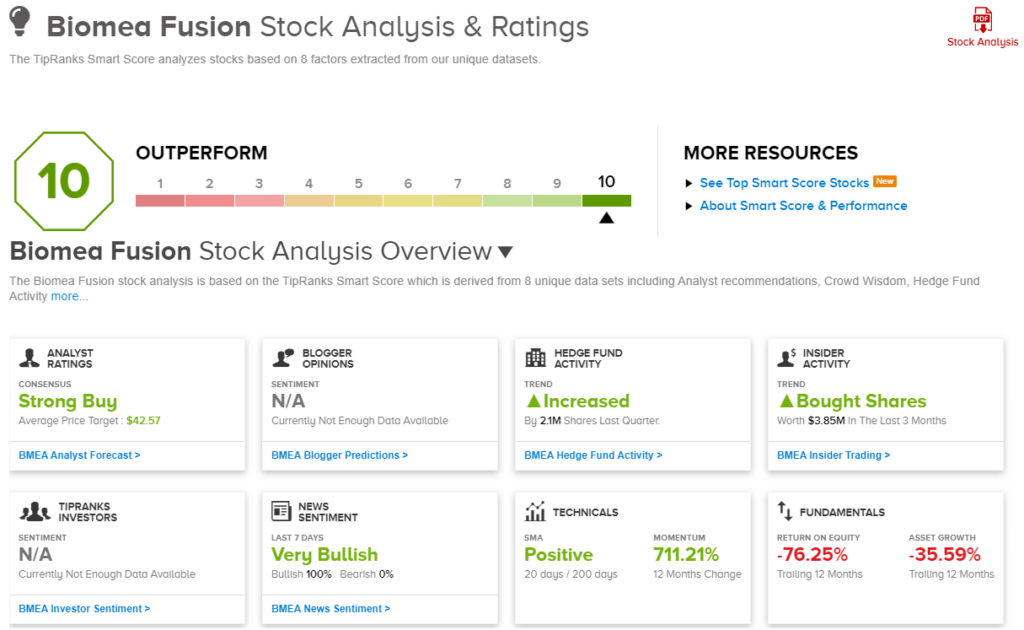

Biomea Fusion (BMEA)

The second stock we’ll look is a clinical stage biopharmaceutical firm, Biomea Fusion. Biomea is working on the discovery and development of novel covalent small molecules, synthetic compounds that permanently bond to the target proteins, for the treatment of patients with a variety of disease conditions, including metabolic diseases such as diabetes and genetically defined cancers. The covalent small molecule approach offers several advantages over existing drugs, including greater precision in targeting and, through that, lower drug exposure for the patient.

Currently, Biomea has one leading drug candidate product ‘in the clinic,’ undergoing human clinical trials. This candidate, BMF-219, has several variations, covalent-101, -102, and -111, with applications to different sets of conditions. Covalent-101 is being tested against liquid tumors, covalent-102 is under investigation against KRAS solid tumors, and covalent-111 is being studied as a treatment for type 2 diabetes.

In the last quarter, Biomea reported advancing its clinical studies in each of these directions. The company is continuing to enroll patients in the four cohorts of the ongoing Phase I study of covalent-101, with particular emphasis on acute lymphocytic and myeloid leukemias (ALL/AML). Data from the AML cohort is expected in 2H23. Covalent-102 is the subject of an ongoing Phase 1/2b study, with three cohorts focused on non-small cell lung cancer (NSCLC), colorectal cancer (CRC) and pancreatic ductal adenocarcinoma (PDAC). This study dosed its first patient in January of this year.

The company has recently reported positive clinical data from the Phase 2 portion of the covalent-111 study, in the treatment of type 2 diabetes. The drug showed a clinically significant effect at all dosages, as well as a favorable safety profile. Additional data is expected in June of this year.

Finally, Biomea announced early this month that it had received FDA clearance on the Investigational New Drug (IND) application for BMF-500, a potential treatment for relapsed or refractory acute leukemia. The clearance sets the stage for clinical trials to begin.

Investors have been cheering Biomea’s progress and the shares are up over 780% in the last 12 months. The stock’s Smart Score reflects this, showing 100% positive news sentiment. In addition, the hedges tracked by TipRanks bought up 2.1 million shares of BMEA last quarter, and company insiders have bought $3.9 million worth of the stock in the last three months. That all adds up to a Perfect 10.

Clinical-stage biopharmas typically get investor interest when they have this many catalysts coming up, and Barclays analyst Peter Lawson explains just why Biomea deserves a close look, writing, “We have a positive outlook on the risk/reward of BMEA ahead of value inflecting data readouts in 2023 which could show meaningful disease modification in diabetes and initial responses in oncology…. The company has a proven management team, and an attractive set of positive catalysts in the near term.”

In Lawson’s view, this supports an Overweight (Buy) rating for the stock, and his $50 price target implies a 47% potential upside for the year ahead. (To watch Lawson’s track record, click here)

Overall, all 7 of the recent analyst reviews on BMEA are positive, making the Strong Buy consensus view unanimous. The stock’s average price target of $42.57 suggests a 25% one-year upside from the current share price of $33.99. (See BMEA stock forecast)

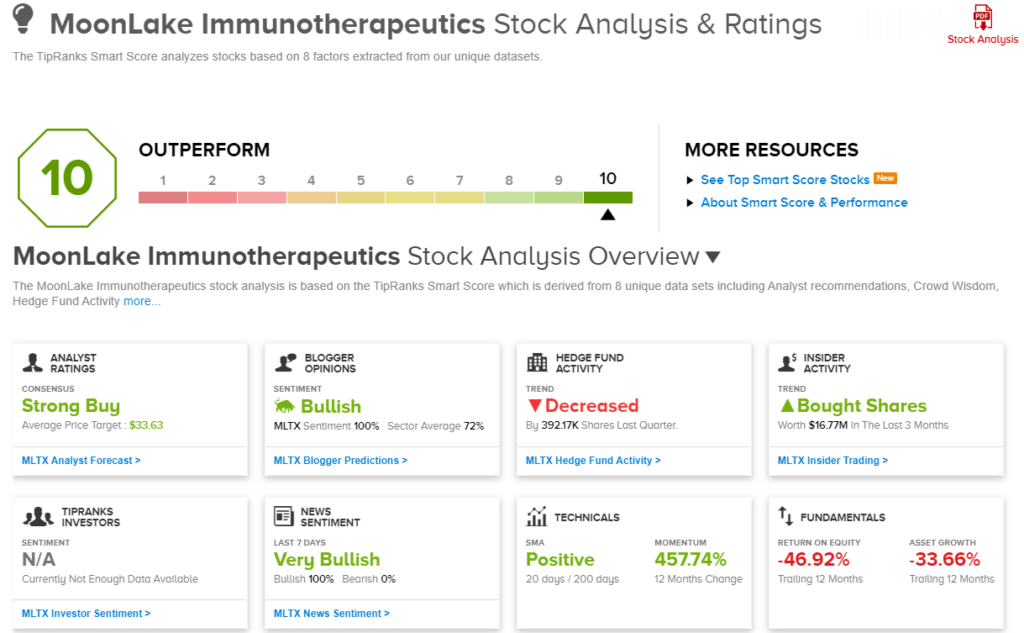

MoonLake Immunotherapeutics (MLTX)

We’ll wrap up this list with MoonLake Immunotherapeutics, another clinical-stage biopharma company. MoonLake’s focus is on the treatment of severe inflammatory diseases, a class of conditions with strong autoimmune involvement and, as the jargon puts it, ‘high unmet medical needs.’ MoonLake has one drug candidate in its pipeline, undergoing several clinical trials simultaneously. The candidate, sonelokimab, is a potential treatment for psoriasis, hidradenitis suppurativa (HS), and psoriatic arthritis (PsA); these are all inflammatory skin conditions.

MoonLake has sole ownership of sonelokimab, which is a novel IL-17 inhibitor. Specifically, the drug candidate is a camelid-derived monovalent nanobody designed to be a ‘next level’ therapeutic agent that will attack the drivers of inflammatory diseases. Sonelokimab directly targets inflammation sites, and gets to inflamed tissues in hard-to-reach areas, especially in the joints.

On the clinical site, MoonLake has three trials going on at once. In the Phase 2 trial studying the treatment of HS, the company is ahead of schedule in the completion of patient enrollment and randomization. Top line results are expected at the end of June, and the full read-out of 24-week data should be available in 4Q23.

Additionally, patient enrollment in a global Phase 2 study of the drug in active psoriatic arthritis (PsA) is going according to plan and a primary end-point readout is anticipated in 4Q23.

In another important announcement, MoonLake earlier this month made public an agreement with Swiss-based SHL Medical. SHL is a specialist in advanced drug delivery systems, and will work with MoonLake to develop an autoinjector for sonelokimab. The autoinjector system will be used in clinical trials, and potentially later in commercialization.

The Smart Score for this top-rated biopharma shows that the stock has 100% bullish sentiment from both the financial bloggers and the news coverage, while the corporate insiders in the last 3 months have bought over $16.8 million worth of MLTX. The stock has gained over 445% in the last 12 months, far outperforming the broader markets.

This all caught the attention of Guggenheim’s Yatin Suneja, who writes, “Our review of MLTX’s current approach suggests that “(1) IL-17 is a reasonable target from a biological perspective to pursue in HS and PsA, and (2) sonelokimab’s unique MoA could support a best-in-class profile and address the high unmet need in IL-17-driven derm/rheum disorders. With solid biological rationale, clinical de-risking from UCB’s bimekizumab (IL-17A/F mAb), and a differentiated MoA suitable for tough inflammatory conditions, we are optimistic for sonelokimab’s success in HS (Phase II data in June 2023; a key value-driving potential catalyst for the stock and major investor focus) and PsA (Phase II primary endpoint data in Dec. 2023).”

“If approved,” Suneja went on to add, “we estimate >$2B in global peak sales for sonelokimab in HS (~$1.8B risk-adjusted), with additional upside potential driven by success in PsA and additional IL-17-mediated indications in which sonelokimab’s differentiated profile could drive meaningful improvements in efficacy/safety.”

This is an upbeat outlook, that backs up Suneja’s Buy rating on the stock. The analyst’s price target, of $51, indicates confidence in additional upside of 83% over the next 12 months. (To watch Suneja’s track record, click here.)

One again, we’re looking at a stock with a Strong Buy consensus rating. The shares have 8 recent analyst reviews, all positive, making that rating unanimous. With a trading price of $27.72 and an average price target of $33.63, MoonLake’s average one-year upside potential comes in at 21%. (See MLTX stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.